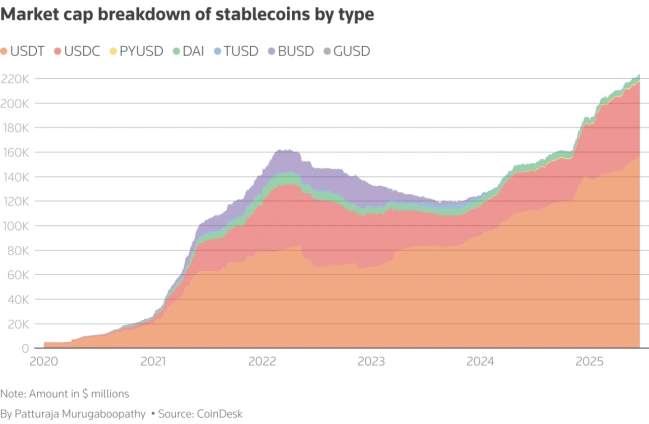

The digital asset ecosystem has witnessed unprecedented growth, with stablecoins emerging as one of its most transformative innovations. These cryptocurrency tokens, designed to maintain stable value relative to reference assets, have become the backbone of digital finance. With stablecoins now representing over 60% of all cryptocurrency transaction volume and reaching a market capitalization exceeding $200 billion as of 2024, their influence extends far beyond simple price stability.

Stablecoins solve a fundamental problem in the cryptocurrency space: volatility. While Bitcoin and Ethereum offer revolutionary blockchain technology, their price fluctuations make them impractical for everyday transactions and value storage. Stablecoins bridge this gap by combining the technological advantages of cryptocurrency—fast, borderless, programmable money—with the predictability that businesses and consumers require.

The stablecoin market has evolved from a niche financial instrument to critical infrastructure supporting a vast ecosystem of decentralized finance (DeFi) applications, cross-border payments, and digital commerce. As we advance through 2025, stablecoins are positioned to play an increasingly central role in the global financial system, with industry analysts projecting growth to $300 billion in market capitalization and potentially $3 trillion over the next five years.

This comprehensive analysis explores the technical mechanisms underlying stablecoins, examines the competitive landscape dominated by Tether (USDT) and Circle’s USD Coin (USDC), and investigates the regulatory frameworks shaping their future. We’ll also examine the risks and challenges facing stablecoin adoption, from depegging events to regulatory uncertainty, while exploring emerging trends that will define the next phase of stablecoin evolution.

The Anatomy of Stablecoins: Types and Mechanisms

Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins represent the most straightforward approach to maintaining price stability. These tokens are backed by traditional fiat currencies held in reserve accounts, typically maintaining a 1:1 ratio with their reference currency. Circle’s USDC exemplifies this model, with all outstanding tokens backed by “at least an equivalent amount of fiat currency denominated reserve assets”.

The reserve composition for these stablecoins typically includes cash balances held at banks, short-dated U.S. Treasury securities, and money market funds. Circle’s reserve strategy includes assets like the Circle Reserve Fund, which invests in highly liquid government securities managed by BlackRock. This approach provides transparency and regulatory compliance, as evidenced by Circle’s monthly attestation reports that detail exact reserve compositions.

The operational mechanics are relatively simple: when users want to mint new stablecoins, they transfer fiat currency to the issuer’s segregated reserve accounts. The issuer then creates new tokens and transfers them to the user’s account. For redemption, the process reverses—users send tokens to the issuer, who burns them and transfers the corresponding fiat amount back to the user’s bank account.

Crypto-Collateralized Stablecoins

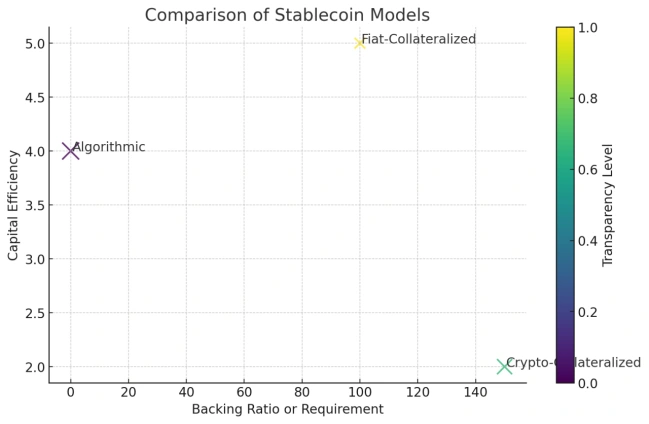

Crypto-collateralized stablecoins use cryptocurrency assets as backing, typically requiring over-collateralization to account for the volatility of the underlying assets. DAI, issued by MakerDAO, represents the most successful implementation of this model, with a market capitalization of approximately $5.8 billion.

These stablecoins rely on smart contracts to manage collateral ratios automatically. When the value of underlying collateral falls below predetermined thresholds, the system can liquidate portions of the collateral to maintain the stablecoin’s peg. This mechanism provides decentralization benefits but introduces complexity in collateral management and potential systemic risks during market stress.

The over-collateralization requirement means that users must typically deposit $1.50 or more in cryptocurrency to mint $1.00 worth of stablecoins. While this provides a buffer against price volatility, it also creates capital inefficiency compared to fiat-collateralized alternatives.

Algorithmic Stablecoins

Algorithmic stablecoins attempt to maintain price stability through programmatic supply adjustments rather than asset backing. These systems use algorithms to expand or contract the token supply based on market demand, theoretically maintaining the peg through market forces alone.

The catastrophic failure of TerraUSD (UST) in May 2022, which lost its peg and contributed to a broader market collapse, highlighted the inherent risks in algorithmic approaches. The $200 billion collapse of the Terra ecosystem demonstrated that purely algorithmic mechanisms may be insufficient to maintain stability during severe market stress.

Despite these failures, development continues on hybrid models that combine algorithmic elements with partial collateralization. These approaches aim to improve capital efficiency while maintaining greater stability than pure algorithmic systems.

Here’s a chart comparing Fiat-Collateralized, Crypto-Collateralized, and Algorithmic Stablecoins based on key attributes:

X-axis: Backing Ratio/Requirement (higher means more collateral required)

Y-axis: Capital Efficiency (higher means more efficient use of capital)

Bubble Size: Operational Complexity (larger bubbles = more complex)

Color: Transparency (brighter color = more transparency)

How Stablecoins Work: Technical Deep Dive

Issuance and Redemption Process

The minting and redemption process forms the core of stablecoin operations. For Circle’s USDC, the process begins when verified customers wire fiat currency to Circle’s bank accounts. Once the funds are confirmed, Circle mints new USDC tokens to the customer’s Circle Mint account, increasing the total supply in circulation.

Circle offers two redemption options: standard redemption, which is “initiated nearly instantly,” and basic redemption, which processes “within two business days.” The company currently doesn’t charge fees for minting or basic redemption, though standard redemption incurs fees ranging from 0.03% to 0.1% depending on the redemption amount.

The redemption process requires Circle to transfer corresponding fiat funds from segregated reserve accounts to customers’ bank accounts. This one-to-one redeemability forms the foundation of stablecoin stability, as it provides arbitrage opportunities that help maintain the peg when secondary market prices deviate from par value.

Reserve Management and Auditing

Proper reserve management is crucial for stablecoin stability and regulatory compliance. Circle maintains reserves in segregated accounts “titled FBO (for the benefit of) holders of USDC and EURC,” ensuring that reserve assets are legally separated from the company’s corporate assets.

The auditing process involves multiple layers of verification. Circle’s auditors use proprietary tools to “independently obtain evidence from public blockchains to test the completeness of stablecoins minted and outstanding by blockchain”. This process includes testing the effectiveness of controls over the minting and burning process and reconciling reserve assets to stablecoins in circulation.

Independent auditing provides transparency and builds market confidence. The auditing process evaluates the composition, quality, and diversification of reserve assets, verifies that reserves match issuer claims, and assesses risks associated with reserve management. Regular audits help identify potential vulnerabilities before they become significant problems and ensure compliance with regulatory requirements.

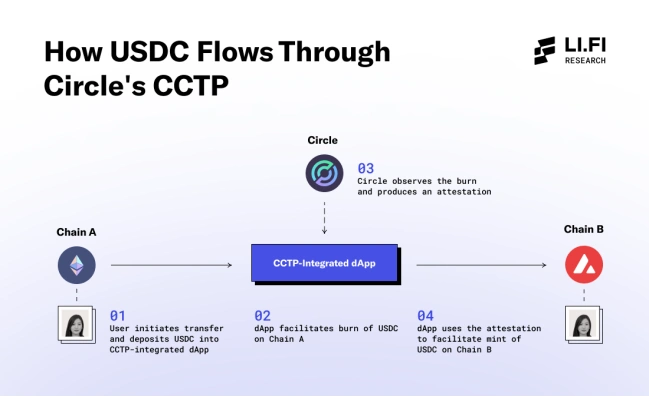

Cross-Chain Bridge Technology

Modern stablecoins operate across multiple blockchain networks, requiring sophisticated bridge technologies. Circle’s Cross-Chain Transfer Protocol (CCTP) exemplifies this approach, handling approximately $24.7 billion in transfers since its launch in April 2023.

CCTP works by redeeming USDC on the source chain and issuing new USDC on the destination chain, using cryptographic attestations to prove proper redemption before reissuing tokens. This process ensures that the total supply remains consistent across all chains while enabling seamless interoperability.

The protocol operates through smart contracts that work alongside the core USDC protocol, providing a public infrastructure that developers can integrate into their applications. This capability represents a significant competitive advantage, as it enables USDC to function as native currency across multiple blockchain ecosystems.

Real-World Applications and Use Cases

Digital Commerce and Payments

Stablecoins have transformed digital commerce by enabling fast, low-cost transactions without the volatility associated with traditional cryptocurrencies. By 2025, stablecoins serve as the backbone of blockchain payments, offering price stability that makes them “perfect for everyday use and long-term storage”.

Cross-border payments represent one of the most compelling use cases. Traditional remittance services often charge high fees and require lengthy processing times, while stablecoins enable users to “send funds anywhere in the world in minutes and at a fraction of the cost”. This capability has proven particularly valuable in emerging markets where traditional banking infrastructure may be limited.

Merchants increasingly appreciate stablecoins for their reduced transaction costs and instant settlements. Unlike credit card transactions that can take days to settle and incur processing fees of 2-3%, stablecoin transactions settle within minutes at minimal cost. This efficiency makes stablecoins attractive for both small purchases like coffee and large transactions like rent payments.

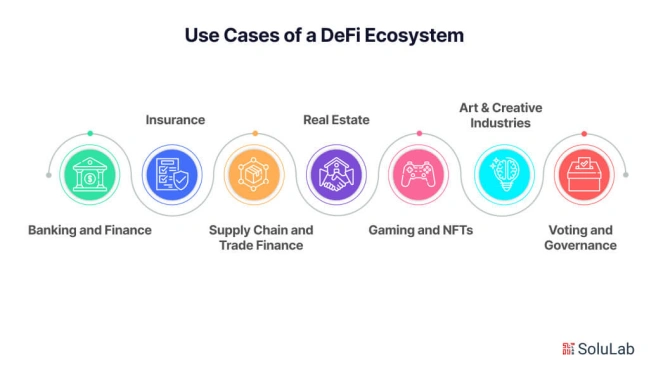

DeFi Ecosystem Foundation

Stablecoins serve as the fundamental building blocks of decentralized finance, powering lending protocols, liquidity pools, and yield farming strategies. They provide the stable value necessary for users to engage with financial services without requiring traditional banks.

In automated market makers (AMMs), stablecoins provide liquidity for trading pairs, enabling efficient price discovery and reducing slippage for traders. The stability of these tokens makes them ideal base assets for constructing complex financial instruments and derivatives.

The lending market particularly benefits from stablecoins, as they enable users to borrow stable value without the volatility risk associated with other cryptocurrencies. This stability allows for more predictable interest rates and repayment schedules, making DeFi lending more accessible to mainstream users.

Corporate Treasury and Institutional Use

Crypto-native companies increasingly use stablecoins for treasury management, taking advantage of their stability and programmability. Stablecoins enable these companies to hold digital assets without exposure to cryptocurrency volatility while maintaining the ability to participate in blockchain-based applications.

Payroll and vendor payments represent growing use cases, particularly for companies with international operations. Stablecoins enable instant, low-cost payments to employees and suppliers worldwide, eliminating the complexity and cost of traditional cross-border wire transfers.

The programmability of stablecoins allows for automated treasury operations, including scheduled payments, conditional transfers, and integration with smart contract-based accounting systems. This automation reduces operational overhead while providing transparency and auditability.

Financial Inclusion in Emerging Markets

Stablecoins offer significant potential for financial inclusion in regions with limited banking infrastructure or unstable local currencies. They provide a wealth preservation mechanism for individuals in countries experiencing hyperinflation or currency devaluation.

The accessibility of stablecoins—requiring only an internet connection and a smartphone—makes them available to populations that traditional banking systems have underserved. This democratization of financial services extends beyond payments to include savings, lending, and investment opportunities.

In regions with high remittance volumes, stablecoins offer a cost-effective alternative to traditional money transfer services. Families can receive funds instantly without the high fees and long processing times associated with conventional remittance providers.

Market Leaders and Competitive Landscape

Tether (USDT): The Controversial Pioneer

Tether (USDT) maintains its position as the largest stablecoin by market capitalization, with approximately $153-154 billion in circulation as of mid-2025. Despite its dominance, USDT faces ongoing scrutiny regarding reserve transparency and regulatory compliance.

The company reported record profits of nearly $14 billion in 2024, largely from its significant U.S. Treasury bond holdings. However, Tether’s market share has experienced a slight decline, now representing about 62.09% of the total stablecoin market, down from higher levels in previous periods.

Tether’s controversial aspects include historical questions about reserve backing and regulatory challenges. The company has faced investigations and settlements with regulators over disclosures about its reserve composition and backing practices. Despite these challenges, USDT remains the most widely used stablecoin for trading and liquidity provision across digital asset markets.

USD Coin (USDC): The Regulated Alternative

Circle’s USDC represents a more transparent and regulated approach to stablecoin issuance, with a market capitalization of approximately $61.05-61.5 billion as of June 2025. Circle became the first MiCA-licensed stablecoin issuer in July 2024, providing regulatory clarity that drives adoption, particularly in regions with high remittance activity.

USDC’s competitive advantages include monthly attestation reports that detail reserve composition, regulatory compliance across multiple jurisdictions, and technological innovations like CCTP. The company’s reserve management approach emphasizes transparency and includes detailed disclosures about asset composition and custody arrangements.

Interestingly, while Tether dominates in market capitalization, data suggests USDC has gained traction in transaction volume on certain networks. Some reports indicate USDC overtook Tether in stablecoin transaction volume on networks like Solana and Base by late 2024, driven by high-speed, low-cost transaction activity.

Emerging Competitors and Market Dynamics

The stablecoin market continues to evolve with new entrants and innovations. Beyond the two dominant players, several other stablecoins serve specific niches or geographic markets, including TrueUSD, Paxos Standard, and various exchange-issued stablecoins.

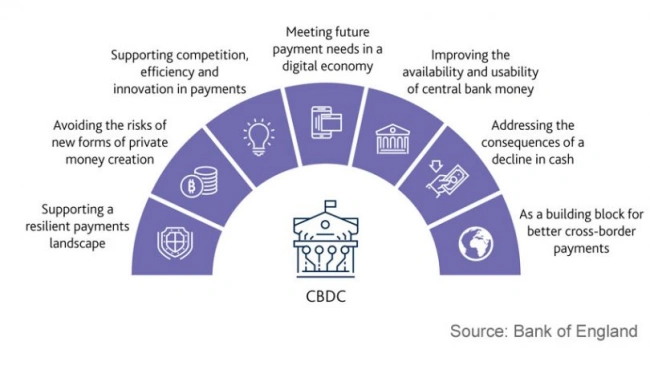

Central Bank Digital Currencies (CBDCs) represent a potential competitive threat to private stablecoins. As governments explore digital versions of their currencies, they may offer direct competition to stablecoins while providing government backing and regulatory clarity.

The market is also seeing innovation in stablecoin design, including yield-bearing stablecoins that provide returns to holders and multi-collateral stablecoins that reduce single-point-of-failure risks. These innovations may reshape the competitive landscape as users seek enhanced functionality beyond basic price stability.

Risks and Challenges

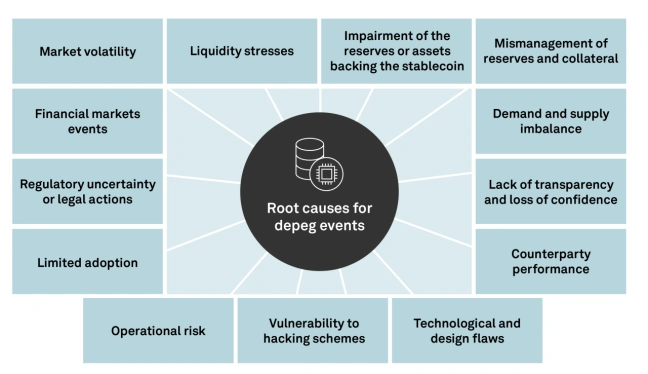

Depegging Events and Market Volatility

Stablecoin depegging events represent one of the most significant risks facing the ecosystem. The March 2023 Silicon Valley Bank (SVB) crisis provides a compelling case study of how external shocks can threaten stablecoin stability.

When SVB failed, Circle had approximately $3.3 billion—roughly 8% of USDC reserves—deposited at the bank. The announcement of SVB’s FDIC receivership “caused some market concern that an inability to instantly access the deposits held at SVB might result in USDC not being fully backed by fiat-denominated reserves”.

The crisis was exacerbated by timing, as the bank failure occurred on a Friday, leaving Circle unable to access traditional banking systems over the weekend. This lack of primary market liquidity, combined with the concurrent failure of two other banks in the Circle ecosystem, created a “temporary supply-demand imbalance” that pushed USDC’s secondary market price below $15.

Circle’s response demonstrated the importance of issuer commitment to maintaining stability. The company “publicly affirmed that in the event SVB did not make a full return of our reserve deposits, we would cover any shortfall using corporate resources”. This commitment, combined with the FDIC’s guarantee of SVB deposits, helped restore confidence and return USDC to its peg.

Regulatory Uncertainty and Compliance Challenges

The regulatory landscape for stablecoins remains complex and evolving. While progress has been made with the U.S. Senate’s passage of the GENIUS Act in June 2025, which would establish a comprehensive regulatory framework for stablecoins, the legislation still requires House approval and presidential signature.

The proposed regulatory framework includes several key requirements: stablecoins must be backed by high-quality liquid assets such as U.S. dollars and short-term Treasury bills, issuers must publicly disclose reserve composition monthly, and companies exceeding $10 billion in outstanding issuance must transition to federal oversight.

For Circle, compliance with potential federal regulations would require obtaining an Office of the Comptroller of the Currency (OCC) charter or being acquired by a bank. The company acknowledges that “there is a risk that we would not receive approval, in which case we would not be able to continue issuing Circle stablecoins in the United States”.

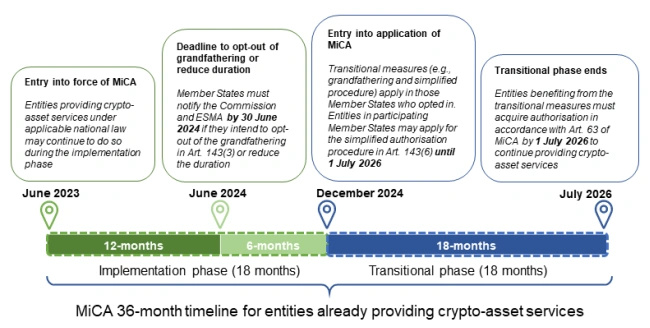

International regulatory developments add another layer of complexity. The European Union’s Markets in Crypto-Assets (MiCA) regulation requires specific compliance measures for stablecoin issuers, including enhanced transparency and reserve management standards.

Systemic Risks and Market Infrastructure

Stablecoins have become critical infrastructure for the cryptocurrency ecosystem, representing over 60% of all cryptocurrency transaction volume. This central role creates systemic risks, as stablecoin failures can cascade through the broader digital asset market.

The risk of concentrated redemption requests poses particular challenges. Circle acknowledges that “privately issued stablecoins may be subject to the risk of significant and concentrated redemption requests, even when they are fully reserved with high quality liquid assets”. In extreme scenarios, the market for short-dated government obligations might not be sufficiently liquid to meet redemption demands in a timely manner.

The interconnectedness of stablecoins with traditional financial markets creates additional risks. As stablecoin reserves increasingly consist of bank deposits and government securities, failures in traditional financial institutions can directly impact stablecoin stability, as demonstrated by the SVB crisis.

Legal and Operational Risks

The legal structure of stablecoins raises important questions about asset ownership in bankruptcy scenarios. If a stablecoin issuer faces insolvency, the treatment of reserve assets remains unclear. Depending on the legal structure, reserve assets might be considered property of the issuer’s bankruptcy estate, potentially leaving stablecoin holders as unsecured creditors. This uncertainty creates significant risks for stablecoin holders. If an issuer were structured to provide only “contractual right to payment from the issuer,” holders might only receive partial recovery in bankruptcy, rather than full reimbursement from segregated reserves.

Operational risks include smart contract vulnerabilities, cybersecurity threats, and human error in reserve management. The complex technology underlying stablecoins creates multiple potential failure points, from blockchain network congestion to smart contract bugs that could affect token functionality.

Regulatory Landscape and Future Compliance

Current Federal Framework Development

The U.S. regulatory landscape for stablecoins is undergoing significant transformation. The Senate’s passage of the GENIUS Act in June 2025 represents a major milestone, establishing the first comprehensive federal framework for stablecoin regulation. The legislation passed with bipartisan support, receiving a 68-30 vote that included numerous Democrats joining Republicans in supporting federal oversight.

The proposed framework establishes several key principles: stablecoins must be backed by liquid assets including U.S. dollars and short-term Treasury bills, issuers must provide monthly public reporting of reserves, and companies exceeding $10 billion in outstanding issuance must obtain federal oversight. This dual regulatory pathway allows both banks and approved nonbank entities to issue stablecoins under specific licensing requirements.

The legislation also addresses jurisdictional clarity by granting state regulators primary supervision authority over state-licensed issuers while giving federal agencies backup enforcement authority. This structure aims to balance innovation with consumer protection while providing regulatory certainty for industry participants.

International Regulatory Coordination

The European Union’s MiCA regulation has already begun influencing global stablecoin standards. Circle’s achievement as the first MiCA-licensed stablecoin issuer in July 2024 demonstrates the practical implementation of these standards. MiCA requires enhanced transparency, specific reserve composition standards, and direct redemption capabilities for end-users.

The regulation mandates that “end-users that are not Circle Mint customers may also redeem USDC or EURC directly from us after providing us with compliance information and supporting documentation”. This requirement extends redemption rights beyond direct customers to all token holders, potentially increasing operational complexity but enhancing consumer protection.

Other jurisdictions are developing similar frameworks, with coordination efforts through G7 and G20 initiatives. The goal is to create consistent global standards that prevent regulatory arbitrage while ensuring adequate consumer protection and financial stability.

Compliance Costs and Market Structure Impact

The evolving regulatory landscape will likely increase compliance costs and create barriers to entry for new stablecoin issuers. Companies must invest in enhanced reporting systems, audit capabilities, and regulatory compliance infrastructure. Circle’s experience illustrates these costs, as the company maintains extensive accounting, treasury, regulatory, and compliance functions.

For smaller issuers, these compliance costs may prove prohibitive, potentially leading to market consolidation. The requirement for companies exceeding $10 billion in issuance to obtain federal oversight may create natural breakpoints in the market, with smaller issuers operating under state licenses and larger ones under federal supervision.

The regulatory clarity, while increasing costs, should also provide benefits including enhanced institutional adoption, improved access to traditional financial services, and reduced regulatory uncertainty that has previously hindered stablecoin integration into mainstream financial systems.

Future Outlook and Emerging Trends

Technological Innovations and Enhanced Functionality

The stablecoin ecosystem continues to evolve with technological innovations that expand functionality beyond basic price stability. Yield-bearing stablecoins represent one significant development, offering holders returns on their holdings while maintaining price stability relative to the underlying reference asset.

Cross-chain interoperability is becoming increasingly sophisticated, with protocols like Circle’s CCTP demonstrating the potential for seamless multi-blockchain operations. This interoperability enables stablecoins to serve as universal currency across different blockchain ecosystems, increasing their utility and adoption potential.

Smart contract integration is enabling more complex financial products built on stablecoin foundations. These include automated market makers, lending protocols, and structured products that use stablecoins as base assets. The programmability of stablecoins allows for innovative financial instruments that would be difficult to implement with traditional currency.

Market Growth and Institutional Adoption

Industry analysts project significant growth in stablecoin adoption, with market capitalization potentially reaching $300 billion in 2025 and up to $3 trillion over the next five years. This growth is driven by expanding use cases, improved regulatory clarity, and increasing institutional adoption.

Institutional adoption is accelerating as regulatory frameworks provide greater certainty. Traditional financial institutions are beginning to integrate stablecoins into their operations, using them for treasury management, cross-border payments, and client services. This institutional embrace validates stablecoins as legitimate financial instruments rather than experimental technology.

The integration of stablecoins into traditional payment systems is also advancing. Mastercard’s exploration of stablecoin integration and similar initiatives by other payment processors suggest that stablecoins may become standard options for digital commerce and everyday transactions.

Competitive Landscape Evolution

The dominance of USDT and USDC is likely to continue, but the competitive landscape may shift as new entrants bring innovative features and regulatory advantages. Web2 companies and fintech firms are exploring stablecoin offerings, potentially challenging existing players with superior user experiences and compliance capabilities.

Central Bank Digital Currencies (CBDCs) represent a significant competitive threat, offering government backing and potentially superior regulatory clarity. However, CBDCs may also complement private stablecoins by providing baseline infrastructure and legitimizing the concept of digital currency.

The market may also see increased specialization, with different stablecoins serving specific use cases or geographic markets. This specialization could lead to a more diverse ecosystem while maintaining the network effects that favor larger, more established stablecoins.

Challenges and Potential Disruptions

Despite positive growth prospects, several challenges could disrupt stablecoin adoption. Regulatory crackdowns, particularly if major issuers face enforcement actions, could significantly impact market confidence. The evolving regulatory landscape, while generally positive, could also create unexpected compliance burdens or restrictions.

Technological challenges include scalability limitations, smart contract vulnerabilities, and the potential impact of quantum computing on cryptographic security. The stablecoin ecosystem must continue innovating to address these challenges while maintaining the stability and reliability that users expect.

Market maturation may also create new challenges, as increased competition could pressure profit margins and force consolidation among smaller issuers. The need to maintain technological leadership while managing regulatory compliance may favor larger, well-resourced organizations over smaller innovators.

Conclusion

Stablecoins have emerged as transformative financial instruments that successfully bridge the gap between traditional finance and digital assets. Their rapid growth to over $200 billion in market capitalization and dominance of cryptocurrency transaction volume demonstrates their fundamental utility in the digital economy. As we progress through 2025, stablecoins are positioned to play an increasingly central role in global finance, supported by improving regulatory clarity and expanding institutional adoption.

The success of market leaders like USDT and USDC illustrates different approaches to stablecoin design and operation. While Tether maintains market dominance through first-mover advantage and widespread adoption, Circle’s regulatory-first approach with USDC demonstrates the value of transparency and compliance in building institutional trust. Both models offer valuable lessons for the broader ecosystem as it matures.

The regulatory landscape continues to evolve favorably, with the U.S. Senate’s passage of the GENIUS Act representing a significant milestone toward comprehensive federal oversight. International coordination through initiatives like MiCA in the European Union suggests that global standards are emerging, providing the regulatory certainty necessary for mainstream adoption.

However, significant challenges remain. The risks demonstrated by depegging events like USDC’s temporary deviation during the SVB crisis highlight the importance of robust reserve management and issuer commitment to stability. The legal uncertainties surrounding asset ownership in bankruptcy scenarios require continued attention from regulators and market participants.

Looking forward, stablecoins are likely to become increasingly integrated into traditional financial systems, serving as digital currency infrastructure for payments, commerce, and financial services. Their programmability and interoperability advantages position them well for the continued digitization of finance, while their stability makes them accessible to users who require predictable value storage and transfer.

The future of stablecoins will depend on successfully balancing innovation with stability, regulatory compliance with operational efficiency, and growth with risk management. As the ecosystem matures, stablecoins that can navigate these challenges while providing superior user experiences and regulatory compliance will likely emerge as the foundation of the digital financial system. For investors, businesses, and users, understanding these dynamics will be crucial for effectively participating in the evolving stablecoin economy.

The journey from experimental digital assets to critical financial infrastructure represents one of the most significant innovations in modern finance. As stablecoins continue to evolve and mature, they promise to reshape how we think about money, payments, and financial services in an increasingly digital world.