The $1.75 billion infused pre-roll market presents unique packaging challenges that extend far beyond basic containment. Premium concentrates demand premium packaging that preserves potency, meets stringent regulatory requirements, communicates brand value, and increasingly, demonstrates environmental responsibility.

As infused pre-rolls continue their meteoric rise—growing from 34.4% market share in 2019 to 44.4% in 2024—packaging has emerged as a critical differentiator. Brands that invest in thoughtful packaging solutions see measurable ROI through improved product preservation, enhanced brand perception, and reduced compliance risks.

This comprehensive guide explores packaging materials, regulatory requirements, sustainability trends, cost considerations, and design strategies specifically tailored for infused pre-roll products. Whether you’re launching a new brand or optimizing an existing line, understanding these packaging fundamentals is essential for success in this competitive market.

Explore This Packaging Guide Interactively

Navigate through market insights, compliance requirements, material comparisons, and sustainability data with visual storytelling and interactive features

Launch Interactive Experience →The Cannabis Packaging Market: Explosive Growth

The cannabis packaging industry is experiencing unprecedented expansion, driven by legalization momentum and premiumization trends.

Table 1: Global Cannabis Packaging Market Overview (2024-2034)

| Metric | 2024 Value | 2030 Projection | 2034 Projection | CAGR |

|---|---|---|---|---|

| Global Market Size | $2.2-$2.85 billion | $22.10 billion | $24.6 billion | 17.4-22.6% |

| US Market Size | $1.36 billion | — | — | 28.9% |

| North America Share | 81.79% | — | — | — |

| Plastic Materials Share | 54.9% | — | — | — |

Sources: GM Insights, IMARC Group, Grand View Research, Towards Packaging

The cannabis packaging market’s 22.6% CAGR significantly outpaces most packaging sectors, reflecting both market expansion and premiumization trends as consumers increasingly demand sustainable and sophisticated packaging solutions.

Chart 1: Cannabis Packaging Market Growth (2024-2034)

2024 ██████ $2.85B

2026 ████████████ $5.2B (est.)

2028 ████████████████████ $9.8B (est.)

2030 ████████████████████████████████ $22.1B

2034 ██████████████████████████████████████ $24.6B

Source: Towards Packaging Analysis

Regulatory Compliance: The Non-Negotiable Foundation

Before considering aesthetics or sustainability, cannabis packaging must meet rigorous federal and state regulatory requirements designed to protect public health and prevent youth access.

Federal Child-Resistant Requirements

All cannabis packaging must comply with Consumer Product Safety Commission (CPSC) standards under 16 CFR 1700.20:

Performance Standards:

- 80% child-resistance: At least 80% of children aged 42-51 months cannot open packaging within 5 minutes

- 90% adult accessibility: At least 90% of adults can successfully open and re-close the package

- Testing protocol: ASTM D3475-20 certification required

- Recertification: Required after any design modification

Testing Costs:

- Initial certification: $3,000-$8,000 per design

- Recertification: $2,000-$5,000

- Timeline: 4-8 weeks for full testing cycle

Table 2: State-Specific Packaging Requirements (Key Markets)

| State | Child-Resistant | Opaque Required | Exit Packaging | Resealable | Special Requirements |

|---|---|---|---|---|---|

| California | ✓ Required | ✓ Yes | ✓ Required | ✓ Yes (multi-serve) | Universal symbol, warning labels |

| Colorado | ✓ Required | ✗ No | ✓ Required | ✓ Yes (multi-serve) | Maximum 10 units per package |

| Massachusetts | ✓ Required | ✗ No | ✓ Required | ✓ Yes | Recyclable materials preferred |

| New York | ✓ Required | ✓ Yes | ✓ Required | ✓ Yes (multi-serve) | Plastic-free by 2028 (goal) |

| Illinois | ✓ Required | ✗ No | ✓ Required | ✓ Yes | Batch/lot tracking required |

| Michigan | ✓ Required | ✗ No | ✓ Required | ✓ Yes (multi-serve) | Universal cannabis symbol |

| Washington | ✓ Required | ✗ No | ✓ Required | ✓ Yes (multi-serve) | Tamper-evident seal |

| Vermont | ✓ Required | ✓ Yes | ✓ Required | ✓ Yes | 60% THC cap on concentrates |

Sources: 420 Packaging, Distru, CannaZip Compliance Guide

Required Labeling Elements

Beyond child-resistance, cannabis product labels must include:

Mandatory Information:

- Product name and brand

- Cannabis/THC universal symbol

- Net weight/quantity

- THC and CBD content (mg and %)

- Batch/lot number for traceability

- Harvest/packaging date

- Warning statements (pregnancy, impairment, etc.)

- Manufacturer/distributor information

- Lab testing certification

- Ingredient list (for infused products)

- “Keep out of reach of children” warnings

Label Size Requirements:

- Minimum 2″ x 2″ label space

- Warning text: Minimum 6-point font

- Universal symbol: Minimum 0.5″ diameter

Pre-Roll Packaging Formats: Materials and Applications

Cannabis pre-rolls utilize diverse packaging formats, each offering distinct advantages for product protection, compliance, and brand presentation.

Table 3: Pre-Roll Packaging Materials Comparison

| Material | Approximate Cost per Unit | Durability | Moisture Barrier | Oxygen Barrier | Light Protection | Sustainability | Premium Perception | Best For |

|---|---|---|---|---|---|---|---|---|

| HDPE Plastic | $0.20-$0.50 | Good | Excellent | Fair | Opaque options | Recyclable (#2) | Medium | High-volume brands |

| PET Plastic | $0.30-$0.60 | Excellent | Good | Fair | Transparent | Recyclable (#1) | Medium-High | Visibility products |

| PCR Plastic | $0.35-$0.70 | Good | Excellent | Fair | Opaque options | Excellent (recycled) | High (eco-conscious) | Sustainable brands |

| Glass | $0.80-$1.50 | Excellent | Excellent | Excellent | Tinted options | Recyclable (infinite) | Very High | Premium products |

| Aluminum | $0.60-$1.20 | Excellent | Excellent | Excellent | Complete | Recyclable (infinite) | Very High | Premium/travel |

| Cardboard | $0.15-$0.40 | Fair | Poor (needs lining) | Poor | Excellent | Excellent (biodegradable) | Medium | Eco-friendly brands |

| Hemp Plastic | $0.50-$1.00 | Good | Good | Fair | Opaque options | Excellent (plant-based) | Very High | Ultra-sustainable |

| Mylar Bags | $0.10-$0.30 | Fair | Excellent | Excellent | Excellent | Poor (multi-layer) | Low-Medium | Multi-packs/value |

Chart 2: Packaging Cost vs. Premium Perception

Ultra-Premium | ● Glass ● Aluminum

| ● Hemp Plastic

Premium | ● PCR Plastic

Mid-Range | ● PET ● HDPE

Budget | ● Cardboard ● Mylar

|________________________________

Low Med High V.High

COST PER UNITMaterial Selection Decision Framework

Choose HDPE/PET Plastic When:

- High-volume production (>50,000 units/month)

- Budget constraints are primary concern

- Standard product positioning

- Clear visibility of product is desired (PET)

Choose PCR/Hemp Plastic When:

- Brand emphasizes sustainability

- Target market values eco-credentials

- 70% of consumers prefer sustainable packaging

- Willing to invest 15-40% premium over virgin plastic

Choose Glass When:

- Premium product positioning (live resin, high-potency)

- Maximum product preservation is critical

- Brand storytelling emphasizes quality

- Willing to invest 2-3x cost of plastic

Choose Aluminum When:

- Premium positioning + durability needed

- Travel/portability is selling point

- Complete light/oxygen protection required

- Sleek, modern aesthetic desired

Sustainability: From Trend to Requirement

Environmental responsibility has evolved from marketing advantage to market expectation, with consumers and regulators increasingly demanding sustainable packaging solutions.

Consumer Demand for Sustainability

Environmental responsibility has evolved from marketing advantage to market expectation, with consumers and regulators increasingly demanding sustainable packaging solutions.

Recent market research reveals strong consumer preference for environmental responsibility:

- 70% of consumers prefer sustainable or recyclable packaging, even at slight price premium

- 70% of consumers prefer packaging with clear sustainability labels

- 55% occasionally notice sustainability labels; 20% always notice

- 35% willing to pay 5-10% premium for eco-friendly packaging

Source: 2025 Sustainable Packaging Consumer Report, Calyx Containers

Table 4: Sustainable Packaging Materials for Cannabis

| Material | Environmental Benefit | Recyclability | Compostability | Carbon Footprint Reduction | Cost Premium | Availability |

|---|---|---|---|---|---|---|

| PCR Plastic (20-100%) | Diverts waste from landfills | ✓ Yes (#1 or #2) | ✗ No | 30-70% vs. virgin | +15-40% | Excellent |

| Hemp Plastic (PLA) | Plant-based, renewable | ✓ Industrial only | ✓ Yes (industrial) | 50-80% vs. petroleum | +50-100% | Good |

| Ocean-Bound Plastic | Prevents ocean pollution | ✓ Yes (#2 HDPE) | ✗ No | Neutral (reclaimed) | +25-50% | Limited |

| Recycled Glass | Infinite recyclability | ✓ Yes (infinite) | ✗ No | 20-40% vs. virgin | +10-25% | Excellent |

| Recycled Aluminum | 95% energy savings | ✓ Yes (infinite) | ✗ No | 95% vs. virgin | +15-30% | Excellent |

| FSC-Certified Paper | Sustainable forestry | ✓ Yes (widely) | ✓ Yes | 60-80% vs. plastic | +5-20% | Excellent |

| Bamboo | Fast-growing, renewable | Limited | ✓ Yes | 70-85% vs. plastic | +40-80% | Limited |

| Mushroom Packaging | Biodegradable, compostable | ✗ No | ✓ Yes (home) | 80-90% vs. plastic | +60-120% | Emerging |

Sources: Contempocard PCR Guide, Gamut Packaging, Custom Cones USA Eco-Friendly Options

PCR Plastic: The Pragmatic Sustainability Solution

Post-Consumer Recycled (PCR) plastic represents the most widely adopted sustainable packaging material, offering meaningful environmental benefits without extreme cost premiums:

PCR Percentage Options:

- 20% PCR: Entry-level sustainability (10-15% cost premium)

- 50% PCR: Balanced approach (20-30% cost premium)

- 100% PCR: Maximum recycled content (35-40% cost premium)

Environmental Impact:

- Energy savings: 30-70% reduction vs. virgin plastic production

- CO₂ reduction: 1.5-3.0 tons per ton of PCR used

- Waste diversion: Each ton of PCR prevents 2 cubic yards of landfill

Performance Characteristics:

- Durability: Equivalent to virgin plastic

- Moisture barrier: Excellent (no compromise)

- Appearance: Slight gray tint (can be colored/opaque)

- Child-resistance: Fully compatible with CR mechanisms

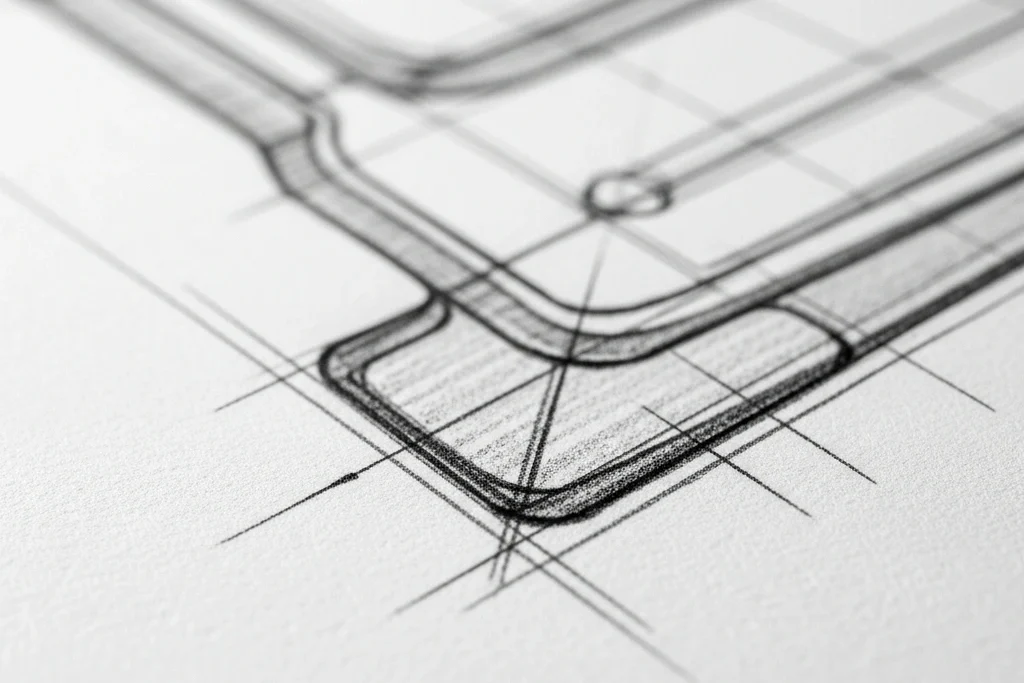

Packaging Design: Maximizing Shelf Appeal

Premium infused pre-rolls demand packaging that communicates quality, protects product integrity, and captures consumer attention in competitive dispensary environments.

Key Design Principles for Infused Pre-Rolls

1. Communicate Premium Positioning

- Metallic accents (gold, silver, copper foil)

- Soft-touch coatings for tactile luxury

- Embossing/debossing for dimensional interest

- Minimalist design language

- High-quality printing (offset vs. digital)

2. Preserve Product Integrity

- Opaque or UV-blocking materials

- Airtight seals to prevent terpene loss

- Humidity control integration (Boveda/Integra packs)

- Cushioning to prevent crushing

- Individual tube protection within multi-packs

3. Enhance User Experience

- Intuitive opening mechanisms

- Resealable closures for multi-serve

- Comfortable grip textures

- Clear product windows (where permitted)

- Easy-to-read dosing information

4. Support Brand Storytelling

- QR codes linking to strain information

- Educational content about concentrates

- Sustainability certifications prominently displayed

- Origin/provenance storytelling

- Artist collaborations (limited editions)

Chart 3: Packaging Investment as % of Product Retail Price

Budget Brands ████ 3-5%

Mid-Tier Brands ████████ 8-12%

Premium Brands ████████████████ 15-20%

Ultra-Premium ████████████████████████ 25-35%

Industry Standard: Cannabis packaging typically represents 10-40% of retail price, with infused products justifying higher packaging investment due to premium positioning.

Packaging Costs: Building Your Budget

Understanding total packaging costs—including materials, printing, compliance testing, and logistics—is critical for accurate margin analysis.

Table 5: Total Cost of Ownership – Pre-Roll Packaging

| Cost Component | Budget Range | Mid-Tier Range | Premium Range | Notes |

|---|---|---|---|---|

| Primary Packaging (tubes) | $0.15-$0.40 | $0.40-$0.80 | $0.80-$1.50 | Material, printing, CR mechanism |

| Secondary Packaging (boxes) | $0.10-$0.25 | $0.25-$0.50 | $0.50-$1.00 | Multi-packs, display boxes |

| Labels/Stickers | $0.03-$0.08 | $0.08-$0.15 | $0.15-$0.30 | Compliance labels, branding |

| Humidity Control | — | $0.10-$0.20 | $0.20-$0.30 | Boveda/Integra packs |

| Tamper-Evident Seals | $0.02-$0.05 | $0.05-$0.10 | $0.10-$0.15 | Compliance requirement |

| Child-Resistant Testing | $0.05-$0.10 | $0.05-$0.10 | $0.05-$0.10 | Amortized over production run |

| Artwork/Design | $0.02-$0.05 | $0.10-$0.20 | $0.20-$0.40 | One-time cost amortized |

| Shipping/Logistics | $0.05-$0.10 | $0.10-$0.15 | $0.15-$0.25 | Freight, warehousing |

| Total per Unit | $0.42-$1.03 | $1.13-$2.20 | $2.15-$4.00 | Complete packaging cost |

| % of $12 Retail Price | 3.5-8.6% | 9.4-18.3% | 17.9-33.3% | Typical infused pre-roll |

Source: Industry Analysis

Multi-Pack Packaging: Maximizing Efficiency

Multi-pack pre-rolls now represent 49.6% of the market, offering cost savings and convenience for both producers and consumers.

Table 6: Single vs. Multi-Pack Packaging Economics

| Configuration | Units per Pack | Primary Packaging Cost | Secondary Packaging | Total Packaging Cost | Per-Unit Savings | Consumer Savings |

|---|---|---|---|---|---|---|

| Individual Singles | 1 | $0.50 | — | $0.50 | Baseline | Baseline |

| 2-Pack | 2 | $0.30 each | $0.20 | $0.80 ($0.40/unit) | 20% | 10-15% |

| 3-Pack | 3 | $0.25 each | $0.25 | $1.00 ($0.33/unit) | 34% | 15-20% |

| 5-Pack (most popular) | 5 | $0.20 each | $0.30 | $1.30 ($0.26/unit) | 48% | 20-25% |

| 10-Pack | 10 | $0.15 each | $0.40 | $1.90 ($0.19/unit) | 62% | 25-30% |

Multi-Pack Design Considerations

Individual Protection:

- Separate tubes/sleeves for each pre-roll

- Prevents cross-contamination of strains/flavors

- Maintains freshness after opening

- Premium perception vs. bulk packaging

Outer Packaging:

- Child-resistant closure required

- Display-ready design for dispensary shelves

- Room for expanded labeling (strain info, dosing)

- Resealable after initial opening

Popular Configurations:

- 5-pack (0.5g each = 2.5g total): 62.2% of multi-pack sellers

- 10-pack minis: 40% of multi-pack sellers

- 3-pack (1g each): 17.8% of multi-pack sellers

- Variety packs: Growing trend (mixed strains/types)

Jarsking's Packaging Solutions for Infused Pre-Rolls

As a premier packaging manufacturer with 20+ years of experience, Jarsking delivers comprehensive solutions specifically engineered for premium cannabis products.

Core Capabilities

Custom Mold Development

- 30,000+ existing molds in stock

- 15-day prototype turnaround for new designs

- 1-hour concept-to-design service

- 2-hour 3D rendering delivery

Child-Resistant Expertise

- Pre-certified CR mechanisms

- In-house testing coordination

- ASTM D3475-20 compliance guarantee

- Design optimization for 80/90 standard

Sustainable Materials Portfolio

- PCR plastic (20-100% recycled content)

- Recyclable glass and aluminum

Premium Finishing Options

- Soft-touch coatings

- Metallic hot stamping (gold, silver, copper)

- Embossing and debossing

- UV spot coatings

- Silk-screen printing

Production Scale and Speed

- 10+ owned factories across South China

- 6+ automatic production lines

- 15 million bottles monthly capacity

- 40+ tons daily glass production

- 30-day bulk order completion

- Global shipping

Quality Certifications

✅ ISO9001 Quality Management

✅ BSCI Social Compliance

✅ ROHS (Restriction of Hazardous Substances)

✅ CE (European Conformity)

✅ MSDS (Material Safety Data Sheets)

✅ LFGB (German Food Safety)

✅ REACH (Chemical Safety)

Why Premium Brands Choose Jarsking

1. Speed to Market

- Fast turnaround in industry

- Reduces time-to-shelf by 40-60%

- Critical for seasonal launches

2. Design Flexibility

- Free design services included

- Unlimited revision cycles

- Multi-format compatibility (tubes, jars, bottles, tins)

3. Sustainability Leadership

- ESG-driven manufacturing

- Circular economy focus

- Transparent supply chain

- Carbon footprint reporting

4. Cost Optimization

- Factory-direct pricing

- No middleman markup

- Volume discounts at all tiers

- Consolidated shipping options

5. End-to-End Support

- Dedicated account managers

- After-sales support team

- Compliance assistance

- Inventory management solutions

Packaging Trends Shaping 2025 and Beyond

The cannabis packaging industry continues rapid evolution, driven by regulatory changes, sustainability demands, and consumer expectations.

Plastic-Free Mandates

New York’s Bold Initiative: New York is pursuing plastic-free cannabis packaging by 2028, requiring:

- Glass, metal, or certified compostable materials

- PCR content as bridge solution

- Extended Producer Responsibility (EPR) programs

Industry Response:

- Accelerated adoption of alternative materials

- Investment in compostable polymer research

- Glass and aluminum capacity expansion

Refillable/Reusable Systems

Circular Economy Models:

- Deposit-return programs for premium glass packaging

- Refill stations in dispensaries

- Branded reusable cases with replaceable inserts

- 30-50% cost savings for consumers after initial purchase

Leading Brands:

- PAX Pod refill programs

- Select Elite return incentives

- Reusable luxury cases (Lowell, Jeeter)

Smart Packaging Integration

Technology-Enhanced Packaging:

- NFC chips for authentication and engagement

- QR codes linking to lab results, strain info

- Temperature indicators showing storage conditions

- Humidity sensors alerting to freshness issues

Consumer Benefits:

- Product authentication (anti-counterfeiting)

- Educational content access

- Loyalty program integration

- Dosing guidance and consumption tracking

Minimalist Design Aesthetic

Premium Simplification:

- Clean lines, negative space

- Muted earth tones replacing vibrant colors

- Typography-focused branding

- Subtle luxury cues (soft-touch, metallic accents)

Market Drivers:

- Destigmatization of cannabis

- Appeal to mainstream consumers

- Shelf differentiation through restraint

- Regulatory pressure to avoid youth appeal

Transparency and Traceability

Supply Chain Visibility:

- Blockchain-tracked materials sourcing

- Carbon footprint disclosure on labels

- Factory certifications prominently displayed

- Ingredient and material transparency

Consumer Expectations:

- 70% want clear sustainability labels

- 65% check origin/manufacturing location

- 58% verify lab testing before purchase

Conclusion: Packaging as Strategic Investment

In the competitive $1.75 billion infused pre-roll market, packaging transcends mere containment—it’s a strategic asset that preserves product quality, ensures regulatory compliance, communicates brand values, and drives purchasing decisions at point-of-sale.

The brands that will dominate this rapidly growing category understand that thoughtful packaging investment delivers measurable ROI through:

✅ Product Preservation – Protecting volatile terpenes and maintaining potency

✅ Compliance Assurance – Avoiding costly recalls and regulatory penalties

✅ Brand Differentiation – Standing out in crowded dispensary displays

✅ Consumer Trust – Demonstrating commitment to quality and safety

✅ Sustainability Leadership – Meeting the 70% of consumers demanding eco-responsibility

✅ Cost Optimization – Leveraging volume pricing and multi-pack efficiency

As the market matures and competition intensifies, packaging excellence separates market leaders from also-rans. Partner with experienced manufacturers like Jarsking who understand the unique demands of cannabis products and deliver solutions that enhance your brand while protecting your bottom line.

FAQs

Cannabis packaging must meet CPSC 16 CFR 1700.20 standards, requiring 80% of children aged 42-51 months cannot open packaging within 5 minutes, while 90% of adults can successfully open and re-close it. Testing costs $3,000-$8,000 per design and takes 4-8 weeks. Packaging must be recertified after any design changes. All states require child-resistant packaging for cannabis products, making this the most critical compliance requirement.

Packaging costs typically range from $0.42-$4.00 per unit, depending on materials and volume. Budget brands invest 3-8% of retail price, mid-tier brands 8-18%, and premium brands 15-35%. For a $12 infused pre-roll, expect $1.50-$3.00 in total packaging costs (primary tube, secondary packaging, labels, humidity control, compliance testing). Volume pricing reduces costs significantly: 1,000-unit orders cost $0.60-$0.75 per plastic tube, while 100,000+ units drop to $0.20-$0.35 each—a 67% savings.

PCR (Post-Consumer Recycled) plastic is made from materials already used and recycled by consumers, typically ranging from 20-100% recycled content. PCR plastic reduces energy consumption by 30-70% compared to virgin plastic, diverts waste from landfills, and appeals to the 70% of cannabis consumers who prefer sustainable packaging. Cost premiums are modest: 15-40% more than virgin plastic. Performance is equivalent—PCR maintains excellent moisture barriers, durability, and child-resistance compatibility. The slight gray tint can be masked with coloring or opaque finishes.

Glass offers superior product preservation (excellent oxygen and moisture barriers, complete light blocking), infinite recyclability, and premium perception that supports 30-50% higher pricing. However, glass costs 2-3x more ($0.80-$1.50 vs. $0.20-$0.50 for plastic), weighs more (increasing shipping costs), and breaks if dropped. Choose glass for ultra-premium products (live resin, diamonds), when maximum terpene preservation is critical, or when brand positioning emphasizes luxury. Choose plastic for high-volume production, budget constraints, or when durability/portability is prioritized over maximum preservation.

Multi-packs reduce per-unit packaging costs by 48-62% compared to individual singles. A single pre-roll tube costs $0.50, while a 5-pack configuration costs $0.26 per unit (primary packaging drops from $0.50 to $0.20 each; one shared $0.30 outer package serves five units). Multi-packs now represent 49.6% of the pre-roll market, with 5-packs being most popular (62.2% of sellers offer them). Beyond cost savings, multi-packs offer consumer convenience, reduced dispensary packaging waste, and opportunities for variety packs showcasing multiple strains.

Key certifications include FSC (Forest Stewardship Council) for paper products, demonstrating sustainable forestry; ISO 14001 for environmental management systems; ASTM D6400/D6868 for compostable materials; and transparent PCR percentage disclosure (20%, 50%, or 100% recycled content). Look for suppliers offering carbon footprint reporting, Extended Producer Responsibility (EPR) program participation, and third-party verified recycled content claims. 70% of consumers prefer clear sustainability labels, so prominently display certifications on packaging. Verify suppliers provide Material Safety Data Sheets (MSDS) and comply with REACH regulations for chemical safety.