The hand cream industry has undergone a remarkable transformation, evolving from a basic necessity into a sophisticated skincare category that blends functionality with luxury. What was once considered a simple moisturizer has become an essential component of daily self-care routines, driven by heightened hygiene awareness, environmental stressors, and an increasing focus on skin health.

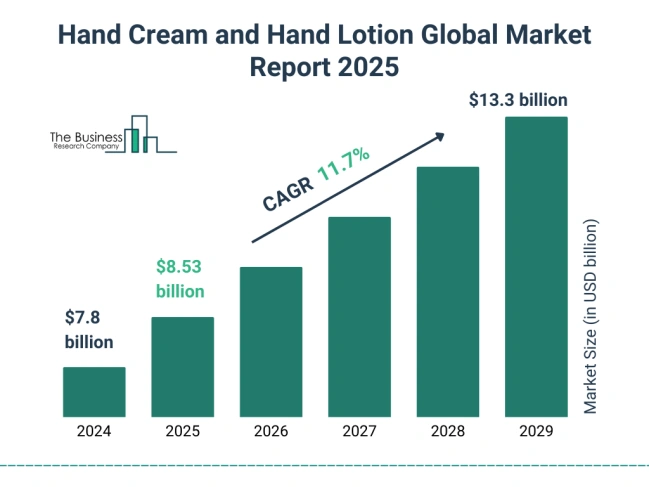

The global hand cream market has experienced unprecedented growth, with projections showing expansion from $7.8 billion in 2024 to $8.53 billion in 2025, representing a robust 9.4% year-over-year increase. This surge reflects not only increased consumer awareness about hand care but also the industry’s response to evolving needs through innovative formulations, premium packaging, and targeted marketing strategies.

The rise of hand care has been particularly pronounced since the global pandemic, which fundamentally changed how consumers view hand hygiene and moisturization. The era of frequent hand washing and sanitizing created an urgent need for products that could counteract the drying effects of these practices while maintaining skin health and comfort.

Modern consumers no longer view hand cream as an afterthought but as an integral part of their skincare regimen. This shift has opened opportunities for brands to position hand creams as accessible luxury items, combining practical benefits with sensorial experiences that appeal to diverse demographics and lifestyle preferences.

Market Analysis and Growth Trends

Current Market Size and Projections

The hand cream market demonstrates remarkable resilience and growth potential across multiple research forecasts. According to comprehensive market analysis, the industry is projected to reach $13.3 billion by 2029, growing at an impressive 11.7% CAGR. Alternative projections suggest the market could reach $1,185.6 million by 2030, with a 6.2% CAGR from 2024 to 20304, while other estimates indicate growth to $784.5 million by 2033 at a 4.81% CAGR.

These varying projections reflect different methodologies and market segment definitions, but all point to consistent upward trajectory. The Asia Pacific region currently represents the largest market5, driven by rising awareness about skincare benefits and increasing disposable income among consumers in emerging economies.

North America accounts for 36.8% of the global hand cream market4, maintaining its position as a mature market with steady growth driven by premium product adoption and brand loyalty. The region’s consumers demonstrate strong preference for products with clinical backing and dermatologist recommendations.

Key Market Drivers

The market’s robust growth stems from multiple converging factors that have fundamentally altered consumer behavior and industry dynamics.

Hygiene awareness remains the primary driver, with sustained increases in hand washing and sanitizing practices creating ongoing demand for moisturizing solutions. Healthcare professionals, food service workers, and frequent hand-washers represent key growth segments, with usage rates significantly higher than general population averages.

Skin health consciousness has expanded beyond basic moisturization to encompass preventive skincare approaches. Consumers increasingly seek products that offer comprehensive benefits, including barrier repair, anti-aging properties, and protection against environmental stressors.

The natural beauty movement continues to drive premium segment growth, with demand for clean, organic ingredients influencing product development and marketing strategies. Brands are responding by incorporating botanical extracts, sustainable sourcing practices, and transparency in ingredient communication.

Working women population, representing 39% globally, drives significant purchase power and influences product convenience features. This demographic seeks products that integrate seamlessly into busy lifestyles while delivering professional-grade results.

The aging population creates additional growth opportunities, as elderly consumers require specialized hand care solutions that address age-related skin changes, including thinning skin, reduced elasticity, and increased sensitivity to environmental factors.

Market Segments and Demographics

Gender breakdown reveals interesting dynamics, with females dominating at 70% of the market but male segment growing at 15% annually. The men’s demand for hand creams is anticipated to grow with a CAGR of 6.9% from 2024 to 2030, reflecting changing attitudes toward male grooming and self-care.

Modern men demonstrate increasing consciousness about maintaining healthy skin, leading to greater adoption of hand creams that offer moisturizing, anti-aging, and protective benefits. Targeted marketing campaigns and male-focused product formulations contribute significantly to this trend.

Age demographics show Generation X leading market share, while millennials demonstrate 23% growth rate. The millennial generation, particularly males, represents a high-opportunity segment due to increased awareness of skincare benefits and willingness to invest in personal care products.

Income levels influence purchase patterns significantly, with the premium segment growing from $586 million to a projected $813 million. Luxury hand creams are increasingly positioned as accessible indulgences, allowing consumers to experience high-end formulations without the investment required for comprehensive skincare systems.

Professional segments including healthcare workers, food service employees, and manual laborers represent specialized growth areas requiring products designed for extreme conditions and frequent application.

Competitive Landscape Overview

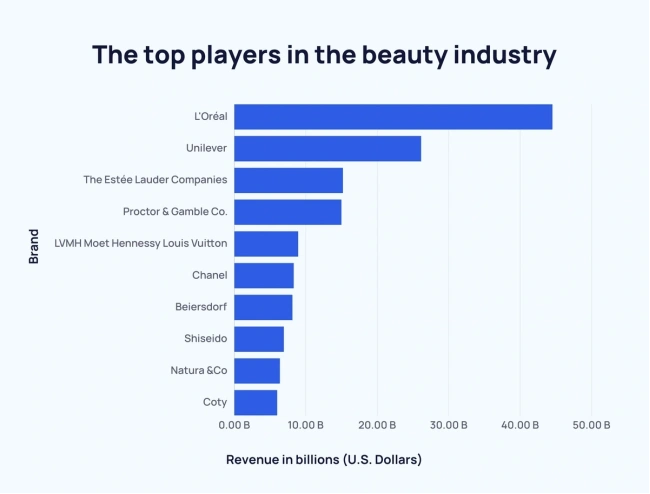

Market leaders including Unilever, L’Oréal, and P&G control approximately 45% market share, while emerging brands capture 25% of the premium segment. This distribution indicates healthy competition with room for innovation and niche positioning.

Independent and boutique brands have successfully carved out premium market positions by focusing on unique formulations, sustainable practices, and targeted consumer segments. Regional players gain traction in specific geographic markets by understanding local preferences and cultural attitudes toward hand care.

The competitive landscape encourages continuous innovation in formulations, packaging, and marketing approaches, benefiting consumers through improved product quality and diverse options that cater to specific needs and preferences.

Product Features and Formulations

Essential Ingredients and Their Benefits

Modern hand cream formulations represent sophisticated combinations of active ingredients designed to address multiple skin concerns simultaneously. Glycerin appears in 85% of formulations, serving as the primary humectant that attracts and retains moisture in the skin.

Shea butter has become a cornerstone ingredient, prized for its rich texture and ability to provide long-lasting hydration without greasy residue. Its natural anti-inflammatory properties make it particularly suitable for sensitive skin and conditions requiring gentle care.

Hyaluronic acid has transitioned from facial skincare into hand care formulations, offering superior moisture retention capabilities. This ingredient can hold up to 1,000 times its weight in water, making it exceptionally effective for addressing severe dryness and maintaining skin plumpness.

Barrier repair agents including ceramides, cholesterol, and fatty acids represent advanced formulation science applied to hand care. These ingredients work synergistically to restore and maintain the skin’s natural protective barrier, preventing moisture loss and environmental damage.

Active ingredients such as urea (up to 40% in therapeutic formulations) and lactic acid provide exfoliation benefits, removing dead skin cells and improving product absorption. These ingredients are particularly beneficial for individuals with extremely dry or rough hands.

Natural extracts including rose de Mai, iris pallida, and various botanical ingredients serve dual purposes of providing skincare benefits and luxury positioning. These ingredients often carry premium pricing but offer unique sensorial experiences and marketing narratives.

Protective compounds incorporating SPF ingredients and antioxidants (Vitamins C and E) address growing consumer awareness of hand aging and environmental protection needs. These formulations target consumers seeking comprehensive anti-aging solutions.

Popular Product Categories

Intensive repair creams represent the fastest-growing segment at 18% CAGR, addressing consumer needs for solutions to extremely dry, cracked hands. These products typically feature higher concentrations of active ingredients and specialized delivery systems.

Anti-aging formulations target fine lines, age spots, and skin texture improvement, appealing to consumers seeking to extend facial skincare benefits to their hands. These products often incorporate retinol, peptides, and brightening agents.

Fragrance-focused products occupy 40% of the luxury market, combining moisturizing benefits with signature scents. These products serve dual purposes as skincare and fragrance, appealing to consumers seeking multifunctional beauty products.

Sensitive skin formulations emphasize fragrance-free, hypoallergenic options designed for healthcare professionals, food service workers, and individuals with skin sensitivities. These products prioritize efficacy and safety over sensorial experience.

Multifunctional products combine moisturizing, nail care, and cuticle treatment in single formulations, appealing to consumers seeking convenience and comprehensive hand care solutions.

Texture and Application Innovations

Fast-absorbing formulations address professional use requirements, providing necessary hydration without interfering with daily activities. These products utilize advanced emulsion technology to deliver moisture without greasy or sticky residue.

Long-lasting protection featuring 8-12 hour moisture barrier technology appeals to consumers seeking convenience and extended wear. These formulations often incorporate film-forming agents that create invisible protective layers on the skin.

Seasonal variations acknowledge changing environmental conditions and consumer needs, with lightweight summer formulations and intensive winter repair options. This approach allows brands to maintain year-round engagement while addressing specific seasonal challenges.

Top-Performing Products and Brands

Mass Market Champions

Neutrogena Norwegian Formula maintains its position as the best selling hand cream globally with 12% market share. This glycerin-based, fragrance-free formula benefits from 40+ years of consumer trust and clinical efficacy backing. Its $3-5 retail price point makes it accessible luxury, while availability in 80+ countries ensures consistent market presence.

The product’s success stems from its dermatologist recommendation status and proven effectiveness for severe dryness. Strong pharmacy and supermarket distribution partnerships maintain visibility and accessibility across diverse retail environments.

Eucerin Advanced Repair ranks among the top 3 in therapeutic hand cream category, featuring ceramide-3 and natural moisturizing factor (NMF) formulations. Its targeting of users with eczema and extremely dry skin conditions creates strong brand loyalty among consumers with specific medical needs.

Clinical backing through dermatologist testing and fragrance-free, dye-free formulation appeals to health-conscious consumers and those with sensitivities. The brand’s medical heritage provides credibility in therapeutic applications.

CeraVe Regenerating Hand Cream demonstrates 35% year-over-year growth in North American market, driven by time-release ceramide technology and hyaluronic acid inclusion. Recommended by 90% of dermatologists surveyed, the product benefits from professional endorsement and premium ingredients at mid-tier pricing ($6-8).

Luxury and Premium Segment Leaders

L’Occitane Shea Butter Hand Cream leverages 25% shea butter concentration and sustainable sourcing from Burkina Faso women’s cooperatives, creating compelling brand narratives around ingredient quality and social responsibility. The brand generates €2.3 billion global revenue, with hand creams representing 18% of sales.

Consumer loyalty metrics show 78% repurchase rate, strongest in 25-45 female demographic, indicating successful targeting and satisfaction levels. The iconic tube design and travel-friendly 30ml format serve as bestsellers, while seasonal collections drive 40% of Q4 sales.

Chanel La Crème Main commands $55 retail price point, targeting ultra-premium segment consumers. The product required 4-year development cycle for pebble-shaped container, demonstrating brand commitment to innovation and luxury positioning. Featuring TXC complex and iris pallida extract with exclusive fragrance blend, the product appeals to 35-55 age group with household income >$100K. Distribution through selective retail channels maintains exclusivity and brand prestige.

Kiehl’s Ultimate Strength Hand Salve benefits from heritage appeal with “Since 1851” brand story and apothecary-style packaging. 94% consumer satisfaction in clinical trials validates product efficacy, while sesame seed oil, avocado oil, and eucalyptus leaf extract provide natural ingredient appeal. Notably, 30% male consumer base represents highest in luxury segment, indicating successful gender-neutral positioning and formulation effectiveness across demographic groups.

Specialty and Professional-Grade Products

O’Keeffe’s Working Hands targets manual laborers, healthcare workers, and extreme conditions users with guaranteed relief or money back positioning. The product achieves 89% awareness among target demographic and maintains 48-hour protection claims.

High concentration of glycerin, paraffin, and lanolin provides intensive repair for severely damaged hands. Strategic retail placement in hardware stores, pharmacies, and occupational health suppliers ensures accessibility for target users.

Burt’s Bees Almond & Milk Hand Cream capitalizes on natural/organic hand cream market growing at 22% CAGR. 99.1% natural ingredients and cruelty-free certification appeal to environmentally conscious consumers seeking clean beauty alternatives. Sweet almond oil, beeswax, and milk proteins provide nourishment while sustainable sourcing practices and recyclable packaging support environmental positioning.

Emerging and Trending Brands

The Body Shop Hemp Hand Protector aligns with CBD and hemp-derived ingredients gaining mainstream acceptance. Intensive moisturizing capabilities for extremely dry skin conditions, combined with ethical positioning through community trade and vegan formulation, appeal to conscious consumers. 45% growth in hemp-based skincare category indicates strong market acceptance and future potential for botanical ingredient innovations.

Bath & Body Works Hand Creams dominate fragrance leadership with 200+ seasonal and permanent scent options. 3-for-$10 promotions driving impulse purchases create accessible luxury positioning, while average customer purchases 8.3 units per year demonstrate strong engagement and repeat purchase behavior. Seasonal strategy featuring limited edition collections for holidays creates urgency and collectibility, driving higher purchase frequency and brand engagement.

Private Label and Store Brands

Trader Joe’s Ultra Moisturizing Hand Cream exemplifies value positioning at $2.99 price point while featuring premium ingredients including shea butter, coconut oil, and vitamin E. 92% Trader Joe’s customer satisfaction rating reflects successful quality-to-price ratio positioning.

Target’s Goodfellow & Co. (Men’s Line) addresses growing men’s grooming segment with masculine packaging, subtle fragrance, and non-greasy formula. Male hand cream usage up 40% since 2020 indicates significant opportunity for gender-specific positioning and product development.

Packaging Innovations and Design Trends

Ergonomic Design Revolution

Packaging innovations represent crucial differentiation factors in the competitive hand cream market, with brands investing significantly in user experience improvements and aesthetic appeal.

Pebble-shaped containers pioneered by Chanel’s La Crème Main required 4 years of development to achieve optimal ergonomics and visual impact. This innovation demonstrates how packaging can become a key brand differentiator and justify premium pricing.

Soft-touch technology implemented by Nivea in tottle packaging improves grip and user experience, particularly important for frequent-use products. Enhanced squeezability and desktop stability address practical consumer needs while maintaining attractive appearance.

User-friendly features including one-handed operation and arthritis-friendly designs acknowledge aging population needs and accessibility requirements. These considerations expand market reach while demonstrating brand sensitivity to diverse consumer capabilities.

Sustainable Packaging Solutions

Environmental consciousness drives significant packaging innovation, with brands responding to consumer demands for responsible packaging choices.

Recycled materials adoption includes Guerlain’s use of post-consumer recycled polypropylene (75% content), demonstrating feasibility of sustainable packaging without compromising product protection or aesthetic appeal. CleanStream technology utilizing advanced AI for material sorting and decontamination enables higher recycled content percentages while maintaining quality standards. This technology addresses previous limitations in recycled packaging applications.

Refillable systems pioneered by Aesop and L’Occitane create ongoing customer relationships while reducing packaging waste. These programs appeal to environmentally conscious consumers and create subscription-like revenue streams.

Biodegradable options incorporating plant-based tubes and caps gain market traction, though implementation challenges include cost premiums and performance limitations. Consumer willingness to pay higher prices for environmental benefits supports continued development in this area.

Smart Packaging Features

Airless pump technology minimizes waste and contamination while extending product life, particularly important for formulations containing active ingredients sensitive to air exposure. These vacuum-sealed systems prevent oxidation and bacterial contamination, extending shelf life by up to 18 months compared to traditional packaging. Precise dispensing mechanisms deliver consistent 0.5ml doses, reducing product waste by 25% while ensuring optimal ingredient potency. Cost-conscious consumers appreciate the complete product evacuation, with 98% dispensing efficiency versus 85% in standard tubes.

UV-resistant materials protect sensitive ingredients from degradation, ensuring product efficacy throughout shelf life by blocking harmful UV rays that break down molecular structures. This protection is particularly important for products containing vitamins C and E, retinol, and natural extracts, which lose 30-50% potency when exposed to light over six months. Amber-tinted containers and UV-blocking additives maintain ingredient stability, reducing reformulation costs and customer complaints. Premium brands invest 15% more in protective packaging to preserve product integrity and justify higher price points.

Customization options including QR codes linking to personalized skincare advice create digital engagement opportunities and brand differentiation, with 67% of millennials scanning product codes for additional information. These features appeal to tech-savvy consumers seeking personalized beauty experiences, generating valuable customer data for targeted marketing campaigns. Digital integration increases brand engagement by 40% and customer retention by 23%, while enabling real-time product education and usage tips. Advanced QR systems track individual product usage patterns, enabling personalized replenishment recommendations and loyalty program benefits.

Gift-friendly packaging drives 40% of top products bundled as gift sets during holiday seasons, creating seasonal revenue spikes that account for 35% of annual profits in Q4. These attractive presentations introduce products to new consumers through gifting occasions, with 45% of gift recipients becoming regular purchasers within six months. Premium gift boxes featuring multiple product sizes or complementary items achieve 70% higher margins than individual products. Holiday packaging investments of 8-12% of product cost generate 200-300% ROI through increased sales volume and brand exposure.

Size and Format Innovations

Travel-size dominance with 30ml tubes representing 35% of unit sales reflects consumer mobility and trial preferences, driven by TSA-compliant regulations and on-the-go lifestyles. These compact formats enable brand sampling at lower price points, reducing purchase risk for consumers trying new products. Airlines, hotels, and subscription boxes increasingly feature travel-sized hand creams, creating additional distribution channels while meeting portability demands of frequent travelers and busy professionals.

Professional dispensers in 500ml+ sizes cater to workplace and healthcare settings, creating B2B revenue opportunities while serving high-usage environments efficiently. These bulk formats reduce per-unit costs by up to 40% compared to individual tubes, appealing to budget-conscious institutions. Wall-mounted dispensers in hospitals, restaurants, and manufacturing facilities ensure consistent product availability while minimizing contamination risks. The institutional market represents 12% of total volume sales with higher profit margins.

Multi-pack offerings drive higher basket sizes in retail environments while providing consumers with convenience and value, typically featuring 15-20% savings compared to individual purchases. These formats particularly appeal to families and high-usage consumers who benefit from bulk purchasing. Seasonal gift sets combining different fragrances or formulations achieve 60% higher profit margins during holiday periods. Retailers favor multi-packs as they increase average transaction values and reduce shelf restocking frequency.

Preview for Part II

Beyond products and packaging lies a deeper story—how consumers actually use, choose, and think about hand cream. Their evolving preferences drive tomorrow’s breakthroughs, from AI-powered personalization to sustainable formulations. Let’s explore the behavioral insights shaping the future of hand care innovation in Part II.