The pet care industry is in the middle of one of the most sustained and far-reaching growth cycles in its history. U.S. pet ownership now spans an estimated 94 million households as of 2025, up from 82 million in 2023. Globally, the pet care market grew 5.9% in 2024 to reach $197.6 billion — and analysts project it will double in size by 2035. Fueling this expansion is a structural cultural shift known as pet humanization: the progression from viewing pets as animals to treating them as full members of the family, with equivalent expectations around nutrition quality, wellness, and lifestyle aesthetics.

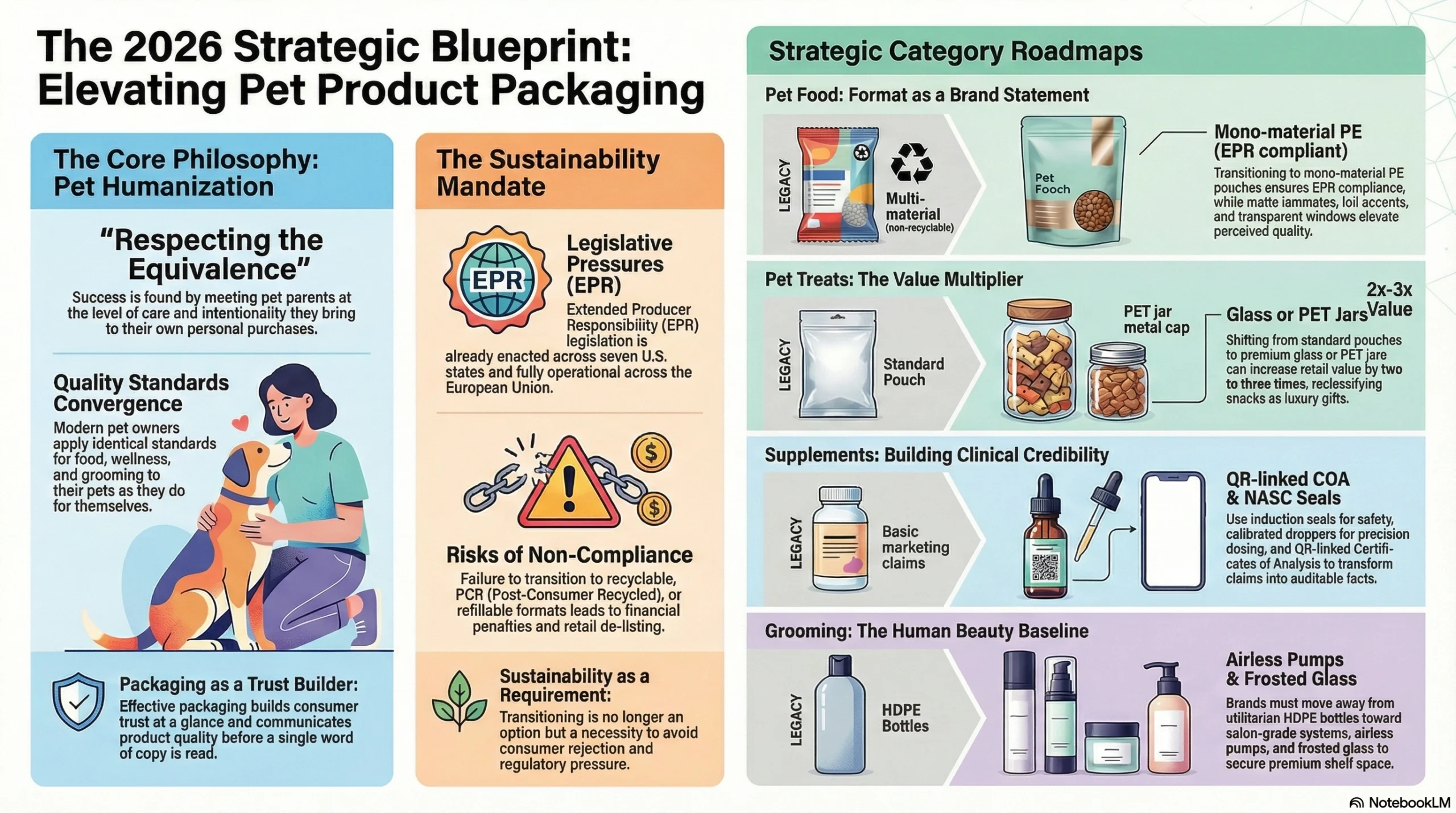

This shift has fundamentally restructured what packaging must do. In 2026, a bag of kibble or a bottle of grooming shampoo is no longer evaluated solely on its ability to contain a product. It is the brand’s first impression in a retail aisle or an e-commerce thumbnail, its primary trust signal at the point of purchase, and — for a growing segment of consumers — a declaration of the brand’s values. Whether you are launching a boutique supplement line or scaling a global grooming brand, this guide is your definitive reference for packaging format, material, and design strategy across every major pet product subcategory.

Why Pet Product Packaging Matters More Than Ever in 2026

The global pet food packaging market is forecast to expand from $14.84 billion in 2026 to $27.06 billion by 2035, at a 6.9% CAGR. But the market size figure alone understates the strategic importance of packaging decisions. In a segment where pet food commands 43.2% of the total pet care market and shelf differentiation is the primary lever of brand value, packaging is simultaneously a brand communications tool, a functional necessity, and a legal compliance challenge that is becoming more demanding by the year.

Three structural forces are reshaping packaging strategy across all pet categories:

- Premiumization. The pet industry follows human beauty and wellness aesthetics by approximately five years. The minimalist, tactile-finish design language now standard in luxury skincare — matte laminate, foil accents, embossed logos — is becoming the new benchmark for premium pet food, supplement, and grooming brands. For first-time buyers with no prior brand experience, packaging quality is product quality. The container makes the claim before the label is even read.

- Sustainability as a commercial and legal imperative. According to a survey by ALPLA Group, 54% of consumers aged 18–34 always or often base purchasing decisions on sustainable packaging, and 79% of that demographic are willing to pay more for eco-friendly formats. This is no longer a niche preference — 51% of all pet owners are now willing to pay a premium for eco-conscious products. Adding hard legal urgency, seven Extended Producer Responsibility (EPR) packaging bills have now been enacted across U.S. states, with penalties for noncompliance reaching up to $50,000 per day in some jurisdictions. California’s SB 54 mandates that 100% of packaging qualify as recyclable or compostable by 2032. The financial risk of continuing with hard-to-recycle formats is no longer theoretical.

- Transparency. Consumers want to understand precisely what they are giving their pets, and packaging must facilitate that understanding. Clean label design, transparent windows, shorter ingredient lists, and QR-code-linked sourcing information are all mechanisms through which packaging communicates trustworthiness — and this principle applies as much to a bag of kibble as it does to a bottle of CBD oil.

Market Insight

The global pet care market is set to double by 2035. In a crowded shelf environment, 67% of millennial pet owners cite sustainability as a key purchase driver, making eco-friendly packaging a critical competitive advantage.

Pet Food Packaging — Where Format Is Strategy

Pet food is the largest and most contested subcategory in the pet care landscape. Dog products alone account for 46.5% of the global pet food packaging market, with cat food following at a 7.9% CAGR as smaller, portion-controlled formats gain momentum in high-density urban markets. In this environment, format selection is not a commodity decision — it carries as much strategic weight as the visual design itself, directly affecting barrier performance, logistics cost, sustainability profile, and consumer perception.

Dry Food (Kibble)

Stand-up pouches, flat-bottom bags (K-seal bags), and multi-wall paper sacks remain the dominant formats for dry kibble. Stand-up pouches deliver outstanding shelf presence and structural versatility across weight ranges from 200 g trial sizes to 15 kg family bags. Flat-bottom bags offer a box-like stability and a generous printable surface — four full panels — that justifies a higher price point on shelf. The competitive action in 2026 is not in format selection, however, but in surface execution.

Premium brands are specifying:

Soft-touch matte laminate — A velvety tactile finish that communicates luxury at first contact, borrowed from high-end spirits and cosmetics packaging.

Spot UV varnish — Applied selectively to logos or claim callouts, creating a glossy contrast against a matte base that adds visual depth and sophistication.

Hot foil stamping — Gold, silver, or holographic foil accents on brand marks signal artisanal quality at a glance and are particularly effective for limited-edition or seasonal lines.

Functional features have crossed from premium differentiator to consumer expectation. Resealable zippers — press-to-close for mid-tier products, slider format for premium positioning — are mandatory. For bags over 5 kg, ergonomic handles and reinforced tear notches directly reduce friction for elderly pet owners and those managing multiple animals. The clean label movement has also influenced the physical structure of packaging, not just the graphics: die-cut transparent windows are now among the highest-ROI design decisions available, allowing the kibble itself to serve as a visual proof point — whole proteins, visible vegetables, recognizable ingredients — that no marketing claim can replicate.

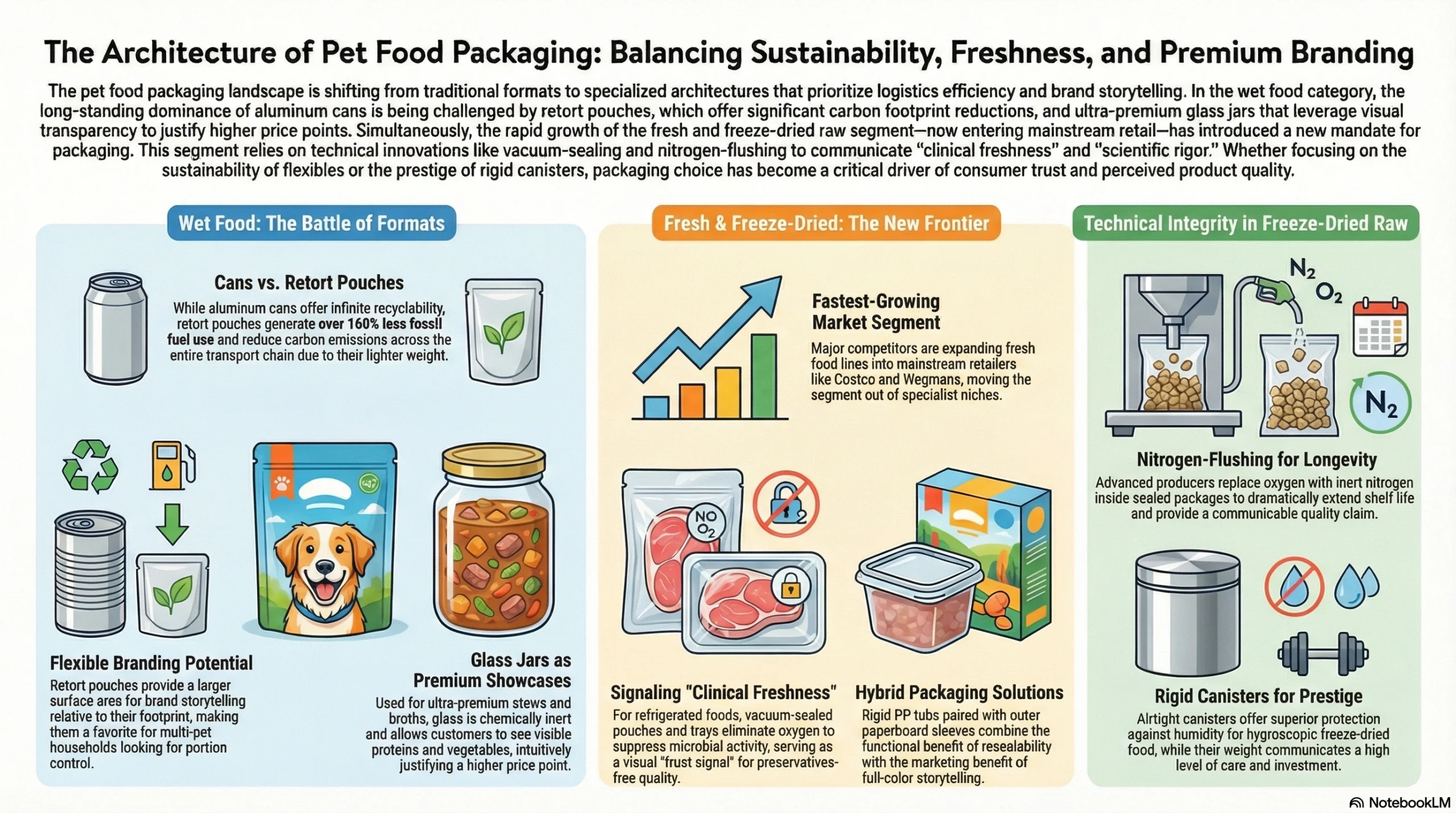

Wet Food

Aluminum cans retain their position as the wet food workhorse, and their credentials are genuine: excellent barrier properties, infinite recyclability, and a shelf life measured in years. However, they face sustained competitive pressure from retort pouches. These flexible, foil-lined pouches undergo the same high-heat sterilization process as cans but arrive with a meaningfully different logistics and sustainability profile: a lifecycle analysis found that aluminum cans generate over 160% more fossil fuel use than equivalent flexible formats. The lighter weight of retort pouches reduces carbon emissions throughout the entire transport chain, and their greater branding surface area relative to footprint enables richer storytelling. Single-serve retort pouches have become the preferred wet food format for multi-cat and multi-dog households, where portioning and waste reduction are consistent purchase drivers.

At the ultra-premium end of wet food, glass jars are establishing themselves in the stew, broth, and food topper segment. Glass is chemically inert — it interacts with neither the formula nor the consumer’s perception of food safety — and it signals culinary-grade quality in a way no pouch or can can match. When the product is visually rich (slow-cooked stews, bone broths with visible proteins and vegetables), the jar becomes a showcase, and the premium price that accompanies it becomes intuitively justified.

Fresh & Freeze-Dried

The fresh and freeze-dried raw segment is the fastest-growing area of pet food. Major competitors are launching fresh food lines and expanding distribution into mainstream retailers like Costco and Wegmans, signaling that this is no longer a specialist niche. The packaging mandate for this segment is unique: formats must communicate clinical freshness and scientific rigor with the same persuasiveness as the ingredient list.

For refrigerated fresh food, vacuum-sealed pouches and trays eliminate oxygen to suppress microbial activity without preservatives — the vacuum-sealed aesthetic itself is a trust signal. Rigid PP tubs paired with outer paperboard sleeves are a strong combination: the sleeve carries full-color brand storytelling while the tub delivers the resealability critical for partial-serving households. For freeze-dried raw, rigid airtight canisters represent the prestige choice — their weight and solidity communicate the same care and investment that went into the formula. These also provide superior protection against humidity, which is critical because freeze-dried food is highly hygroscopic. Advanced producers are specifying nitrogen-flushing — replacing the oxygen inside the sealed package with inert nitrogen — which dramatically extends shelf life and functions as a credible, communicable quality claim for the most discerning raw-feeding consumer.

Pet Treat & Chew Packaging — The Science of the Impulse Buy

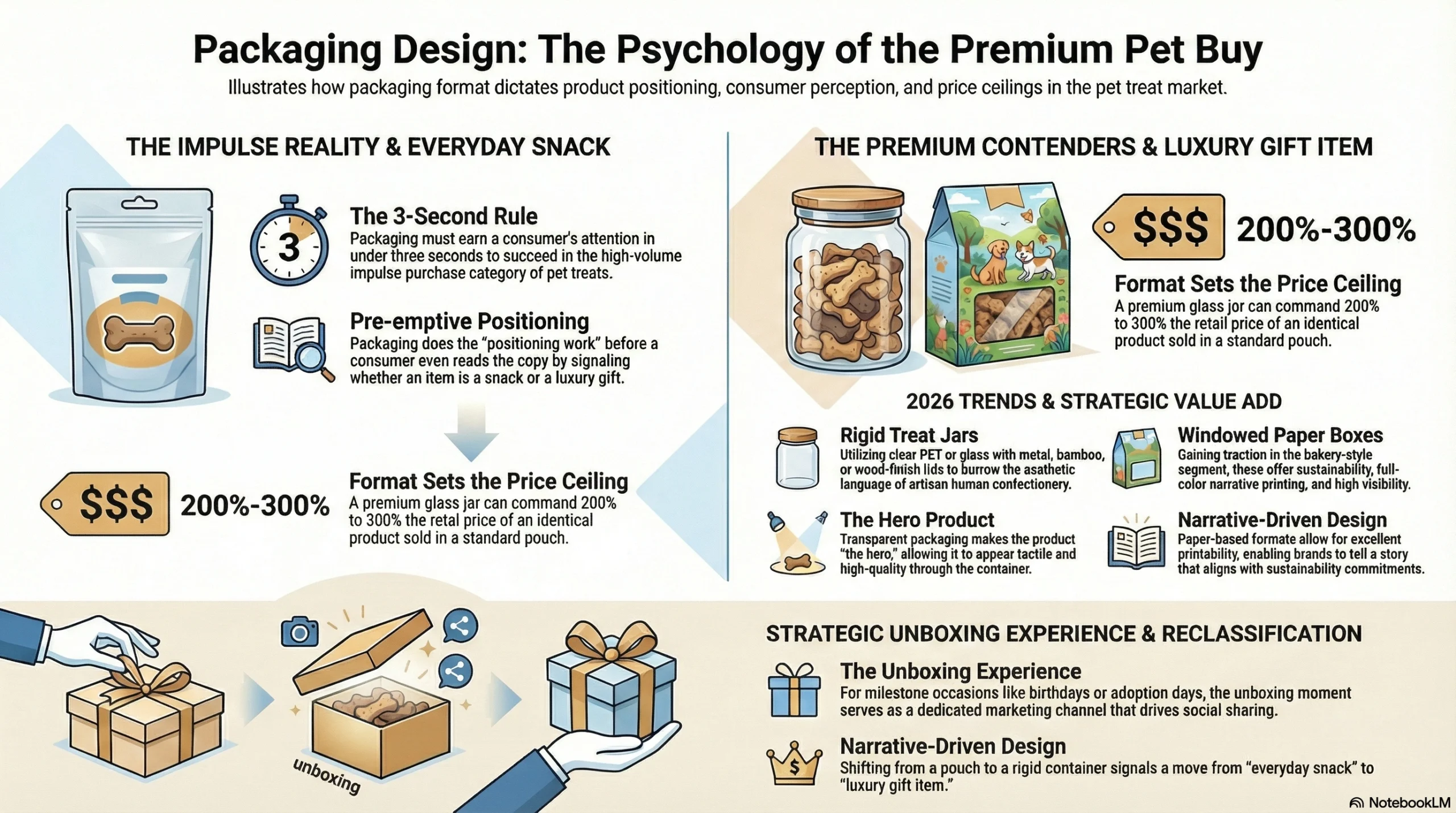

Treats represent the highest-volume impulse purchase category in pet retail, and packaging must earn attention in under three seconds. Stand-up pouches remain dominant by volume, but 2026 is witnessing a clear divergence in the premium segment toward two formats that fundamentally reposition a brand.

Rigid treat jars — clear PET or glass with decorative metal, bamboo, or wood-finish lids — borrow aesthetic language directly from artisan human confectionery. The product becomes the hero, visible and tactile through the container, and the format inherently commands a higher price point. The format shift is not merely cosmetic: it signals a reclassification of the product itself, from everyday snack to luxury gift item. The packaging has already done the premium positioning work before the consumer reads a word of copy.

Windowed paper boxes are gaining traction in the biscuit and bakery-style segment, especially for seasonal gifting occasions. Paper-based formats align with sustainability commitments, offer excellent full-color printability for narrative-driven label design, and deliver an unboxing experience that drives social sharing. For brands targeting birthdays, holidays, and adoption milestones, the unboxing moment is a marketing channel.

The practical lesson: packaging format sets the price ceiling. A product in a premium glass jar can legitimately command two to three times the retail price of an identical product in a standard pouch, because the container has already communicated the category of purchase the consumer is making.

Pet Supplement & Wellness Packaging — Clinical Credibility at Every Touchpoint

The global pet dietary supplements market is valued at approximately $3.06 billion in 2026 and is projected to reach $6.61 billion by 2035 at a CAGR of 8.93% — making it one of the fastest-growing subcategories in all of pet care. The growth driver is preventive healthcare logic applied to animals: the same joint, digestive, and immune support that human nutraceutical consumers seek for themselves is now being actively sought for their pets.

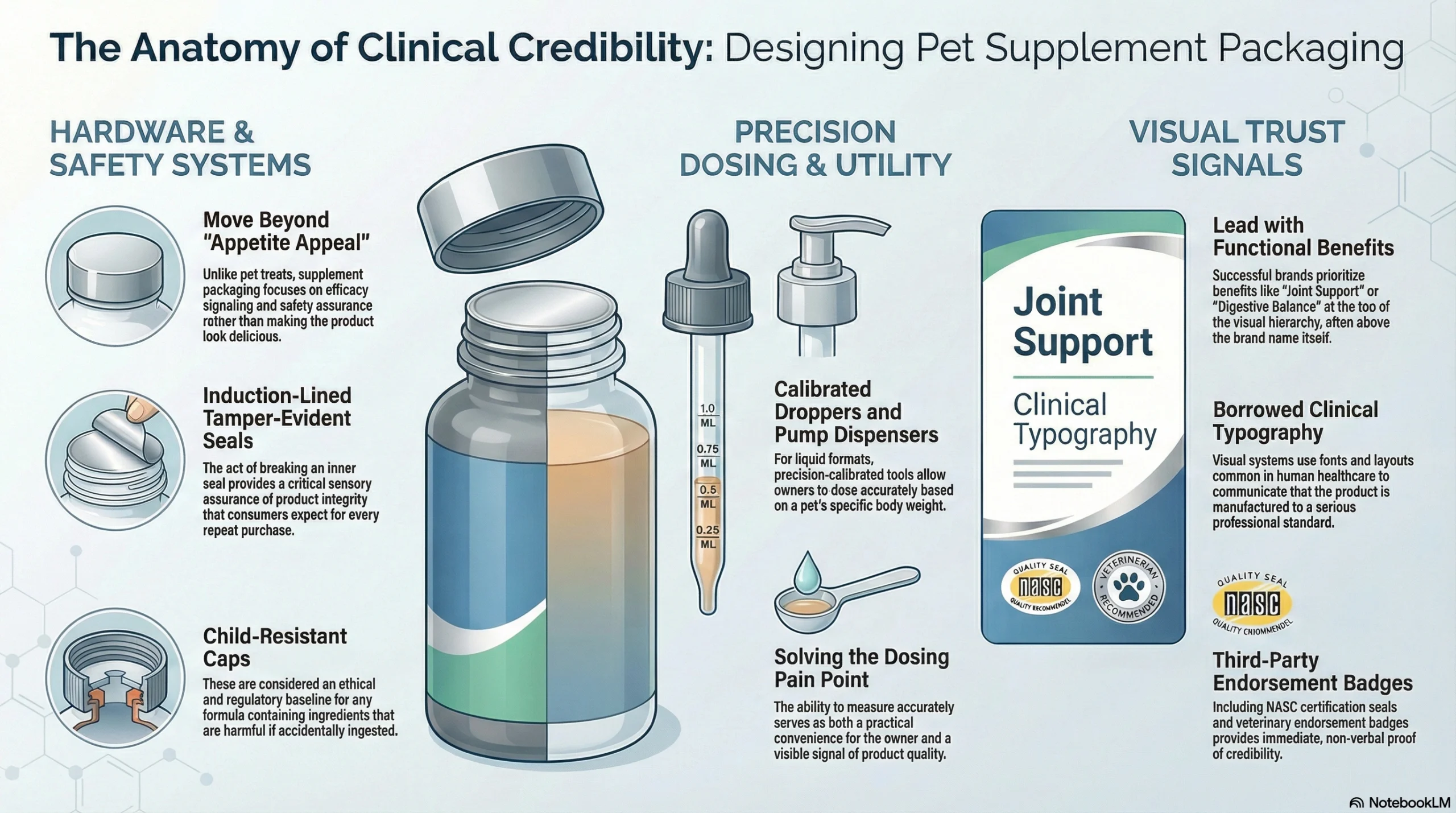

The packaging brief for supplements is categorically different from food or treats. Appetite appeal is irrelevant. What matters is efficacy signaling, safety assurance, and clinical credibility. The aesthetic playbook is borrowed from the human pharmaceutical and nutraceutical industries, which have spent decades developing visual systems that communicate trustworthiness at a glance.

Selecting the Right Bottle Format

| Format | Best Application | Why It Works |

|---|---|---|

| Amber Glass | Liquid supplements, CBD oils, tinctures | Inert material; UV filtration for light-sensitive actives; projects apothecary quality |

| HDPE Packers | Powders, soft chews, tablets | Durable, moisture-resistant, widely recyclable; the vitamin industry standard |

| PET Clear/Amber | Gummies, colorful soft chews | Glass-like clarity but shatterproof; ideal for showcasing product form and color |

| Airless Pump | Liquid additives, topical supplements | Full oxidation prevention; enables precise dosing; projects clinical sophistication |

Closure Systems and Safety

Trust is hard-won in the supplement category and easily lost. Every liquid product should include an induction-lined tamper-evident seal — the moment a consumer breaks that inner seal is a sensory assurance of product integrity they will expect on every repeat purchase. Child-resistant caps are an ethical and regulatory baseline for any formula containing ingredients that could be harmful if accidentally ingested. For liquid formats, calibrated dropper or pump dispensers solve a genuine pain point: owners dosing by the pet’s body weight need precision, and the ability to measure accurately is both a practical convenience and a visible quality signal.

Trust Signal Design

Successful supplement brands lead with the functional benefit — “Joint Support,” “Calm & Relax,” “Digestive Balance” — rather than the brand name in the primary visual hierarchy. Supporting design elements should include NASC (National Animal Supplement Council) certification seals, veterinary endorsement badges, and clinical typography that would not be out of place on a human healthcare product. These visual cues communicate, before the consumer reads a single word of body copy, that the product is formulated and manufactured to a serious standard.

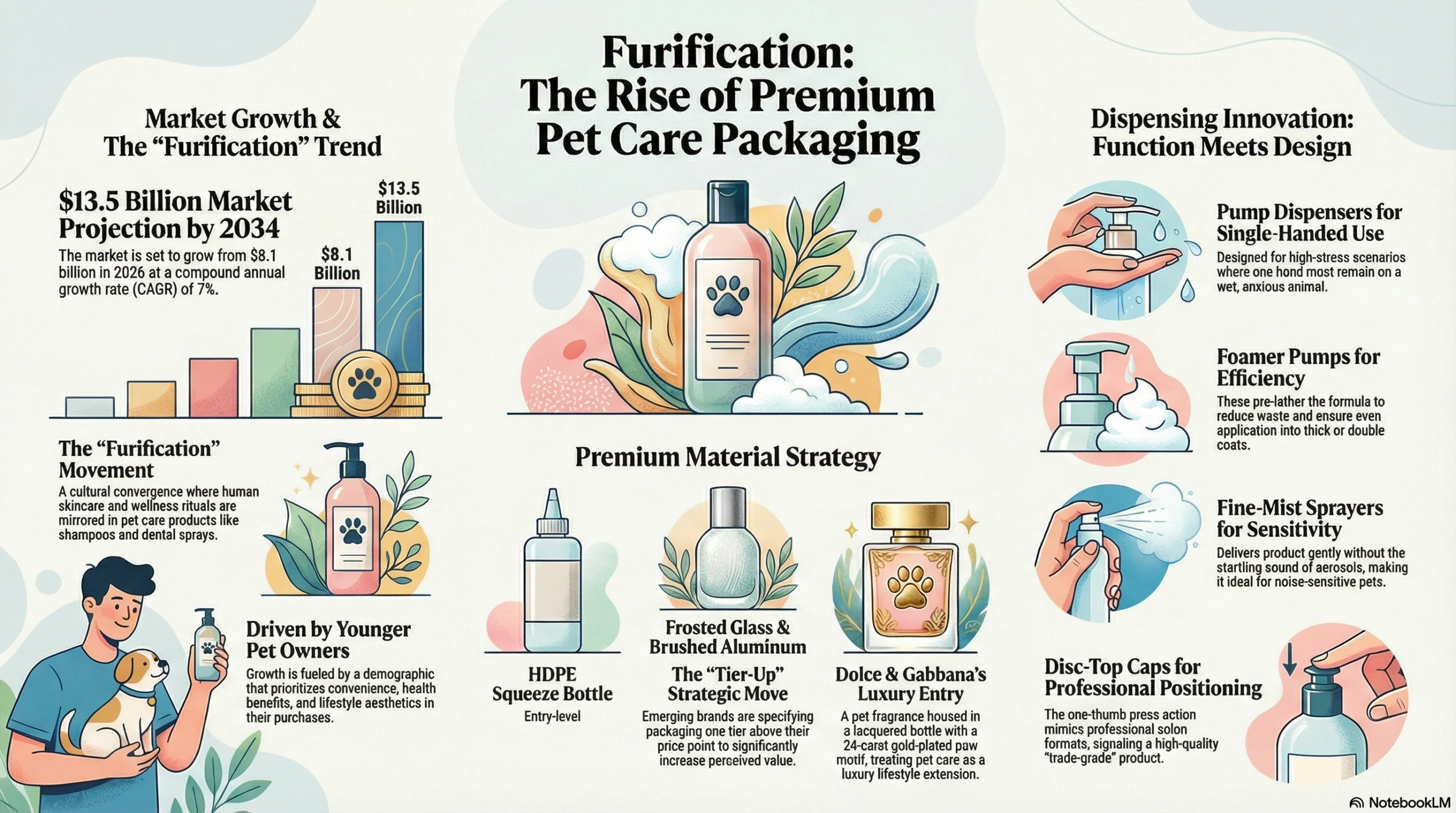

Pet Grooming & Personal Care Packaging — Where Beauty Meets Pet Care

The pet grooming market is projected to advance from $8.1 billion in 2026 to $13.5 billion by 2034 at a 7% CAGR, driven by younger pet owners who prioritize convenience, health benefits, and lifestyle aesthetics in everything they purchase. This growth is part of a broader cultural convergence that BeautyMatter has termed “furification” — the extension of human skincare and wellness rituals into the animal care space. Premium pet shampoos, conditioners, and dental sprays are now deliberately designed to be visually indistinguishable from high-end human beauty products: frosted glass bottles, brushed aluminum dispensers, minimalist label systems.

The material spectrum runs from entry-level HDPE squeeze bottles to premium frosted glass and aluminum. For emerging brands, the strategic move is to specify a format at least one tier above where the price point alone might suggest — the uplift in perceived value consistently justifies the marginal cost of the upgrade. Luxury brands have pushed this logic to its extreme: Dolce & Gabbana recently entered the pet category with a fragrance housed in a lacquered bottle bearing a 24-carat gold-plated paw motif, positioning pet care as a luxury lifestyle extension.

Dispensing Innovation

Bath time is a functionally demanding scenario, and dispensing design becomes a genuine differentiator:

Pump dispensers enable single-handed operation — the other hand is occupied restraining a wet, anxious animal.

Foamer pumps pre-lather the formula before dispensing, reducing product waste and simplifying application into thick or double coats.

Fine-mist sprayers deliver deodorizing mists and coat conditioners gently and evenly, without the startling pressure or sound of aerosol propellants — a meaningful consideration for noise-sensitive animals.

Disc-top caps offer a clean, one-thumb press action common in professional salon formats, immediately signaling a trade-grade positioning.

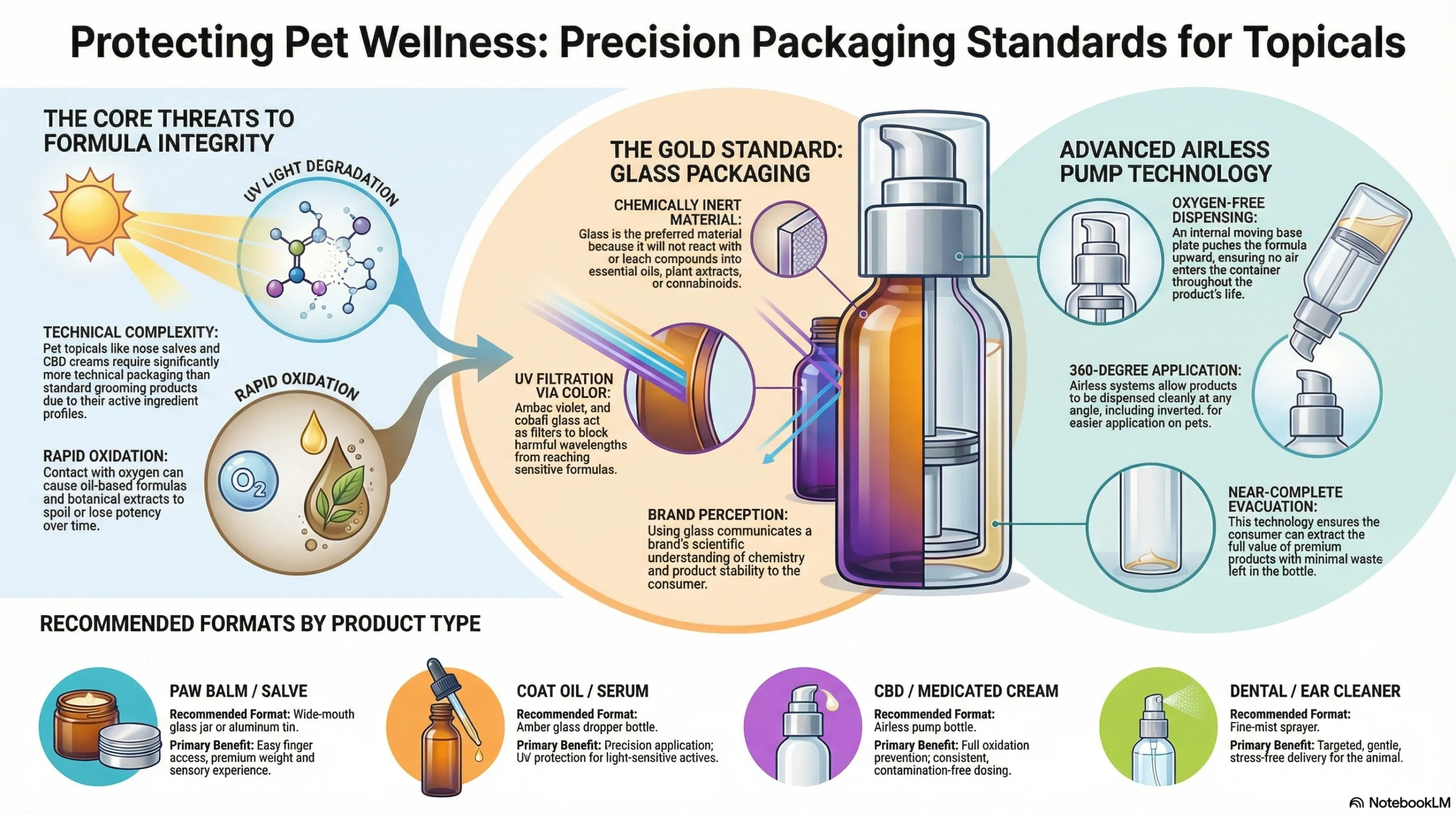

Pet Wellness Topicals — Paw Balms, Serums, and CBD

As the pet wellness category expands into topicals — paw balms, coat serums, nose salves, ear cleaners, and CBD-infused creams — packaging requirements become significantly more technical. These are typically oil-based products or formulas containing expensive active ingredients that face two primary threats: UV light degradation and oxidation.

The Case for Glass

Glass is the gold standard for topicals, and for defensible scientific reasons. It is chemically inert — it will not react with or leach compounds into essential oils, plant-based extracts, or cannabinoid formulations. Amber, violet, or cobalt glass also provides UV filtration, blocking the specific wavelengths most responsible for degrading photosensitive active ingredients. A glass dropper bottle or jar communicates, through the material choice alone, that the brand understands the chemistry of what it is selling.

Airless Pump Technology

Airless dispensing systems — in which a moving internal base plate pushes the formula upward as it is dispensed, rather than allowing air to fill the evacuated space — are increasingly specified for pet serums and medicated topicals. The advantages are substantive: they prevent oxygen from ever contacting the formula throughout the product’s life, extending shelf life without preservative reliance; they dispense cleanly at any angle, including inverted; and they achieve near-complete product evacuation, ensuring the consumer extracts full value from a premium product.

| Product Type | Recommended Format | Primary Benefit |

|---|---|---|

| Paw Balm / Salve | Wide-mouth glass jar or aluminum tin | Easy finger access; premium weight and sensory experience |

| Coat Oil / Serum | Amber glass dropper bottle | Precision application; UV protection for light-sensitive actives |

| CBD Topical / Medicated Cream | Airless pump bottle | Full oxidation prevention; consistent, contamination-free dosing |

| Dental Spray / Ear Cleaner | Fine-mist sprayer | Targeted, gentle, stress-free delivery for the animal |

Sustainable Packaging — From Brand Value to Legal Requirement

Sustainability in pet product packaging has undergone a decisive shift in 2026: it has moved from a marketing differentiator to a baseline business requirement enforced by both the market and the law. With 79% of consumers aged 18–34 willing to pay more for eco-friendly packaging, the commercial case is already compelling. The legislative case is now equally urgent. The EU’s Packaging and Packaging Waste Regulation required all member states to implement EPR schemes by the end of 2024, while across the U.S., seven EPR packaging bills have been enacted. California’s SB 54 — the most expansive in scope — mandates 100% recyclable or compostable packaging by 2032, with penalties for noncompliance reaching $50,000 per day. For any brand distributing in these markets, the question of sustainable materials is no longer a future concern.

The practical material toolkit for 2026:

PCR (Post-Consumer Recycled) Plastics — rPET and rHDPE directly reduce virgin fossil fuel consumption and allow brands to communicate a specific, auditable recycled content percentage as an on-pack credential.

Mono-material PE Flexible Pouches — Multi-layer laminates (mixing PE, PET, aluminum foil, and nylon) are effectively non-recyclable because layers cannot be separated at sorting facilities. Single-material PE pouches are compatible with existing flexible film recycling streams — a crucial distinction as EPR fee structures increasingly penalize non-recyclable formats.

Infinitely Recyclable Glass and Aluminum — Both can be recycled without degradation across unlimited cycles. For supplement, grooming, and topicals brands, the transition to glass or aluminum is simultaneously a sustainability and premiumization decision — the two objectives reinforce each other.

Refillable Systems — Glass or aluminum “forever bottles” paired with lightweight recyclable refill pouches significantly reduce total packaging material over a product’s lifetime while building a subscription loyalty dynamic. The refill model is gaining particular traction in the premium grooming segment.

Design Principles That Drive Conversion

Outstanding packaging strategy extends beyond material and format selection. The visual system you deploy is what converts a three-second shelf glance into a purchase decision, and the principles that govern effective design are consistent across categories.

The Three-Second Hierarchy

Retail shoppers scan shelves fast enough to give each product approximately three seconds of evaluation. Your packaging visual hierarchy must answer three questions in that window, in this order:

What is it? — Product type and primary benefit, immediately legible at arm’s length.

Why choose it? — A single differentiating claim: “Grain-Free,” “Vet-Formulated,” “Human-Grade.”

Who makes it? — Brand mark, recognizable and consistently positioned.

Anything that does not serve one of these three functions is visual noise that dilutes the primary message. Restraint is the strategy, not a compromise.

Color Psychology

Color performs subconscious category signaling before the consumer consciously engages with the text. A well-chosen palette does half the positioning work before a word is read:

| Palette | Consumer Association | Best Application |

|---|---|---|

| Greens & Browns | Natural, organic, earthy | Grain-free food, natural treat lines |

| Pastels (Blue, Pink) | Gentle, safe, sensitive | Puppy lines, sensitive skin formulas |

| White & Cool Grey | Clinical, pure, scientific | Supplements, dental care, veterinary lines |

| Black & Deep Navy | Luxury, premium, professional | High-end treat jars, professional grooming |

| Kraft & Terracotta | Sustainable, artisanal | Raw food, organic supplement lines |

Connected Packaging

QR codes are now standard on premium pet packaging, and the business case for them is compounding. 80% of brands surveyed in Appetite Creative’s 2024 Connected Packaging Report stated that QR-enabled packaging will be increasingly important to the packaging industry. In practice, a QR code on a kibble bag can link to a farm-sourcing map, a batch-specific nutritional analysis, or a breed-and-weight-specific feeding calculator. On supplement labels, it can surface certificates of analysis and veterinary endorsement content without crowding the physical label. Beyond product information, connected packaging drives loyalty program sign-ups, app downloads, and first-party consumer data — an increasingly valuable asset as third-party tracking tools are retired across the digital ecosystem.

How to Choose the Right Packaging Manufacturer

In a market defined by premiumization, rapidly evolving sustainability requirements, and short new-product development cycles, your packaging manufacturer is a strategic partner, not a commodity vendor. Evaluating on unit cost alone is the fastest way to compromise brand quality and market positioning. These six capabilities define the difference between a strategic partner and a basic supplier:

Quality Certifications — ISO 9001, BSCI, and where relevant, pharmaceutical-grade GMP certification. These are auditable, systematic assurances that your packaging is produced to documented and consistent standards.

Custom Mold Capability — A proprietary bottle shape or jar design is a defensible brand asset that competitors cannot easily replicate. Confirm that your manufacturer can develop bespoke tooling, and clarify the ownership structure for any molds created.

MOQ Flexibility — Your packaging partner should scale with you, from low-volume pilot launches through mass production, without requiring you to change suppliers at a critical growth stage.

Sample Lead Times — Speed to a production-representative sample matters more than the quoted bulk lead time. A manufacturer who can deliver accurate samples in three to five days compresses your innovation cycle and reduces time to market.

Material Range — Holding glass, PCR plastic, airless systems, and aluminum capabilities under one roof reduces supply chain complexity and makes sustainable material transitions significantly easier to execute.

Category Experience — Premium pet care packaging sits at the intersection of cosmetic aesthetics, pharmaceutical functional standards, and food-grade safety compliance. A manufacturer with proven depth across beauty and pharmaceutical packaging can apply that institutional knowledge directly to your pet brand.

Jarsking has spent over 20 years operating at precisely this intersection. With 30,000+ ready molds available for immediate sampling, global offices in Guangzhou, Dubai, and Los Angeles, and sample delivery in as few as three days, Jarsking is structured to support brands from early-stage concept through full-scale production. Explore Jarsking’s pet packaging solutions for the complete material and format range.

Conclusion: Packaging Is Your Most Powerful Marketing Asset

The pet product market in 2026 is defined by convergence: between human and pet aesthetics, between packaging function and brand identity, and between commercial ambition and sustainability compliance. Packaging is the bridge between your formulation and the pet parent who wants the very best for their animal — and it is increasingly the primary factor that determines shelf success, price positioning, and brand loyalty.

The brands that will lead through the rest of this decade are those that have stopped treating packaging as a cost line and started treating it as their most powerful marketing asset — one that builds consumer trust at a glance, communicates product quality before a word of copy is read, and turns a first-time buyer into a loyal, long-term advocate.

The strategic roadmap across every category is clear:

Pet Food — Mono-material PE pouches satisfy incoming EPR legislation while matte laminates, foil accents, and transparent windows elevate perceived quality on shelf. Format is not a commodity decision; it is a brand positioning statement.

Pet Treats — The shift from standard pouch to premium glass or PET jar is not an aesthetic upgrade. It is a price positioning strategy with documented potential to multiply retail value two to three times over, reclassifying the product from everyday snack to luxury gift.

Supplements — Clinical credibility is earned through the entire physical system: the induction seal the consumer breaks on first use, the calibrated dropper that enables precise weight-based dosing, and the NASC seal combined with a QR-linked Certificate of Analysis that transforms a marketing claim into an auditable, verifiable fact.

Grooming & Topicals — The convergence with human beauty is no longer a trend to monitor — it is the competitive baseline. Brands still packaging in utilitarian HDPE bottles are actively ceding premium shelf real estate to competitors who have adopted airless pumps, frosted glass, and salon-grade dispensing systems.

Sustainability — With EPR legislation enacted across seven U.S. states and fully operational across the EU, the question is no longer whether to transition to recyclable, PCR, or refillable formats. It is how quickly you can execute before penalties, retail de-listing pressures, and consumer rejection of non-compliant packaging make the decision for you.

Cutting across all of it is the deepest truth of the pet humanization era: today’s pet owner applies the same quality standards to their pet’s food, wellness, and grooming products as they do to their own. The packaging that wins is the packaging that respects that equivalence — meeting the pet parent at the level of care and intentionality they bring to every single purchase they make for the animals they love.

FAQs

For premium dry kibble, flat-bottom bags or stand-up pouches are the strongest choices. The key differentiators in 2026 are:

Surface finish — Soft-touch matte laminate, spot UV varnish, and hot foil stamping separate premium brands from mid-tier competitors at a glance

Functional closures — Slider zippers and ergonomic handles are consumer expectations, not optional upgrades

Material construction — Mono-material PE specification ensures recyclability compliance under EPR legislation in California and other states

Pet food packaging is designed to attract and entice. Supplement packaging has an entirely different job — it must project clinical credibility and safety assurance. In practice, this means:

Borrowing visual language from the human pharmaceutical industry: clean sans-serif typography, neutral palettes, structured information hierarchies

Choosing formats based on formula chemistry: amber glass for UV-sensitive liquids, HDPE packers for powders and chews, airless pumps for oxidation-sensitive additives

Prioritizing trust signals over appetite appeal at every design touchpoint

At minimum, every supplement pack should include:

Induction-sealed foil liners — A hermetic seal that delivers a multisensory integrity check (sight, feel, and sound) when broken for the first time

Shrink bands — Heat-applied sleeves for powder and tablet formats that confirm the product has not been opened since manufacture

Child-resistant closures — Push-and-turn caps or twist-to-lock pump dispensers, required by the U.S. Poison Prevention Packaging Act for formulas containing certain active compounds and a credibility signal that the product is professionally manufactured

The container defines the category of purchase before the consumer reads a single word. Specifically:

A treat in a standard resealable pouch reads as an everyday snack

The same treat in a glass apothecary jar with a metal or wood-finish lid reads as a luxury gift item

This perceptual shift — driven entirely by format — allows brands to legitimately charge two to three times more for the same product

For brands targeting boutique retail or gifting occasions, moving to rigid premium containers is one of the highest-ROI packaging decisions available.

The main sustainable material options for pet brands in 2026 are:

Mono-material PE pouches — Compatible with existing flexible film recycling streams

PCR plastics (rPET, rHDPE) — Reduce virgin fossil fuel use and support auditable recycled content claims on-pack

Glass and aluminum — Infinitely recyclable; simultaneously the premium and the sustainable choice

Refillable systems — Durable primary containers paired with lightweight refill pouches, gaining traction in the grooming segment

On the legal side, EPR packaging legislation is now enacted in seven U.S. states. California’s SB 54 mandates 100% recyclable or compostable packaging by 2032, with penalties reaching $50,000 per day for noncompliance. For brands distributing in these markets, this is an active compliance obligation — not a future consideration.

Six capabilities define a strategic partner versus a basic supplier:

Quality certifications — ISO 9001, BSCI, and pharmaceutical-grade GMP as auditable manufacturing standards

Custom mold capability — Proprietary shapes are defensible brand assets; confirm tooling ownership terms upfront

MOQ flexibility — Your manufacturer should scale with you from pilot launch through mass production without forcing a supplier change at a critical growth stage

Sample lead time — Production-representative samples in three to five days matter more to your innovation cycle than bulk lead time

Full material range — Glass, PCR plastics, airless systems, and aluminum under one roof reduces supply chain complexity

Category experience — Pet care packaging sits at the intersection of cosmetic aesthetics, pharmaceutical safety, and food-grade compliance; choose a manufacturer with proven depth across all three