As industry professionals prepare to converge at the Mandalay Bay Convention Center for the 22nd edition of Cosmoprof North America Las Vegas on July 15-17, 2025, the timing couldn’t be more opportune for a comprehensive analysis of the US beauty industry. This premier B2B beauty trade show, which welcomed 26,000 attendee visits from 113 countries and showcased over 1,100 exhibitors representing 45 nations in its previous edition, serves as a barometer for the industry’s health and future direction. The event’s expanded show floor and dedicated Korean Beauty area underscore the dynamic evolution occurring within America’s beauty landscape.

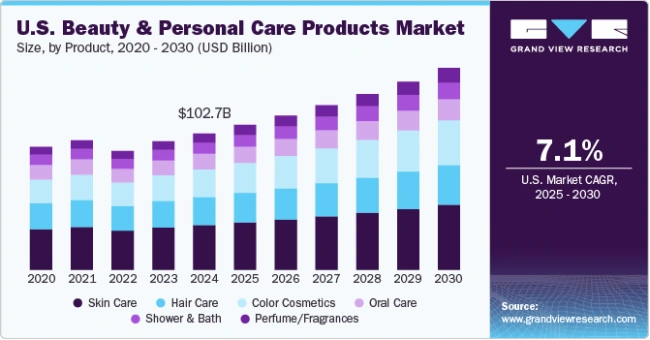

The US beauty industry represents a massive economic force, with the broader beauty and personal care market expected to generate $104.10 billion in revenue in 2025. Multiple market analyses present varying valuations, with the cosmetics segment alone valued between $20.3 billion and $97.89 billion in 2024, projected to reach $26.7 billion to $149.53 billion by 2033, depending on market scope and methodology. This variance reflects the complexity of categorizing beauty products across skincare, makeup, haircare, and personal care segments.

The global beauty industry, valued at $450 billion with 7% annual growth from 2022 to 2024, positions the United States as the largest single market, accounting for $89.7 billion in spending. This market leadership extends beyond mere size, as American consumers drive innovation trends that ripple across international markets. The convergence of technology, sustainability consciousness, and demographic shifts creates an unprecedented landscape of opportunities and challenges for industry participants.

This comprehensive analysis examines the multifaceted dynamics shaping the US beauty industry in 2025, from market fundamentals and consumer behavior to competitive strategies and future projections. As attendees at Cosmoprof North America engage with cutting-edge innovations and forge new partnerships, understanding these underlying market forces becomes essential for strategic decision-making in an increasingly complex and competitive environment.

Market Size and Financial Performance

Current Market Valuation

The US beauty market demonstrates remarkable scale and complexity across multiple measurement frameworks. According to recent industry analysis, the United States cosmetics market reached approximately $20.3 billion in 2024, with projections indicating growth to $26.7 billion by 2033 at a compound annual growth rate (CAGR) of 3.1%. However, broader market assessments present significantly larger valuations, with comprehensive beauty and personal care market data showing $97.89 billion in 2024, expected to expand to $149.53 billion by 2033 with a 4.82% CAGR.

These variations reflect different methodological approaches to market segmentation, with some analyses focusing purely on cosmetics while others encompass the entire beauty ecosystem. The global beauty and personal care product market valuation reached $712.4 billion in 2025, anticipated to grow at an 8.2% CAGR through 2035, reaching $1,566.3 billion. Within this global context, the United States maintains its position as the world’s largest beauty market, representing approximately $89.7 billion in consumer spending.

The makeup segment specifically demonstrates robust growth potential, with the US makeup market projected to increase from $7.40 billion in 2024 to $12.77 billion by 2032, representing a 7.18% CAGR. This segment’s acceleration reflects changing consumer preferences and the influence of social media on beauty purchasing decisions.

Market Segmentation by Revenue

Category distribution within the US beauty market reveals distinct consumer preferences and spending patterns. Hair care commands the largest market share at 24%, followed closely by skin care at 23.7%, demonstrating the fundamental importance of these basic beauty categories. Cosmetics and color cosmetics represent 14.6% of the market, while perfumes and colognes account for 9.5%. The remaining segments, including deodorants, personal care products, and oral hygiene, collectively represent 19.6% of total market value.

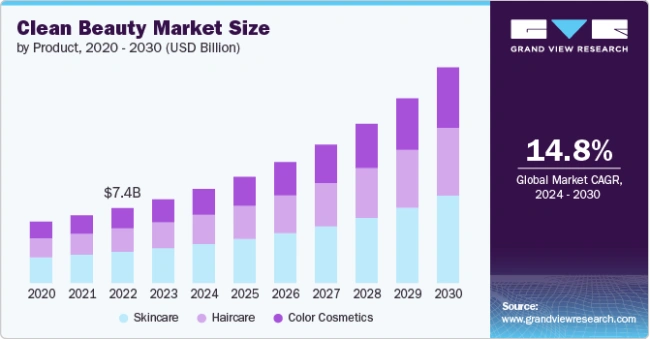

Regional analysis indicates significant geographic variations in beauty spending patterns, with higher-income markets demonstrating greater premium product adoption. The clean beauty sector specifically shows exceptional growth potential, with forecasts predicting an increase of $7.65 billion between 2024 and 2029, supported by a remarkable 13.2% CAGR. This segment’s expansion reflects growing consumer awareness of ingredient transparency and sustainability concerns.

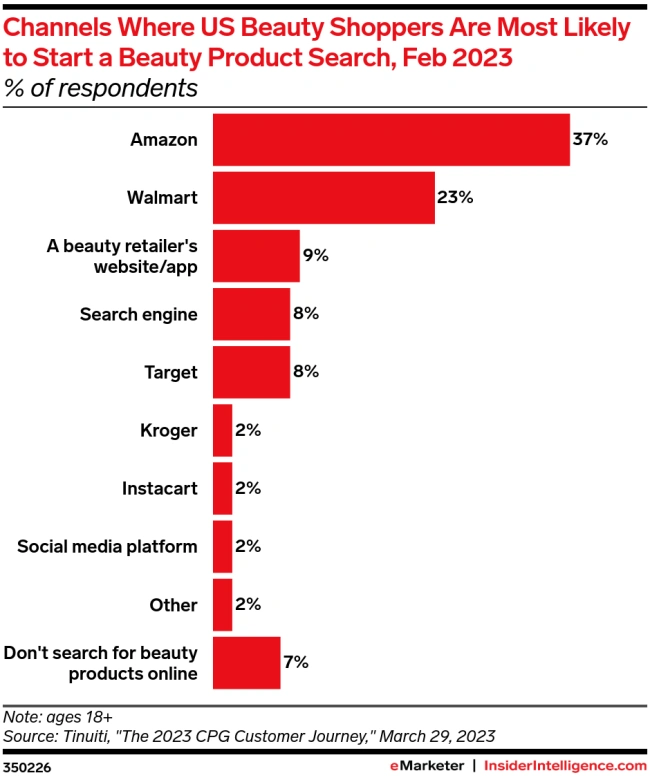

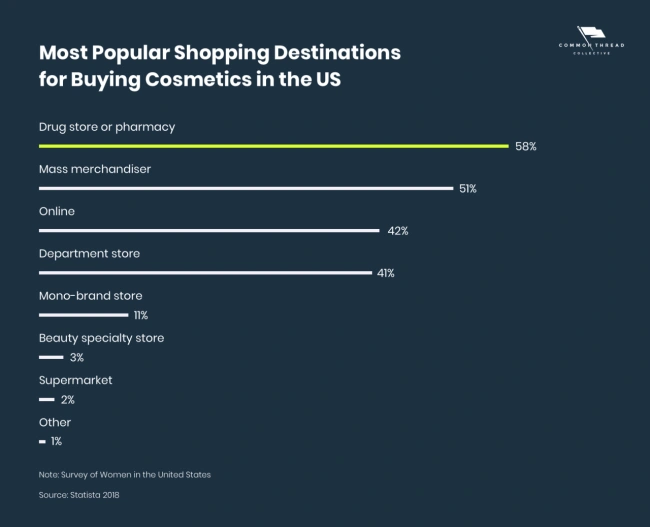

Distribution channel performance reveals the continuing importance of traditional retail alongside digital expansion. Pharmacy channels experience notable growth in beauty product sales, driven by convenience factors as consumers incorporate beauty purchases into prescription pickup visits. E-commerce continues its rapid ascent, with 37% of US beauty shoppers initiating product searches on Amazon, compared to 23% on Walmart and 9% on retailer websites.

Global Context and US Position

The United States beauty market’s dominance extends beyond domestic consumption to influence global trends and innovation cycles. American consumer preferences, particularly regarding clean beauty, personalization, and social media-driven discovery, increasingly shape international product development strategies. The US market’s sophistication in integrating technology with beauty experiences, from AI-powered personalization to virtual try-on capabilities, establishes benchmarks for global industry evolution.

Comparative analysis reveals the US beauty market’s exceptional per-capita spending, with American consumers allocating significantly higher percentages of disposable income to beauty products compared to other major markets. China follows as the second-largest market at $58.3 billion, while Japan represents $36.9 billion in beauty spending. However, growth rates in emerging markets, particularly China at 6.7% CAGR, suggest potential shifts in global market dynamics over the coming decade.

Key Market Trends and Drivers

Clean Beauty and Sustainability Movement

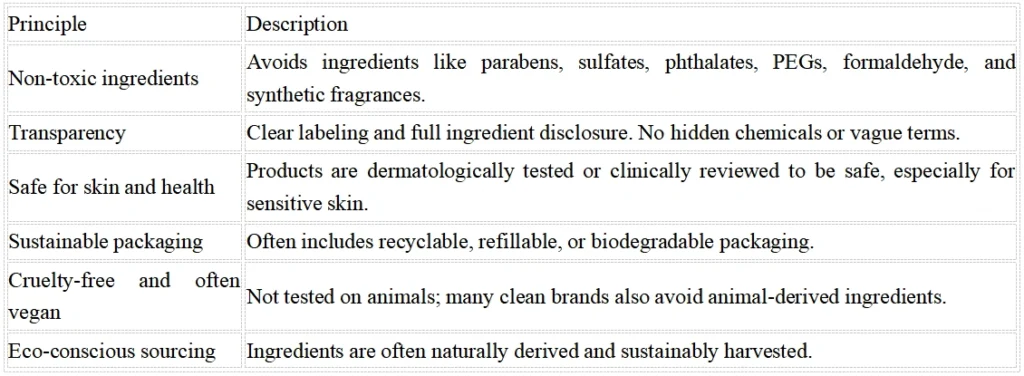

The clean beauty revolution represents one of the most significant transformative forces in the contemporary US beauty landscape. Consumer research indicates that 68% of Americans actively seek products described as “clean,” while 59% prefer items labeled as “natural and organic”. This trend demonstrates particular strength among younger demographics, with 43% of millennials and Gen Z consumers preferring natural skincare products, compared to 31% of the general population.

The movement extends beyond ingredient preferences to encompass comprehensive sustainability considerations. Consumers increasingly evaluate packaging materials, manufacturing processes, and corporate environmental commitments when making purchasing decisions. Beauty brands respond by reformulating products to eliminate parabens, sulfates, and synthetic fragrances while pursuing cruelty-free and vegan certifications. This shift challenges established brands to adapt quickly or risk obsolescence as nimble startups emerge with biologically-derived, organic, and waterless products.

The economic impact of clean beauty expansion is substantial, with projections indicating this segment will add $7.65 billion in value between 2024 and 2029. Major beauty companies increasingly allocate research and development resources toward sustainable ingredient sourcing and eco-friendly packaging solutions, recognizing that environmental consciousness is becoming a permanent consumer expectation rather than a temporary trend.

Technology Integration and Personalization

Artificial intelligence and biotechnology innovations are fundamentally reshaping beauty product development and consumer experiences. AI-powered personalization enables customized beauty experiences, from skin care recommendations based on individual skin analysis to personalized product formulations addressing specific concerns. The Beauty Health Company exemplifies this trend, utilizing artificial intelligence-powered tools to provide personalized advice on product selection and usage.

Biotechnology advancements create opportunities for high-performance ingredients with reduced environmental impact, supporting both efficacy and sustainability objectives. Smart skincare devices and virtual try-on technology transform how consumers discover and evaluate beauty products, particularly in e-commerce environments where physical testing is impossible. The integration of augmented reality applications enables virtual makeup trials and color matching, significantly improving online conversion rates.

The personalization trend extends to product development, with brands offering customizable formulations addressing diverse skin types, tones, and specific concerns. This approach reflects growing consumer demand for inclusive beauty products that acknowledge the inadequacy of one-size-fits-all solutions. Advanced data analytics enable brands to identify emerging consumer needs and develop targeted products more efficiently than traditional market research methods.

Social Media and Digital Influence

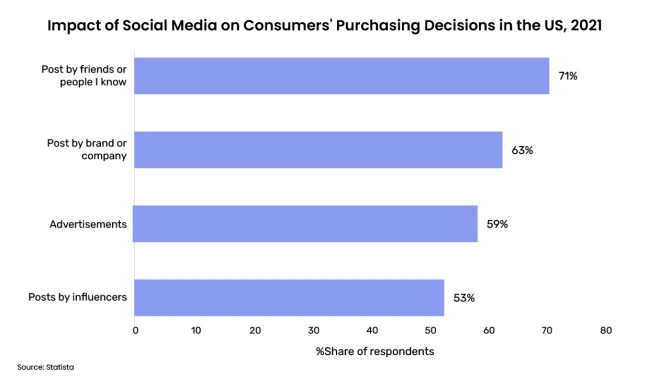

Social media platforms, particularly TikTok and Instagram, exercise unprecedented influence over beauty trends and purchasing decisions. These platforms serve as primary discovery channels for new products, with beauty influencers and content creators shaping consumer preferences through authentic product demonstrations and reviews. The phenomenon of viral beauty trends can transform niche products into mainstream successes within weeks, dramatically accelerating traditional product adoption cycles.

Video commerce emerges as a game-changing retail format, with 58% of consumers expressing openness to shopping via livestream. Shoppable videos demonstrate higher engagement rates across platforms, enabling brands to convert entertainment content directly into sales transactions. This evolution reflects changing consumer expectations for interactive and immersive shopping experiences that traditional e-commerce formats cannot deliver.

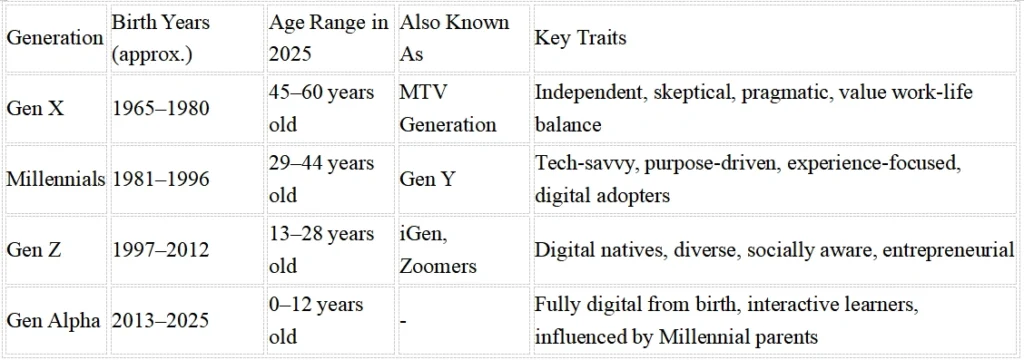

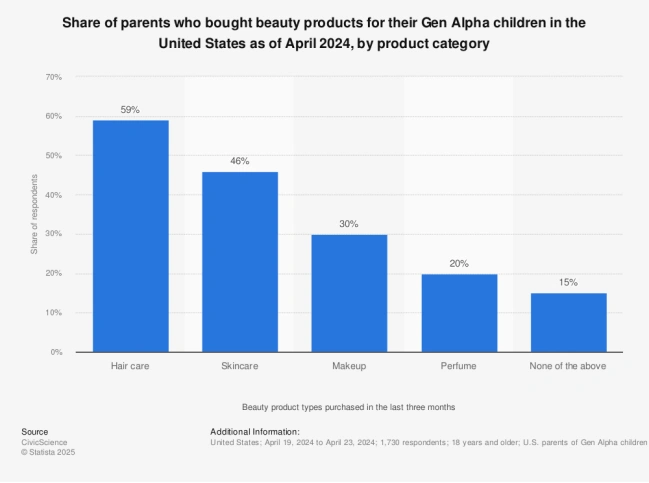

The demographic impact of social media influence varies significantly across age groups. Gen Alpha’s entry into the beauty market demonstrates how digital natives approach product discovery and evaluation differently than previous generations. Higher-income households with children under 18 have increased beauty spending three times faster than other demographic segments, indicating the powerful influence of younger consumers on family purchasing decisions.

Demographic Expansion

The men’s grooming market experiences significant expansion, driven by evolving social attitudes toward male beauty and self-care. Rising demand for high-quality skincare, hair care, and grooming products reflects changing masculine identity concepts and increased acceptance of beauty routines among male consumers. This demographic shift creates substantial opportunities for brands willing to develop male-focused products and marketing strategies.

Generational behavior analysis reveals surprising patterns that challenge traditional marketing assumptions. Gen X consumers demonstrate beauty engagement behaviors more aligned with younger Gen Z and Millennial consumers than with older Boomers. This finding suggests that chronological age may be less predictive of beauty consumption patterns than previously assumed, requiring more sophisticated segmentation approaches.

The aging population presents both challenges and opportunities for beauty brands. Baby boomers increasingly embrace digital platforms, with TikTok usage among this demographic increasing 57% since 2021. This digital adoption enables brands to reach older consumers through channels previously considered youth-focused, expanding potential market reach significantly.

Consumer Behavior and Preferences

Purchasing Patterns and Channels

Contemporary beauty consumers demonstrate sophisticated multichannel shopping behaviors that blend digital discovery with strategic purchasing decisions. Amazon dominates the initial product search process, with 37% of US beauty shoppers beginning their journey on the platform, significantly outpacing Walmart (23%), retailer websites (9%), and search engines (8%). This pattern reflects Amazon’s investment in beauty-specific features, including virtual try-on capabilities and comprehensive review systems.

The e-commerce segment continues rapid expansion, with online beauty sales representing an increasingly larger share of total category revenue. Millennials lead digital adoption, with 56% of their beauty spending occurring online according to UK market data that reflects broader international trends. However, traditional retail channels maintain importance, particularly for experiential purchases where physical product testing influences final decisions.

Pharmacy channels experience notable growth as consumers appreciate the convenience of combining beauty purchases with prescription pickups. This trend reflects time-pressed consumers’ preference for efficient shopping experiences that maximize convenience. Beauty specialty retailers adapt by expanding their service offerings, including professional consultations and personalized shopping experiences that justify premium pricing.

Value Consciousness and Quality Focus

Despite continued market growth, consumers demonstrate increased value consciousness and skepticism toward marketing claims. Industry executives identify uncertain consumer appetite as the greatest risk to future growth, with 54% citing restricted spending as a primary concern. This heightened scrutiny requires brands to deliver demonstrable product efficacy rather than relying solely on marketing messaging.

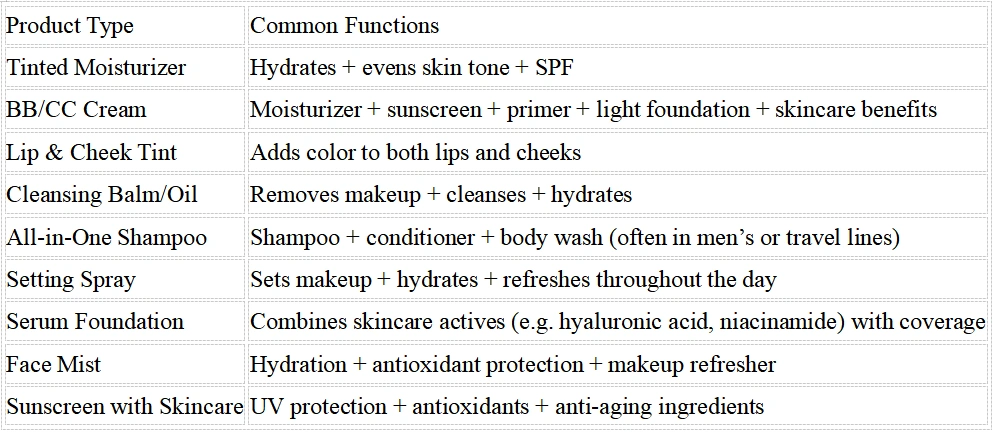

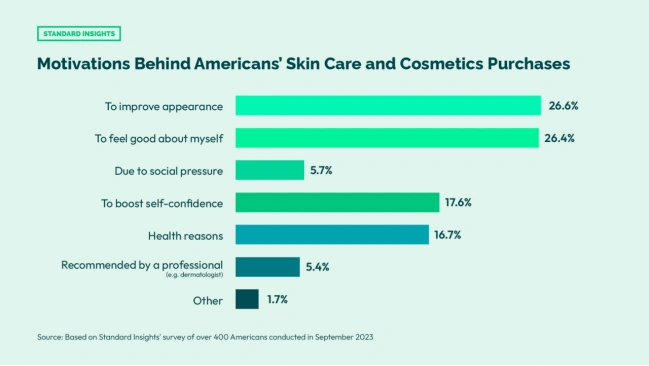

The “lipstick effect,” where beauty purchases remain resilient during economic uncertainty, continues to operate but with evolved characteristics. Consumers maintain beauty spending but allocate it more strategically, favoring multifunctional products that deliver multiple benefits. This shift favors brands that clearly communicate value propositions and provide transparent information about product ingredients and benefits.

Quality expectations have risen substantially, with consumers expecting professional-grade results from consumer products. The Beauty Health Company’s focus on medical-grade skincare technologies exemplifies this trend, as consumers seek products that bridge the gap between professional treatments and at-home routines. This elevation in quality standards challenges brands to invest heavily in research and development while maintaining accessible pricing.

Health and Wellness Integration

The convergence of beauty and wellness creates expanded market opportunities as consumers adopt holistic approaches to self-care. Beauty products increasingly incorporate wellness-focused ingredients and positioning, with skincare products promoting stress reduction, mood enhancement, and overall well-being benefits. This integration reflects broader lifestyle trends that prioritize mental health and self-care practices.

Multifunctional products gain popularity as consumers seek efficiency in their beauty routines without compromising results. Products that combine skincare benefits with sun protection, anti-aging properties, and color correction appeal to time-conscious consumers who prefer streamlined routines. This trend favors brands capable of developing sophisticated formulations that deliver multiple benefits effectively.

The wellness integration extends to shopping experiences, with consumers seeking brands that align with their values regarding sustainability, ethical sourcing, and social responsibility. Beauty brands increasingly communicate their corporate values and social impact initiatives, recognizing that modern consumers evaluate companies holistically rather than focusing solely on product attributes.

Competitive Landscape and Major Players

Market Leaders and Their Strategies

The US beauty market features established multinational corporations that leverage scale advantages alongside agile emerging brands challenging traditional approaches. L’Oréal maintains its position as the largest beauty company globally, with $40.31 billion in revenue and 85% brand recognition among US online consumers. The company’s success reflects comprehensive portfolio management spanning mass market to luxury segments, combined with strategic acquisitions that expand technological capabilities and demographic reach.

Procter & Gamble commands significant market presence with 10-12% market share, focusing on personal care products and leveraging brand loyalty in mass markets through eco-friendly solutions and digital engagement strategies. The Estée Lauder Companies demonstrate particular strength in prestige beauty segments, generating $16.4 billion in revenue through portfolio brands that target affluent consumer segments seeking luxury experiences.

Unilever’s $25.11 billion beauty and personal care revenue reflects successful mass market penetration combined with sustainability leadership that resonates with environmentally conscious consumers. The company’s acquisition strategy targets innovative brands that complement existing portfolios while providing access to emerging trends and younger consumer demographics.

Emerging Brands and Market Disruption

Startup beauty brands demonstrate remarkable ability to challenge established players through direct-to-consumer strategies and social media-native marketing approaches. These companies typically focus on specific consumer needs or underserved demographics, developing loyal followings before expanding into broader markets. The success of brands like Glossier and Fenty Beauty illustrates how authentic brand storytelling and inclusive product development can rapidly capture market share.

The clean beauty movement particularly benefits emerging brands, as consumers often associate newer companies with more progressive ingredient philosophies and sustainable practices. Established brands must balance heritage and innovation while newer entrants can build sustainability and transparency into their foundational business models.

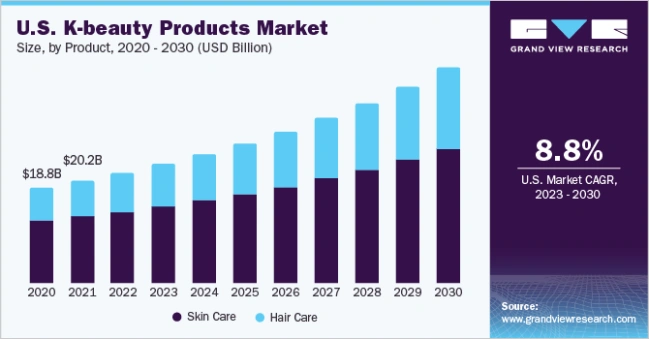

Korean beauty brands continue expanding US market presence, driving innovation in skincare formulations and application techniques. The dedicated Korean Beauty area at Cosmoprof North America Las Vegas demonstrates this segment’s importance to overall market dynamics. K-beauty’s influence extends beyond specific brands to shape broader consumer expectations regarding product efficacy and multi-step beauty routines.

Competitive Dynamics

Industry competition increasingly centers on innovation velocity and consumer engagement rather than traditional advertising spend or distribution advantages. Brands must demonstrate continuous product development capabilities while maintaining authentic connections with evolving consumer preferences. The most successful companies balance heritage credibility with adaptation agility, preserving brand equity while embracing necessary changes.

Technology investments become essential competitive differentiators, with brands implementing artificial intelligence, augmented reality, and data analytics to enhance customer experiences. Companies that effectively integrate these technologies into product development and marketing strategies gain significant advantages in consumer acquisition and retention.

Sustainability initiatives transform from optional corporate social responsibility programs to essential competitive requirements. Consumers increasingly evaluate brands based on environmental impact, social values, and ethical business practices, making corporate responsibility a key competitive battleground. Brands must demonstrate authentic commitment to sustainability rather than superficial marketing messaging.

Market Challenges and Opportunities

Current Market Challenges

The beauty industry faces unprecedented challenges stemming from geopolitical uncertainty, supply chain disruptions, and changing consumer expectations. Global economic instability affects consumer confidence and spending patterns, with 54% of industry executives identifying uncertain consumer appetite as the greatest risk to future growth. Inflation pressures create particular challenges for brands attempting to maintain accessible pricing while absorbing increased raw material and transportation costs.

Market saturation in certain segments creates intense competition for consumer attention and market share. The proliferation of beauty brands across all price points makes differentiation increasingly difficult, requiring companies to develop distinctive value propositions that resonate with specific consumer segments. This saturation particularly affects mass market segments where private label alternatives offer comparable quality at lower prices.

Regulatory complexity increases as government agencies scrutinize beauty product safety, environmental impact, and marketing claims more thoroughly. Brands must navigate evolving regulations while maintaining innovation momentum, creating additional operational complexity and compliance costs. International expansion faces similar regulatory challenges as different markets implement varying safety and labeling requirements.

Growth Opportunities

Demographic expansion presents substantial opportunities for brands willing to develop products and marketing strategies for underserved consumer segments. The men’s grooming market demonstrates exceptional growth potential, with increasing male acceptance of skincare routines and beauty products. Gen Alpha’s early engagement with beauty products suggests long-term market expansion as this generation matures with different beauty consumption patterns than previous generations.

International expansion offers significant growth opportunities, particularly in emerging markets where rising disposable incomes drive beauty category growth. US brands can leverage technological innovations and clean beauty expertise to capture market share in regions where local competitors may lack these capabilities. E-commerce platforms facilitate international expansion by reducing traditional barriers to market entry.

Technology integration creates opportunities for enhanced customer experiences and operational efficiency. Artificial intelligence enables personalized product recommendations and customized formulations that command premium pricing. Biotechnology innovations allow development of high-performance ingredients that satisfy both efficacy and sustainability requirements.

Macroeconomic Factors

Interest rate changes and inflation pressures affect consumer spending patterns and corporate investment strategies. Higher borrowing costs may reduce acquisition activity and limit expansion investments, while inflation creates pricing pressures that disproportionately impact price-sensitive consumer segments. Beauty brands must balance pricing strategies to maintain accessibility while preserving profit margins.

Currency fluctuations impact international operations and ingredient sourcing costs, particularly for companies that rely on global supply chains. Raw material price volatility creates forecasting challenges and margin pressure, requiring sophisticated procurement strategies and supplier relationship management. Companies with geographically diversified operations may benefit from natural hedging effects.

Labor market dynamics affect both manufacturing operations and retail experiences. Skilled labor shortages in research and development roles may constrain innovation capabilities, while retail worker availability impacts customer service quality. Companies invest in automation and employee retention strategies to mitigate these challenges.

Regional Analysis and Market Distribution

Regional Market Size and Growth Patterns

The US beauty market demonstrates significant regional variations in both market size and growth trajectories. The South region emerges as the largest beauty market with the highest consumer spending concentration, driven by cultural diversity, large population centers, and growing interest in beauty and self-care. Texas, Florida, and Georgia serve as primary growth drivers within this region, with consumers increasingly engaged in comprehensive skincare routines, makeup application, and specialized haircare products.

The West region, particularly California, holds commanding influence on national beauty trends due to its trendsetting culture and focus on health-conscious beauty practices. Los Angeles functions as a global beauty capital, with consumers gravitating toward innovative, cruelty-free, and sustainable beauty products. This region demonstrates the fastest growing market dynamics nationally, with wellness-driven beauty trends including natural skincare and clean beauty gaining exceptional traction.

The Northeast region plays a pivotal role due to high population density and strong consumer spending power, with metropolitan areas including New York, Boston, and Philadelphia serving as influential fashion and beauty trend hubs. Consumer demand for luxury and premium cosmetic products, coupled with rising interest in clean and sustainable beauty formulations, propels substantial market growth in this region.

The Midwest region represents an increasingly important market segment, driven by expanding consumer base and rising disposable income levels. Midwest cities like Chicago function as key retail and distribution hubs for cosmetic brands, facilitating broader audience reach across multiple states. Regional consumers demonstrate growing interest in both drugstore and luxury beauty products, with particular emphasis on skincare and wellness-focused formulations.

Traditional Retail Channel Performance

Specialty beauty retailers demonstrate continued expansion despite e-commerce growth, with Ulta Beauty operating 1,445 stores across the United States as of February 2025, representing a net addition of 60 locations during fiscal 2024. The company projects long-term potential to expand to more than 1,800 freestanding locations nationwide, indicating substantial untapped market opportunity in underserved geographic areas.

Store performance metrics reveal strong fundamentals with average square footage per store maintaining consistency at approximately 10,457 square feet, including dedicated salon space of approximately 950 square feet. The company’s smaller footprint prototype stores, ranging between 5,000-7,500 square feet, provide flexibility to enter smaller markets and shopping centers previously inaccessible to larger format stores.

Investment requirements for new store openings average $2.1 million per location, including capital investments net of landlord contributions, pre-opening expenses, and initial inventory net of payables. This consistent investment model enables predictable expansion planning and market penetration strategies.

Pharmacy Channel Growth Dynamics

Pharmacy channels experience notable expansion in beauty product sales, driven by convenience factors as consumers incorporate beauty purchases into prescription pickup visits. This trend reflects time-pressed consumers’ preference for efficient shopping experiences that maximize convenience while accessing trusted retail environments.

Pharmacies expand product assortments to include premium dermatologist-approved brands, attracting customers seeking reliable and practical beauty solutions. The emphasis on health and wellness positioning enables pharmacies to feature products addressing specific skin concerns including acne treatment, anti-aging formulations, and sensitivity-focused skincare.

Health-conscious beauty products demonstrate exceptional growth within pharmacy channels, with consumers increasingly seeking formulations containing natural or organic ingredients that align with wellness-focused lifestyles. This trend supports pharmacy positioning as trusted health and beauty destinations rather than mere convenience channels.

E-commerce and Digital Channel Evolution

Online beauty sales capture 41% of total beauty and personal care product purchases nationally, with Amazon dominating the digital transformation. Approximately one-third of Amazon’s beauty growth derives from consumers migrating away from traditional beauty specialty stores and mass retailers including Walmart and Target.

Social commerce emerges as a transformative retail format, with 6.2% of beauty sales now originating from social selling platforms. TikTok alone captures 2.6% of total market share despite launching its commerce platform less than 18 months ago, demonstrating rapid consumer adoption of social-driven purchasing.

Consumer experience satisfaction rates exceed traditional expectations, with 84% of beauty shoppers who made purchases via social commerce reporting good or excellent experiences. More than two-thirds of social commerce purchases occur as impulse-driven transactions, indicating the powerful influence of social media content on immediate purchasing decisions.

Traditional e-commerce maintains growth trajectory with 37% of US beauty shoppers initiating product searches on Amazon, compared to 23% on Walmart and 9% on individual retailer websites. This search behavior pattern reflects Amazon’s investment in beauty-specific features including virtual try-on capabilities and comprehensive review systems.

Regional Consumer Preferences and Behavioral Patterns

Southern states demonstrate elevated demand for sun protection and anti-aging products, reflecting climate conditions and outdoor lifestyle preferences. Year-round sun exposure creates consistent demand for SPF-enhanced skincare products and protective formulations that address environmental stressor concerns.

Western markets prioritize clean beauty formulations with California consumers leading national adoption of organic, cruelty-free, and sustainable products. Environmental consciousness and health-focused lifestyles drive preference for brands demonstrating authentic sustainability commitments and transparent ingredient disclosure.

Northern regions show seasonal purchasing patterns with increased moisturizer and protective skincare product sales during winter months, while summer periods drive higher sunscreen and lightweight formulation demand. These predictable seasonal variations enable retailers to optimize inventory management and promotional strategies.

Coastal markets demonstrate higher premium product penetration compared to interior regions, reflecting income differences and cultural exposure to luxury beauty trends. Urban coastal areas show 2-3x higher per-capita spending on prestige beauty products compared to rural interior markets.

College town markets exhibit unique consumption patterns with higher turnover rates in trendy, affordable products driven by student populations seeking experimentation and social media-worthy products. These markets serve as testing grounds for emerging brands and viral product launches.

Retirement-focused communities in Florida and Arizona demonstrate growing demand for anti-aging and corrective skincare products, creating specialized market opportunities for age-focused beauty brands. This demographic shift creates substantial long-term growth potential in age-inclusive product development.

Conclusion

The US beauty industry in 2025 demonstrates remarkable resilience and innovation capacity despite facing significant macroeconomic and competitive challenges. Market valuations ranging from $20.3 billion to $149.53 billion by 2033, depending on scope and methodology, indicate substantial economic impact and growth potential. The industry’s ability to adapt to changing consumer preferences while maintaining growth momentum reflects fundamental consumer commitment to beauty and self-care practices.

Key trends shaping the industry include the clean beauty movement’s continued expansion, technology-driven personalization, social media influence on purchasing decisions, and demographic diversification beyond traditional target markets. These trends create both opportunities and challenges for established players and emerging brands, requiring strategic adaptation and innovation investment to maintain competitive positioning.

The upcoming Cosmoprof North America Las Vegas event on July 15-17, 2025, will provide crucial insights into industry direction as 26,000+ attendees explore innovations and forge partnerships that will shape the next phase of market evolution. Jarsking Packaging will participate in this trade show at Booth 32085, showcasing our sustainable packaging solutions for cosmetic and perfume products. Following our success at COSMOPROF Bologna 2025, where we generated bulk orders for our macaron-colored skincare sets, Jarsking aims to demonstrate how our eco-friendly packaging meets the beauty industry’s demand for environmental responsibility while maintaining luxury appeal. Visitors can explore our refillable designs, airless bottle technologies, and customizable solutions within COSMOPACK North America’s dedicated packaging pavilion, where we will highlight our approach to reducing waste while enhancing brand positioning.