After examining Hainan’s competitive positioning in the free-port hierarchy (Blog 1) and its geopolitical role as “infrastructure” for China-centric trade (Blog 2), the critical question remains:

How should businesses actually use this new infrastructure—profitably and safely?

Hainan Free Trade Port (FTP) has moved beyond a “policy concept” into a real operational regime with island-wide special customs operations and a distinctive “first line / second line” customs model—freer access at the first line (Hainan ↔ overseas) and regulated access at the second line (Hainan ↔ mainland). A flagship lever inside that model is the 30% value-added rule, which allows certain processed goods to enter mainland China tariff-free if the value-added threshold is met. Source

The practical challenge is simple to describe and hard to execute:

- Understanding policy is one thing.

- Engineering a compliant value chain that reliably hits 30%—batch after batch, quarter after quarter—is another.

This gap explains why early adopters are seeing both:

- wins (lower landed cost, smoother cash flow) and

- pain (customs delays, documentation gaps, miscalculations, and “we thought we qualified” surprises).

This article is written for CFOs, supply chain leaders, procurement directors, and operations executives who need a practical answer—not a policy recap.

By the end of this guide, you’ll have frameworks to:

- Decide whether Hainan makes sense for your products and China market mix

- Calculate expected savings and required investments

- Identify and mitigate operational, regulatory, geopolitical, and financial risks

- Build a phased implementation plan—from pilot to scaled operations

Hainan FTP 2026: 30% Value‑Add Calculator + Cluster Mode (Interactive)

Model your imported vs domestic cost buckets, test qualification against the 30% threshold, and explore industry-specific ROI + an operational roadmap for 2026 execution.

Built by Jarsking Packaging — strategic manufacturing + packaging execution mindset.

Built by Jarsking Packaging — strategic manufacturing + packaging execution mindset.

Mastering the 30% Value-Added Rule

The Formula Demystified

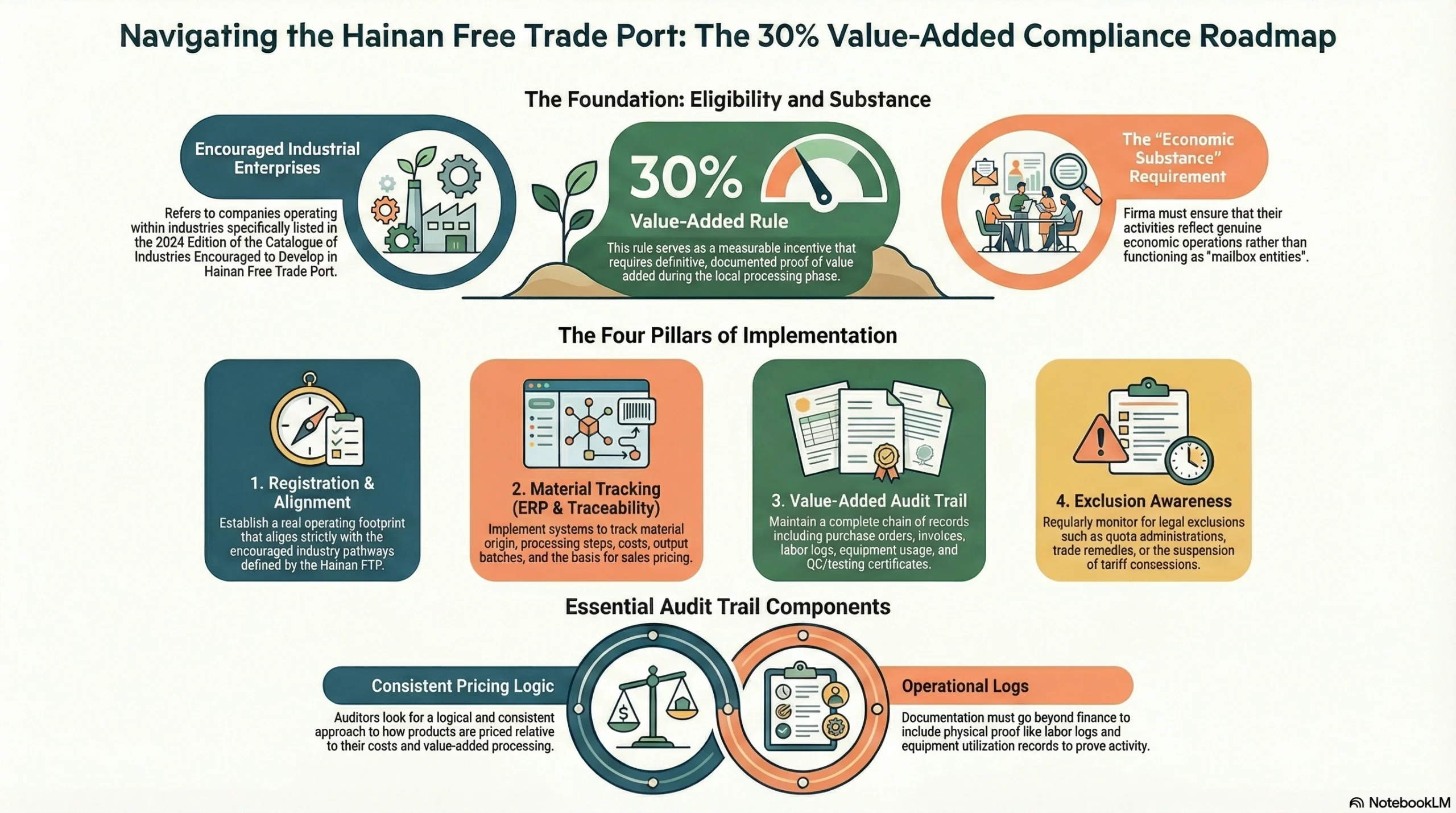

At the center of Hainan’s “usefulness” for China-focused supply chains is the 30% value-added rule.

A widely cited definition states:

“The 30 percent added value rule allows goods produced by encouraged industrial enterprises that contain duty-free imported materials and have 30 percent or more local added value generated in the Hainan FTP to be exempted from import tariffs when shipped to the Chinese mainland.” Source

Official formula (as commonly published):

Value-added percentage = [(Domestic sales price – price of imported materials – price of domestically purchased materials) / ( price of imported materials + price of domestically purchased materials)] * 100% Source

Threshold: ≥30% → qualify for tariff-free mainland entry (subject to exclusions and compliance).

Important tax reality check:

“Import VAT and consumption tax will still be levied, unless these taxes have already been paid during the goods’ circulation within Hainan.” Source

That single sentence is where many boardroom models go wrong: tariff relief is the headline, but VAT/consumption tax treatment is still a separate layer.

Component 1: Domestic Sales Price (what you actually charge the mainland buyer)

Definition (practical): the transaction price when you sell to mainland China—your B2B ex-Hainan sales price.

Operational implications:

- Use B2B transaction price, not retail MSRP (a common modeling mistake).

- Keep pricing consistent and defensible—big swings can trigger audit attention.

- Ensure sales price is supported by a complete commercial trail (contracts, invoices, proof of payment).

Component 2: Imported Materials Cost (what came from “outside China”)

Definition: inputs sourced from outside China used in the processed good.

Operational implications:

- Your team must be able to prove origin/value with customs documentation and purchase records.

- Your incoterms and landed-cost accounting must be consistent with how customs expects you to report the cost basis.

Component 3: Domestic Materials Cost (what you sourced in China)

Definition: materials purchased within China that go into the product.

Operational implications:

- Domestic material sourcing can be a strategic lever: the structure of your supply chain often determines whether you pass or fail 30%.

- In many industries, shifting from importing semi-finished parts to importing raw inputs (and doing more transformation in Hainan) can dramatically improve your ratio.

Calculation Examples—From Simple to Complex

Example 1: Single-Stage Processing (Simple) — Cosmetic Face Cream

| Item | Value | Notes |

|---|---|---|

| Imported fragrance oils (France) | $50,000 | imported inputs |

| Imported hyaluronic acid (Japan) | $30,000 | imported inputs |

| Domestic packaging materials (Guangdong) | $20,000 | bottles, boxes |

| Total materials (denominator) | $100,000 | imported + domestic |

| Hainan labor + QC + overhead | $40,000 | processing value |

| Selling price to mainland | $140,000 | B2B transaction price |

| Value-added | 40% | ✅ qualified |

Why this matters for packaging companies like Jarsking: in cosmetics and fragrance, packaging is not “just packaging.” Decoration, filling, kitting, serialization, labeling, QC, and compliance documentation can be engineered into repeatable value-add steps—if structured correctly.

Example 2: Multi-Stage Processing (Complex) — Automotive ECU

A major advantage of the Hainan model is that multiple Hainan entities can contribute to the 30% value-add.

As described:

“If several registered companies in Hainan are involved in processing the product at different stages (for example, one company does assembly, another does packaging), their value-added contributions can be combined. In that case, the same formula applies, but the material costs and prices from all involved companies are added together.” Source

This matters because it enables a cluster effect: you can distribute processing steps across specialized partners (assembly, testing, packaging, labeling, compliance), rather than forcing one company to do everything.

Example 3: Optimization Strategy — Luxury Watch (designing to pass 30%)

In luxury, the usual failure mode is: “we do assembly in Hainan, so we should qualify.” Often, assembly alone is not enough.

The strategic lesson: the 30% rule is not only about what you do in Hainan, but how you structure sourcing (raw vs semi-finished) and where you perform monetizable value-add services.

For luxury and beauty packaging, the parallels are direct:

- importing semi-finished components → low value-add

- importing raw components + doing decoration/assembly/QC/traceability in Hainan → higher value-add and stronger audit narrative

Compliance Requirements and Documentation

Eligibility and enforcement are not “light touch.” Think of the 30% rule as a measurable incentive that requires measurable proof.

Key published eligibility concept:

“‘Encouraged industrial enterprises’ refers to companies operating within industries included in the Catalogue of Industries Encouraged to Develop in Hainan Free Trade Port (2024 Edition)… firms must ensure that these activities reflect genuine economic substance…” Source

From a practical implementation standpoint, build around four requirements:

- Enterprise registration + eligibility alignment

You need a real operating footprint aligned with the encouraged industry pathway (not a “mailbox entity”). Material tracking system (ERP + traceability)

You must track:

- material origin

- processing steps

- costs

- output batches

- sales price basis

3. Value-added audit trail

Keep a complete chain:

- purchase orders, invoices, payment records

- labor logs, equipment usage

- QC/testing certificates

- consistent pricing logic

4. Exclusion awareness

Legal guidance highlights that even if you meet 30%, exclusions may still apply (e.g., quota administration, trade remedies, tariff concessions suspensions, retaliatory tariffs). Source

Industry-Specific Use Cases—Who Benefits Most?

Below are the sectors where the Hainan model is most “executable,” because they naturally generate value-added through processing, testing, compliance, or packaging.

Pharmaceuticals & Biotechnology (Boao Lecheng)

Why Hainan fits:

- pharma value chains already require rigorous documentation, QC, and controlled packaging—making value-add calculation and audit trails more natural than in “light processing” industries.

- official commentary has explicitly used biopharma as an example of end-to-end benefits (zero tariffs for equipment/materials, 30% pathway for products, and potential 15% CIT for qualified enterprises). Source

Pharma is packaging-heavy (serialization, tamper evidence, compliance labeling, track-and-trace). If a manufacturer needs to increase value-add, packaging + compliance operations are often the most controllable levers.

Electronics & Semiconductors

Electronics can be attractive when the business model is China-market focused (not export processing). Legal guidance positions the 30% rule as a “concrete lever” for manufacturers relying on overseas components but selling into the mainland. Source

Best-fit electronics patterns:

- import components → assemble/test in Hainan → mainland distribution

- maximize value-add via testing, certification, firmware localization, labeling, packaging

Automotive Parts & EV Components

EV supply chains are strategic and processing-intensive. Hainan is relevant when:

- imported materials face meaningful tariffs when brought in as “finished” goods

- refinement / processing / testing adds substantial value

Luxury Goods & Fashion

Luxury is a strong match when:

- the product allows monetizable customization and QC

- brand owners want control over China-bound inventory and packaging presentation

Packaging insight: luxury purchases are highly sensitive to unboxing, authenticity cues, and traceability. That makes packaging, serialization, and QA steps both value-add and brand-critical.

Food & Beverage Processing

Food processing can work when:

- import tariffs are significant and volumes justify it

- processing steps are substantial (roasting, blending, functional formulation, packaging)

- inspection/clearance processes can be stabilized through experienced partners

Cost-Benefit Analysis—Building the Financial Case

A finance‑grade ROI model for the Hainan Free Trade Port (FTP) 30% value‑added rule must separate policy benefit (tariff exemption when eligible) from implementation cost (what it takes to run a compliant, audit‑ready operation in Hainan).

This separation matters because the policy benefit is conditional (binary): official framing confirms processed goods may be sold to the mainland duty‑free if local processing generates 30% or more value‑added. Source And widely cited guidance clarifies that this mechanism exempts import tariffs, while “Import VAT and consumption tax will still be levied…” in many cases. Source

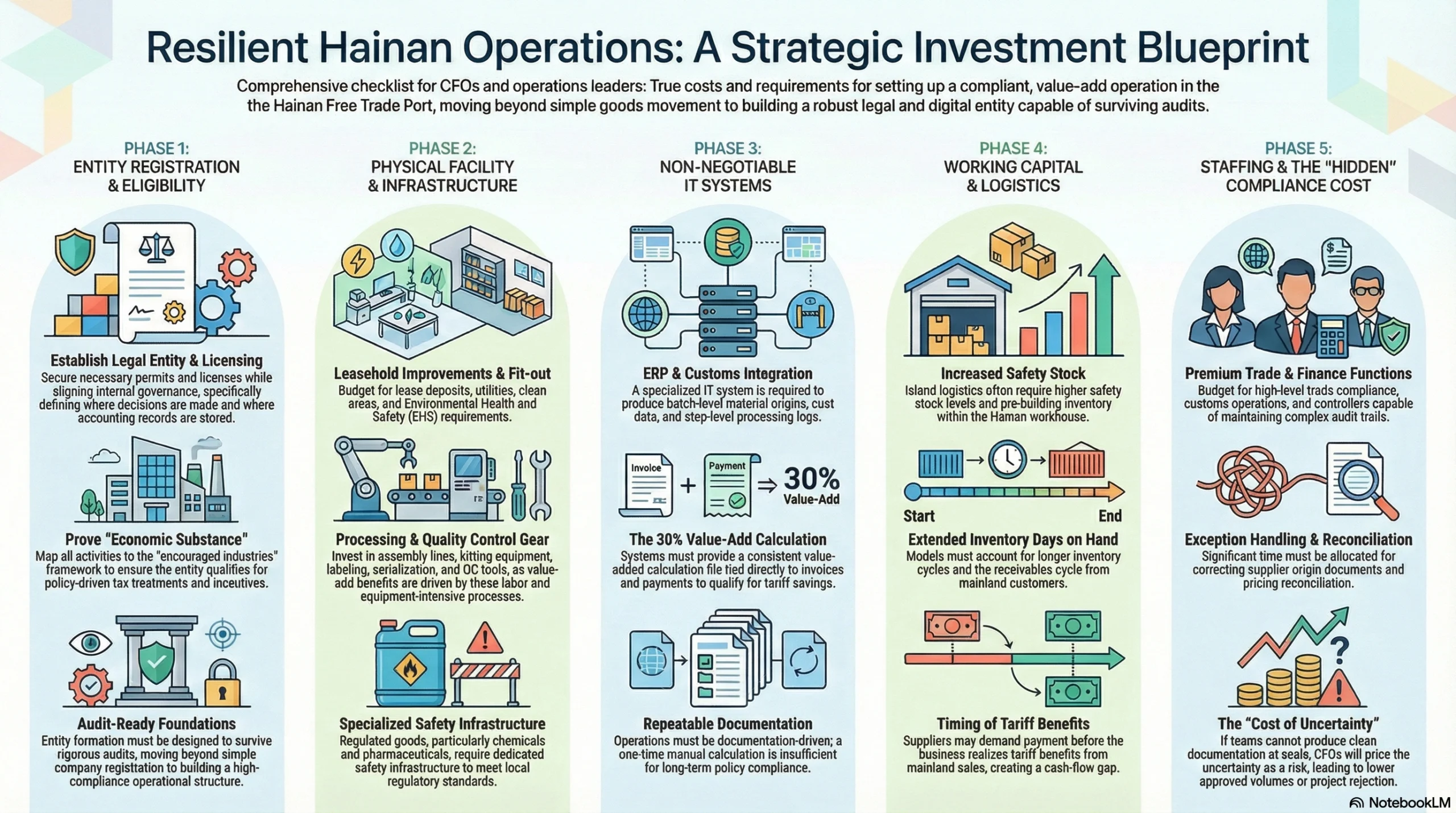

Investment Requirements

A typical setup budget should be built as a capex + opex + working-capital package. CFOs usually underestimate two lines: systems/compliance build and inventory/cash-cycle timing.

Below is a structured checklist you can convert into your internal spreadsheet model.

1) Entity registration and eligibility work

This includes:

- setting up the legal entity and licenses

- mapping your activity to the “encouraged industries” framework and building proof of economic substance (a recurring theme in eligibility language) Source

- aligning internal governance (who signs contracts, where decisions are made, where accounting records sit)

Why it costs more than people expect: you are not only forming a company—you are building an entity that can survive audits and qualify for policy treatment.

2) Facility setup (leasehold improvements + equipment)

Typical categories:

- lease deposit + fit‑out (utilities, clean areas if needed, EHS)

- packaging/processing equipment (printing, coating, assembly lines, QC equipment, labeling, serialization)

- safety infrastructure (especially for chemicals, pharma, or regulated goods)

For packaging businesses, the “Hainan value‑add” often comes from decoration, assembly/kitting, serialization, and QA/QC—which are equipment + labor + SOP intensive.

3) ERP / customs IT systems (non‑negotiable)

You need a system that can produce:

- batch‑level materials origin and cost

- step‑level processing logs

- a consistent value‑added calculation file tied to invoices and payments

This is how you turn the 30% formula into repeatable operations—not a one-time calculation. (The rule is formula-driven and documentation-driven.) Source

4) Working capital for inbound inventory

Most firms model “tariff savings” but forget cash timing:

- you may need to pre-build inventory in Hainan

- you may need higher safety stock because of island logistics

- suppliers may demand payment before you realize tariff benefit in mainland sales

So your model must include:

- inventory days on hand (Hainan warehouse)

- receivables cycle from mainland customers

- any deposits or prepayments

5) Staffing and professional services

Budget for:

- trade compliance + customs ops (usually premium talent)

- finance/controller functions that can maintain audit trails

- local operations management

- legal/tax advisory + customs broker support

The hidden cost that kills projects: compliance time

Even with a good ERP, teams spend real time on:

- exception handling

- correcting supplier origin docs

- pricing reconciliation

- preparing audit packs

- responding to customs questions

If your team cannot produce clean documentation at scale, the benefit becomes uncertain—and uncertainty is what CFOs price as risk (higher hurdle rate, lower approved volume, or “pilot only” decision).

Break-Even Analysis (template logic)

A CFO‑ready model should be structured around annual benefits vs annual incremental costs, with a clear pass/fail branch for compliance.

Annual Benefits

1.Tariff savings (primary lever)

The policy’s headline benefit is tariff exemption on eligible goods entering mainland China when the 30% threshold is met. Source

Model it as:

- Tariff savings = Mainland taxable base × tariff rate

- Use conservative assumptions on the “taxable base” (transaction price) and avoid mixing B2C retail prices into B2B calculations.

2. Working capital improvement (cycle-time reduction)

Model the financial value of faster clearance / reduced duty cash-out (where applicable) as:

- reduced days cash is tied in inventory or clearance

- lower financing cost (WACC or short-term borrowing rate)

3. Secondary benefits (often real, but should be discounted) Examples:

- better quality control before mainland distribution (fewer returns/write-offs)

- faster China‑market SKU localization (language, compliance packs, packaging refresh)

- reduced gray-market arbitrage pressure in categories where pricing is sensitive (luxury/beauty)

These are valuable, but CFOs typically require evidence—so treat them as “Phase 2 validated” unless you already have data.

Annual Costs

Incremental overhead + compliance staffing + broker/advisory

- compliance headcount

- customs broker fees

- audit and tax advisory

- incremental admin overhead

Depreciation (if capex-heavy) If you buy equipment, your ROI should reflect:

- depreciation schedule

- maintenance contracts

- planned upgrades (automation, serialization systems)

Logistics complexity (island lead times + buffers)

- extra freight legs

- buffer inventory cost

- potential premium shipping for urgent mainland replenishment

Critical constraint: treat 30% compliance as binary

Your financial model must branch explicitly:

- Pass (≥30%) → tariff relief (plus any validated cycle-time benefits)

- Fail (<30%) → standard tariffs + potential penalties + reputational risk

This “binary compliance gate” is the core difference between Hainan FTP ROI modeling and normal logistics optimization.

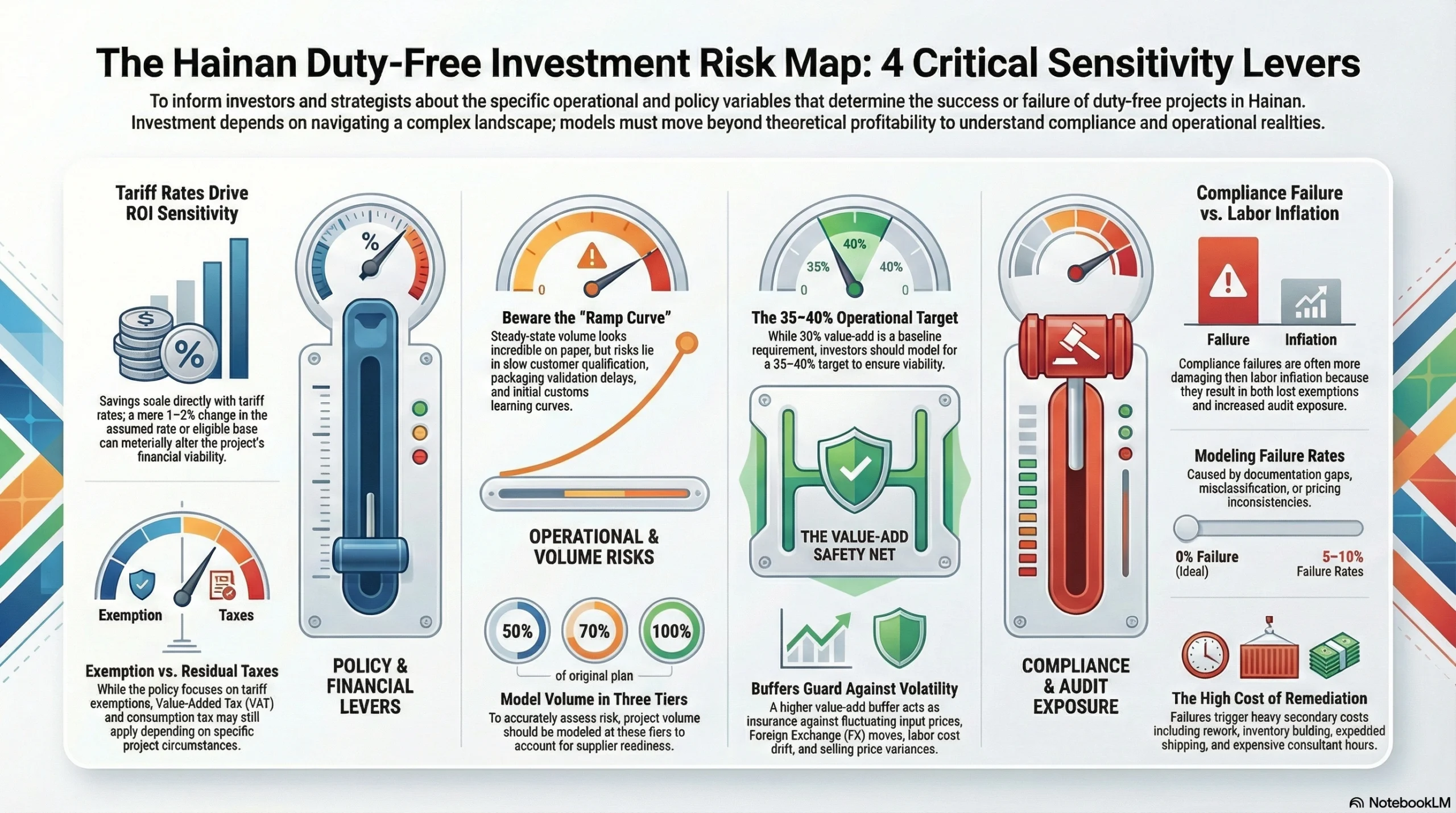

Sensitivity Analysis

The most sensitive variables determine whether the project stays investable under stress. Run three scenarios (base / downside / upside) and include a “compliance failure” stress case.

1) Tariff rate (policy lever)

Because savings scale directly with tariff rate, even a 1–2% change in assumed tariff rate or eligible base can materially change ROI. Also keep in mind the policy is specifically about tariff exemption, while VAT/consumption tax may still apply depending on circumstances. Source

2) Throughput (volume ramp risk)

Most Hainan projects look incredible at steady-state volume. The real risk is the ramp curve:

- slow customer qualification

- delayed packaging validation cycles

- initial customs learning curve

- supplier document readiness

Sensitivity: model volume at 50%, 70%, and 100% of plan.

3) Value-add buffer above 30% (operational risk)

Don’t model exactly 30%. Model your operational target at 35–40%. Why: input prices move, FX moves, labor costs drift, and selling prices vary—your buffer is your insurance.

4) Compliance failure rate (process risk)

Model scenarios like:

- 0% of shipments fail (ideal)

- 5–10% fail due to documentation gaps, misclassification, or pricing inconsistencies

- remediation costs (rework, holding, expedited shipping, consultant hours)

This variable is often more damaging than labor cost inflation, because it hits both savings (lost exemptions) and risk (audit exposure).

Risk Management Framework

Hainan’s upside is real—but it’s not “free money.” Treat it like a regulated operating model: a blend of customs engineering, financial controls, and repeatable documentation. The rule is explicitly framed around a 30%+ value-added threshold for processed goods entering the mainland tariff-free, under Hainan’s “first line / second line” customs architecture. Source A widely cited formulation also makes clear that the exemption targets import tariffs, while VAT and consumption tax may still apply in many cases. Source

To make your strategy credible to CFOs, auditors, and partners, your risk framework should be documented like a compliance manual: define risks, define controls, define monitoring cadence, define escalation paths.

Operational Risks

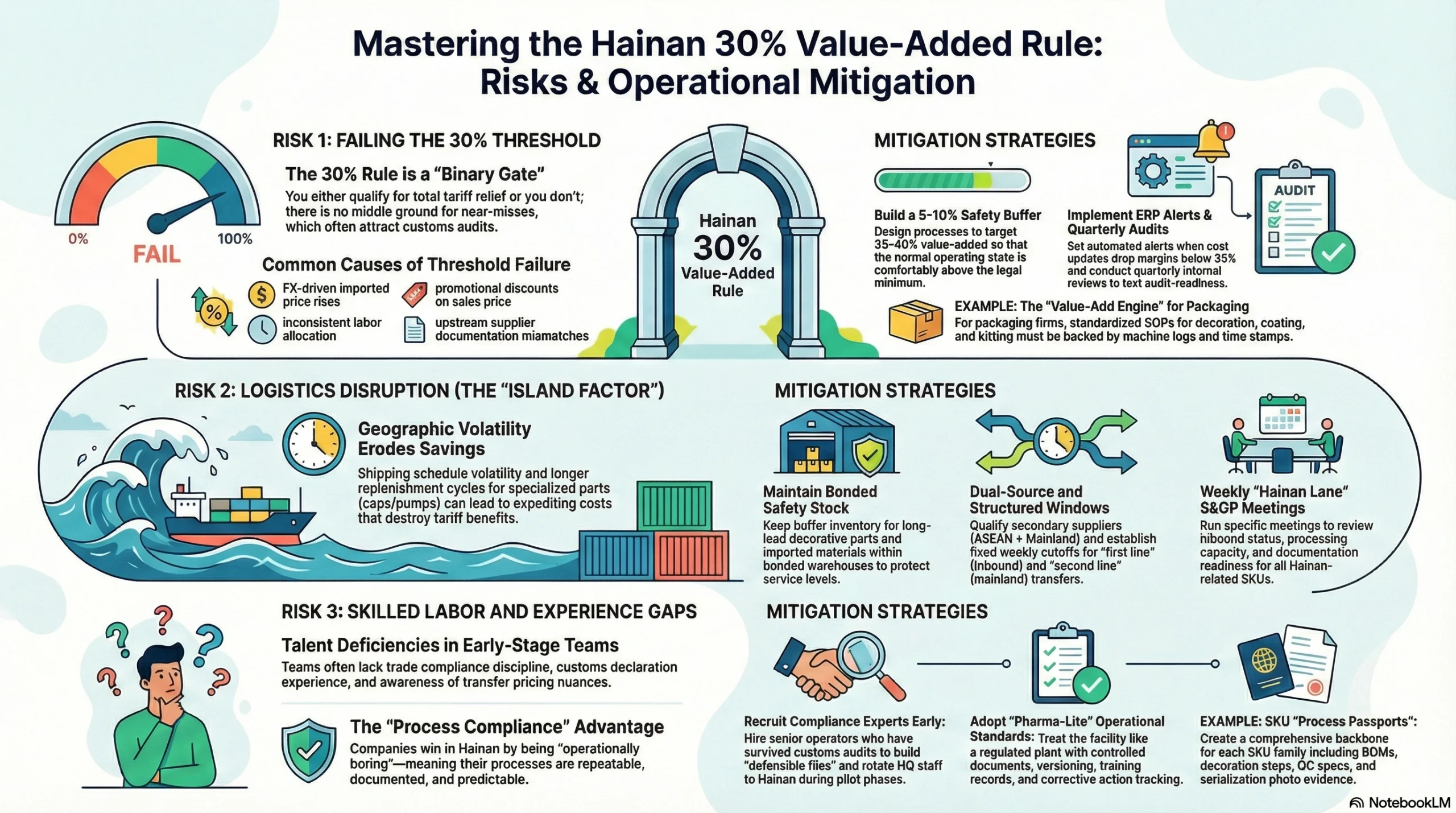

Risk 1: Failing the 30% threshold

What it looks like in real operations:

Your first few shipments qualify, then a later batch fails because:

- imported input prices rise (FX, supplier price changes)

- domestic sales price is discounted for a promotion or distributor negotiation

- labor/overhead allocation is inconsistent or poorly documented

- a supplier’s “domestic material” turns out to be imported upstream (documentation mismatch)

Why it’s dangerous:

The 30% rule is a binary gate: you either qualify and get tariff relief, or you don’t. And because qualification is formula-driven and audit-driven, repeated “near-misses” can attract attention. The rule is described as allowing goods meeting 30%+ value-added to be exempted from import tariffs when shipped to the mainland. Source

Mitigation (make it operational, not theoretical):

- Target 35–40% (build a buffer): Design your process so the normal state is comfortably above 30%. Treat 30% as a legal minimum, not an operating target.

- Implement ERP alerts + pre-declaration checks: Your ERP should calculate value-add at the batch level and trigger alerts when margin-to-threshold shrinks (e.g., when a cost update drops you below 35%).

- Run quarterly internal audits + periodic external reviews: Quarterly internal checks validate your logic (pricing, cost allocation, origin proof). External reviews (semi-annual or annual) test audit-readiness and “red flag” patterns before customs does.

Packaging-specific control tip (Jarsking angle):

Standardize value-added SOPs for packaging processes (decoration, coating, kitting, serialization, QC) with time stamps, machine logs, and QC reports. Those steps are often your “value-add engine” and must be consistently evidenced.

Risk 2: Logistics disruption (island factor)

What it looks like:

Hainan adds a geographic layer. Problems can include:

- shipping schedule volatility at “first line” entry points

- longer replenishment cycles for specialized packaging components (caps, pumps, decorative parts)

- missed delivery windows into the mainland (second line) causing customer stock-outs

- higher expediting costs that erode tariff savings

Why it matters:

Even when tariffs drop, a disrupted service level can destroy commercial relationships—especially in cosmetics/perfume launches where timing is critical.

Mitigation:

- Safety stock in bonded warehousing: Maintain buffer inventory for critical components and imported materials (especially long-lead decorative parts). This is often cheaper than expediting and protects service levels.

- Alternate suppliers and routing: Dual-source where possible (ASEAN + mainland + backup). For critical packaging components, qualify at least one secondary supplier early.

- Structured scheduling windows for “first line” and “second line”: Treat the logistics calendar as part of compliance: fixed weekly cutoffs for inbound imports and mainland transfers reduce chaos and make documentation more consistent.

Operational best practice:

Run a weekly S&OP-style meeting specifically for “Hainan lane” SKUs: inbound status, processing capacity, documentation readiness, and second-line shipment plan.

Risk 3: Skilled labor / experience gap

What it looks like:

Early-stage teams often have manufacturing talent but lack:

- customs declaration experience

- trade compliance documentation discipline

- transfer pricing awareness (if intra-group charges exist)

- “audit mentality” operations management

Why it matters:

The 30% rule is a process compliance advantage. Companies win by being operationally boring: repeatable, documented, predictable.

Mitigation:

- Recruit trade compliance + customs operations experts early: You need at least one senior compliance operator who has lived through customs audits and understands how to build “defensible files.”

- Rotate experienced staff from HQ during pilot: Send your most rigorous QA/operations managers to build the first SOPs and training modules.

- Build SOPs and training like a regulated plant: Treat the Hainan facility like you would treat pharma GMP-lite: controlled documents, versioning, training records, and corrective action tracking.

Packaging-specific control tip:

Create packaging “process passports” for each SKU family: materials BOM + decoration steps + QC specs + serialization logic + photo evidence. This becomes your audit-ready backbone.

Regulatory Risks

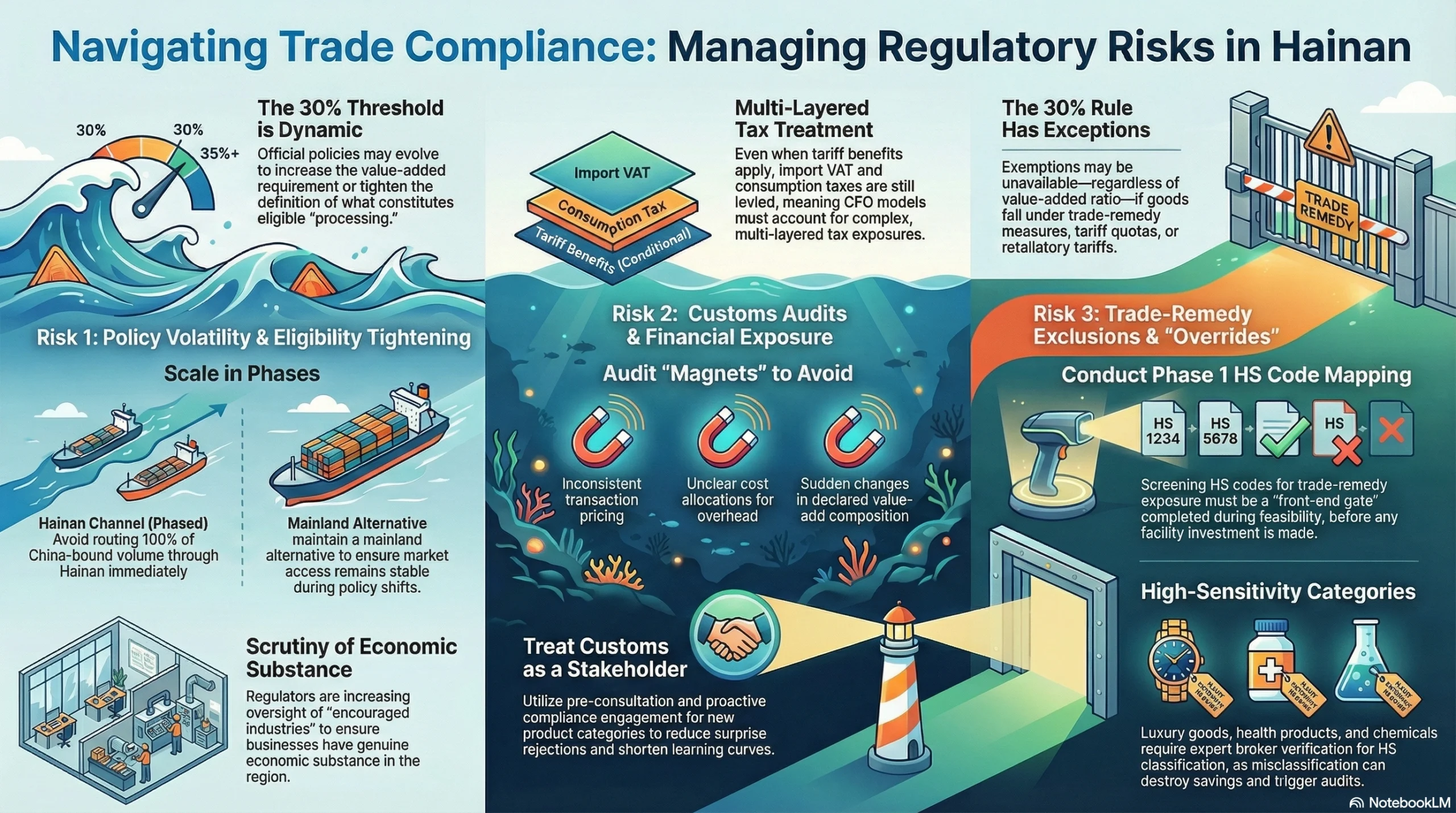

Risk 4: Policy changes / eligibility tightening

What it looks like:

The policy environment could evolve in ways that change ROI:

- threshold adjustments (e.g., 30% → 35% or higher)

- tighter definitions of eligible “processing”

- increased scrutiny of economic substance for encouraged industries

- new exclusions or product coverage changes

Official sources emphasize the 30% value-added threshold as the key condition for tariff-free mainland entry of processed goods. Source

Mitigation:

- Diversify: don’t route 100% of China volume through Hainan immediately: Scale in phases—keep a mainland alternative alive until Hainan operations prove stable over time.

- Scenario plan threshold and exclusions: Model what happens if the threshold rises, or if certain HS codes become excluded.

- Keep mainland backup capability: Maintain at least minimal capacity or qualified partners on the mainland so your China market access isn’t hostage to one policy pathway.

Risk 5: Customs audits and penalties

What it looks like:

Audits can be triggered by:

- inconsistent transaction pricing

- unclear cost allocations (especially overhead and inter-company charges)

- missing invoices or upstream origin proofs

- sudden changes in declared value-add composition

A key point for CFO models: “Import VAT and consumption tax will still be levied…” even when the tariff benefit applies. Source That means tax treatment is multi-layered, and audit exposure can arise from misunderstandings, not just fraud.

Mitigation:

- Maintain consistent transaction pricing: Large price swings without commercial justification are classic audit magnets.

- Maintain complete audit trails; avoid “creative” transfer pricing: If you have related-party processing fees, prepare defensible transfer pricing logic and keep documentation clean.

- Use pre-consultation + proactive compliance engagement: Treat customs as a stakeholder. For new product categories, pre-consultation reduces surprise rejections and shortens learning curves.

Risk 6: Trade-remedy exclusions

What it looks like:

Even if your value-added ratio is ≥30%, the exemption may still be unavailable if your goods or inputs fall under categories like:

- tariff quota administration

- trade remedy measures

- suspension of tariff concessions

- additional/retaliatory tariffs

This “override” risk is emphasized in legal guidance discussing exclusions that can apply even when the threshold is met. Source

Mitigation:

- Map HS codes + trade-remedy exposure in Phase 1 feasibility: Do not wait until you’ve invested in a facility. Screening HS codes and policy exclusions should be a front-end gate.

Packaging-specific warning:

If you package goods that fall into sensitive categories (luxury, health products, chemicals), ensure your HS classification is verified by experienced brokers—misclassification can destroy savings and trigger audit flags.

Geopolitical Risks

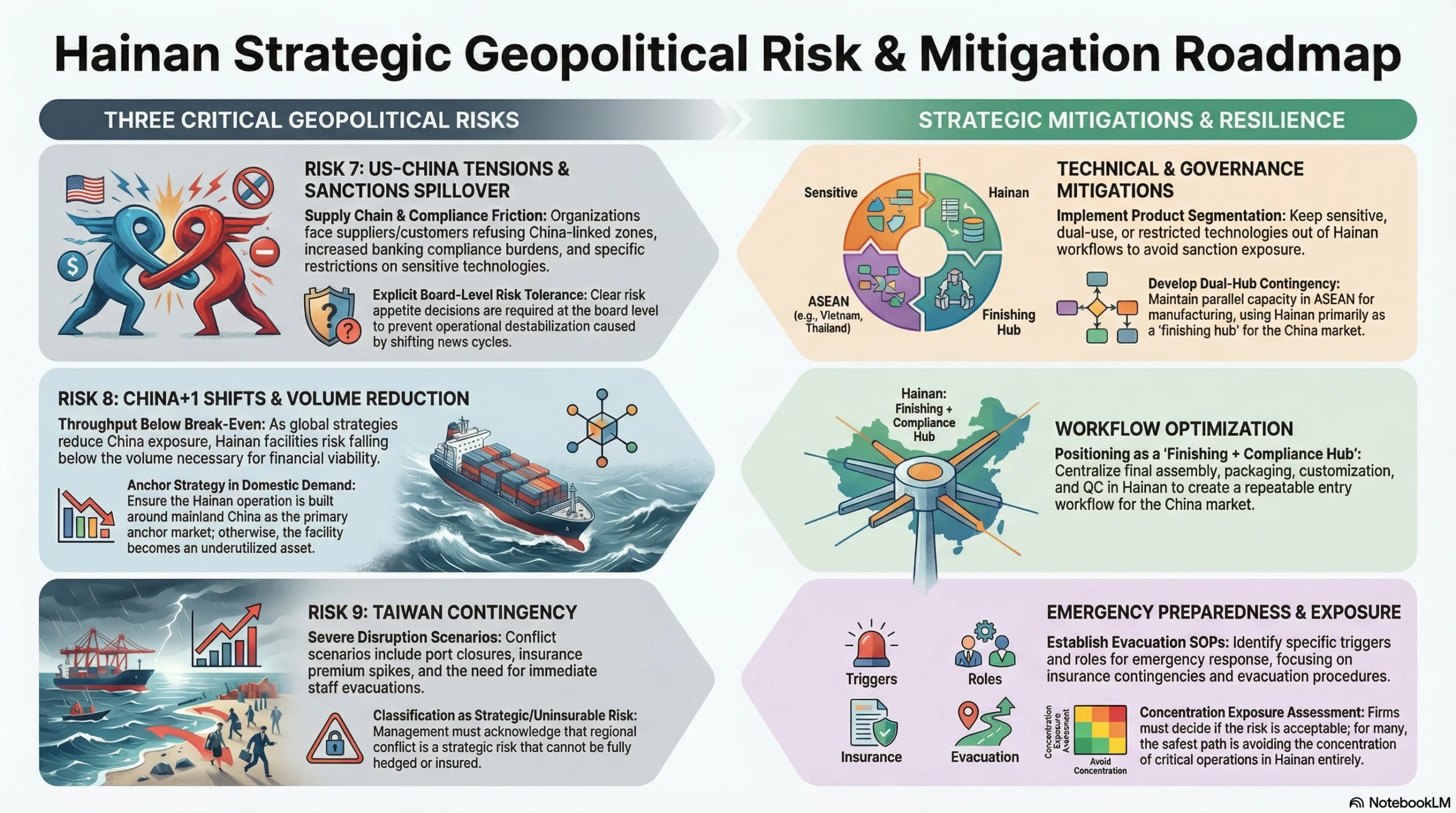

Risk 7: US–China tensions / sanctions spillover

What it looks like:

Potential impacts include:

- suppliers or customers refusing to ship through China-linked zones

- increased compliance burden from banks/insurers

- restrictions on certain technologies or components

- reputational concerns for some brands

Mitigation:

- Product segmentation: Keep sensitive, sanction-exposed, dual-use, or restricted technology out of Hainan workflows.

- Dual-hub contingency capacity (ASEAN + China): Maintain parallel capability (e.g., Vietnam/Thailand for manufacturing + Hainan as China entry “finishing hub” where appropriate).

- Board-level risk tolerance decision: Make it explicit. If risk appetite is unclear, the operation will be destabilized by every news cycle.

Risk 8: China+1 shifts reduce China volume

What it looks like:

If your company’s global strategy reduces China exposure, your Hainan throughput may fall below break-even.

Mitigation:

- Build Hainan strategy around China domestic demand (if that’s your thesis): If mainland China is truly the anchor market, Hainan supports that thesis. If not, Hainan becomes an underutilized asset.

- Position Hainan as “finishing + compliance hub” for China entry: This is especially relevant for packaging: final assembly, customization, serialization, QC, and China-market compliance packs can be centralized as a repeatable entry workflow.

Risk 9: Taiwan contingency

What it looks like:

Severe disruption scenarios can include port closures, insurance premium spikes, and staff evacuation challenges.

Mitigation:

- Acknowledge it as strategic/uninsurable risk: Don’t pretend it’s fully hedgeable.

- Plan insurance/evacuation contingencies: Identify triggers, roles, and evacuation SOPs.

- Decide whether exposure is acceptable: For some firms, the right answer is simply not to concentrate critical operations in Hainan.

Financial Risks

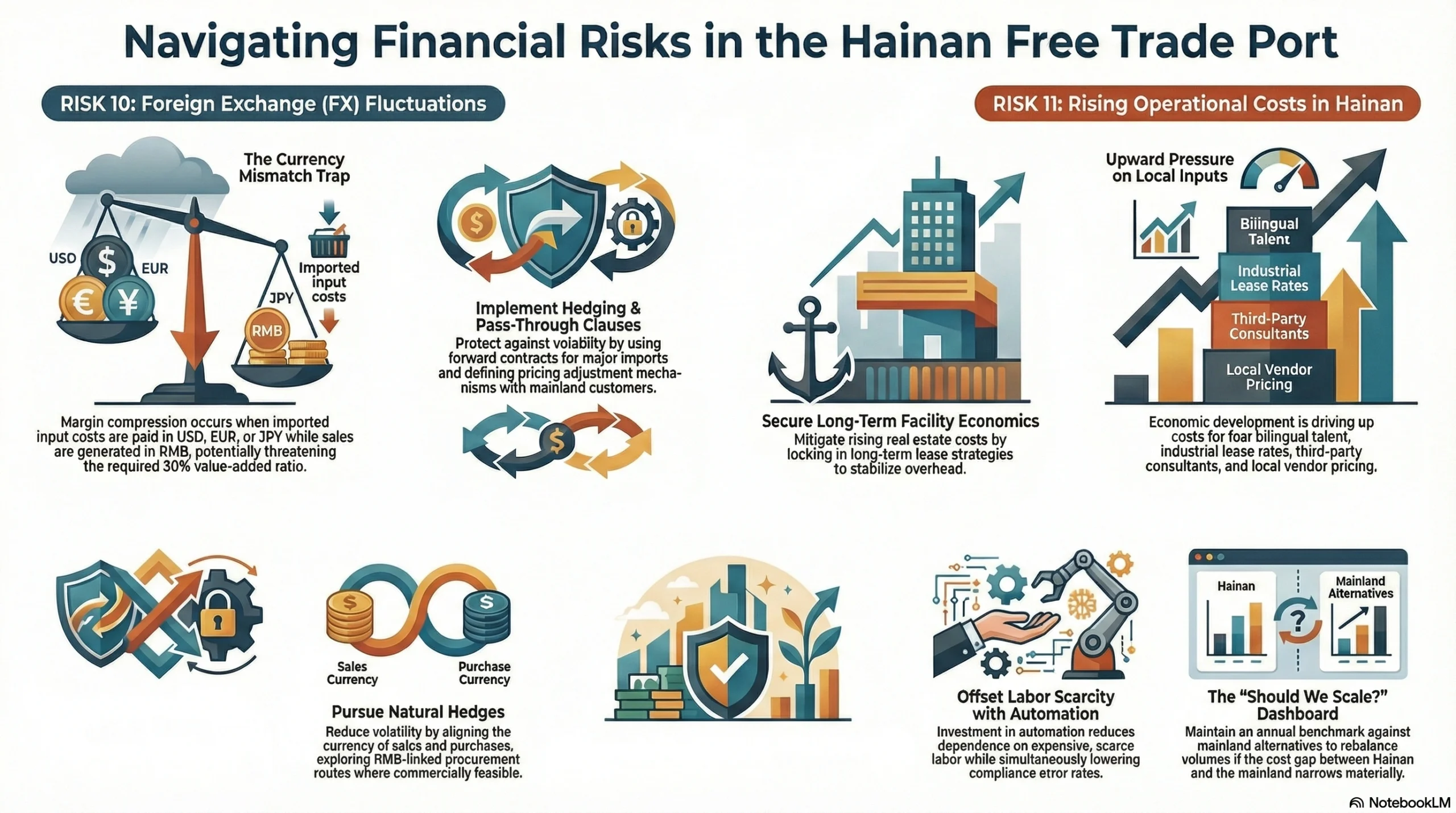

Risk 10: FX fluctuations

What it looks like:

Imported input costs move with USD/EUR/JPY, while mainland sales may be RMB. That can compress margins and also affect your 30% ratio if imported material costs increase.

Mitigation:

- Hedging policy + pass-through clauses: Use forward contracts for major imports, and define pricing adjustment mechanisms with mainland customers for large FX swings.

- Align currency of sales and purchases where possible: Natural hedges reduce volatility. If sales are RMB, explore RMB-linked procurement routes where commercially feasible.

Risk 11: Rising costs in Hainan

What it looks like:

As the zone develops, you may see upward pressure in:

- wages for compliance and bilingual operations talent

- industrial lease rates

- third-party service fees (brokers, consultants)

- local vendor pricing

Mitigation:

- Long-term lease strategy: Lock in facility economics where possible.

- Automation investment: Reduce dependence on scarce labor and improve process repeatability (which also reduces compliance error rates).

- Annual benchmark vs mainland alternatives: Maintain a “should we keep scaling here?” dashboard—if cost gaps narrow materially, you can rebalance volume without disrupting the business.

Implementation Roadmap—From Pilot to Scale

This is where most companies either (a) win big or (b) fail expensively. The winning pattern is phased execution.

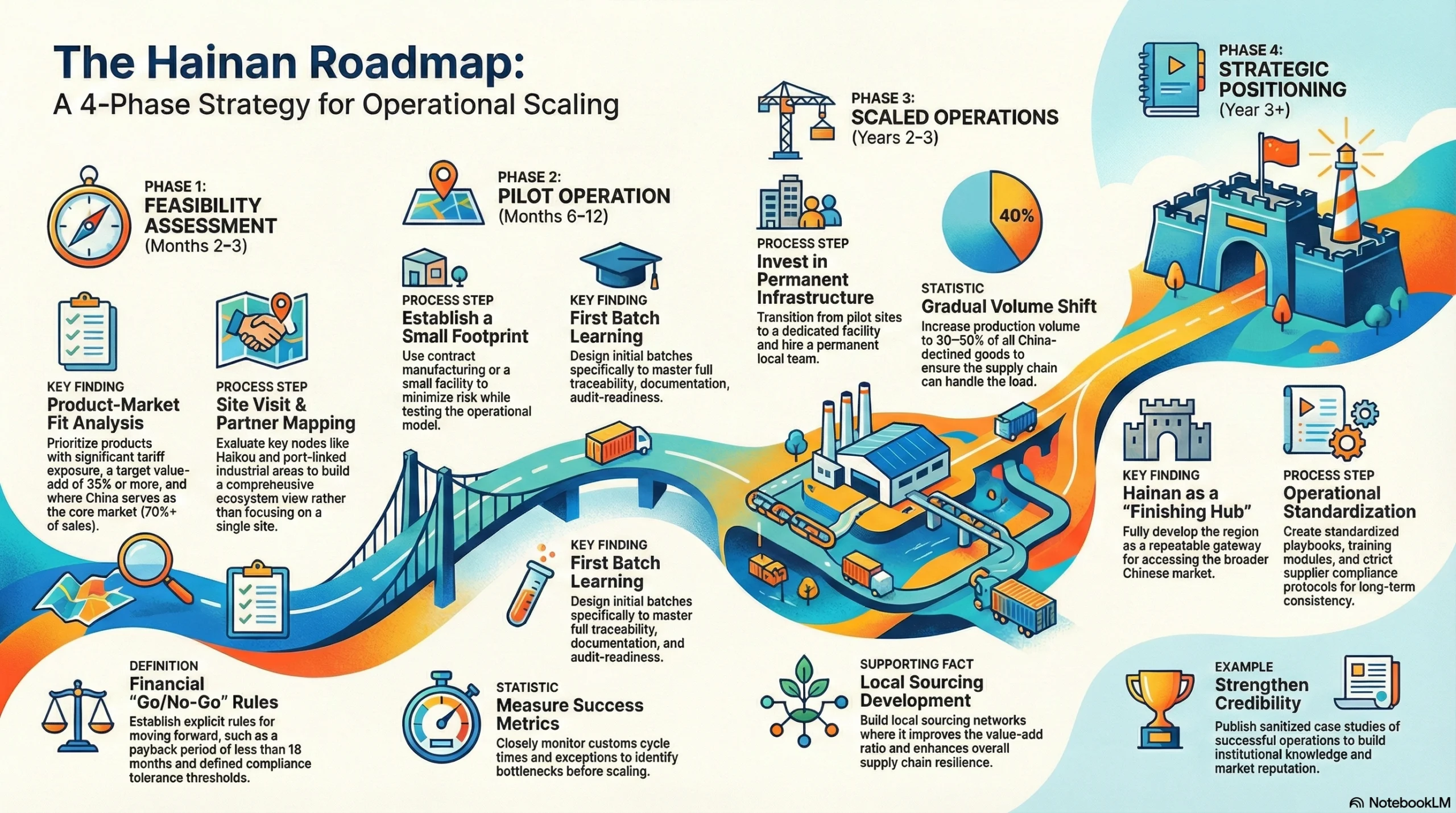

Phase 1—Feasibility Assessment (2–3 months)

Product-market fit analysis

Choose products with:

- meaningful tariff rate exposure

- achievable value-add (≥35% target)

- China as core market (e.g., 70%+ of sales)

Site visit & partner mapping

Evaluate key nodes like Haikou and port-linked industrial areas; build an ecosystem view, not a single-site view.

Regulatory consultation

Validate eligibility and set documentation standards early.

Financial modeling

Make “go/no-go” rules explicit (e.g., payback <18 months; compliance tolerance thresholds).

Phase 2—Pilot Operation (6–12 months)

- small facility footprint or contract manufacturing

- first batches designed for learning: full traceability, full documentation

- measure customs cycle time, exceptions, and audit-readiness

Phase 3—Scaled Operations (Year 2–3)

- invest in a real facility and permanent team

- shift volume gradually (30–50% of China-destined volume)

- build local sourcing where it improves the ratio and resilience

Phase 4—Strategic Positioning (Year 3+)

- develop Hainan as a repeatable “finishing hub” for China access

- standardize playbooks, training, and supplier compliance protocols

- publish sanitized case studies to strengthen credibility

CONCLUSION: From Policy to Practice—Your Action Plan

This three-blog series leads to a clear strategic picture:

- Blog 1: Hainan, Singapore, and Dubai serve different functions; it’s not a winner-take-all competition.

(Read Blog 1) - Blog 2: Hainan is also geopolitical and institutional infrastructure—a China-centric interface designed to keep trade functioning under stress.

(Read Blog 2) - Blog 3 (this guide): The deciding factor is not policy awareness—it’s implementation capability: finance modeling, compliance engineering, and phased execution.

The Strategic Decision Framework

When to use Hainan

- Mainland China is your primary market (often ≥70% of sales)

- Your products have meaningful tariff exposure

- You can engineer value-added steps that are real, repeatable, and auditable

- You have sufficient scale to justify compliance overhead

When to stay with Singapore/Dubai

- You’re primarily multi-market distributing (not China-centric)

- Your products have thin margins and low feasible value-add

- You are in geopolitically sensitive sectors

- Your China volume is too small to justify setup and compliance

Action items by stakeholder

For CFOs

- commission a tariff + value-add ROI model with scenario planning

- quantify compliance cost (people + systems) as a first-class budget item

For supply chain managers

- map China-bound flows and identify the SKUs where value-add can be engineered

- run a pilot with strict documentation discipline

For procurement directors

- restructure supplier terms and incoterms to support documentation and cost basis integrity

- build a compliant supplier declaration package (origin + pricing + traceability)

For CEOs / BU leaders

- decide whether China market access is strategic enough to justify the operational and geopolitical exposure

- set the “risk boundary” explicitly (what you will and won’t process through Hainan)

Final thought

Hainan FTP is not a silver bullet—it’s a sophisticated tool. Companies that approach it strategically will capture meaningful competitive advantage. Those who rush in without systems, buffers, and audit discipline will face costly surprises.

FAQs

It’s a mechanism that can exempt certain Hainan-processed goods from import tariffs when shipped into mainland China—if the product meets a ≥30% value-added calculation and other eligibility criteria. Source

Value-added percentage = [(Domestic sales price – price of imported materials – price of domestically purchased materials) / ( price of imported materials + price of domestically purchased materials)] * 100% Source

Yes in many cases. A widely cited note states: “Import VAT and consumption tax will still be levied, unless these taxes have already been paid during the goods’ circulation within Hainan.” Source

Yes. If several registered Hainan companies perform processing at different stages, their value-added contributions can be combined, using the same formula with aggregated costs/prices. Source

You generally lose the tariff exemption benefit and may face normal tariff treatment; if documentation or declarations are found inaccurate, regulatory consequences can be more serious. The best prevention is targeting a buffer (often 35–40%) and maintaining complete documentation.

The rule is commonly described as applying to “encouraged industrial enterprises” operating under the Hainan encouraged industries framework and meeting substance expectations. Source

Run a pilot with limited SKUs and batch sizes, using either a small leased footprint or qualified partners, and treat documentation and traceability as the core deliverable—alongside savings.