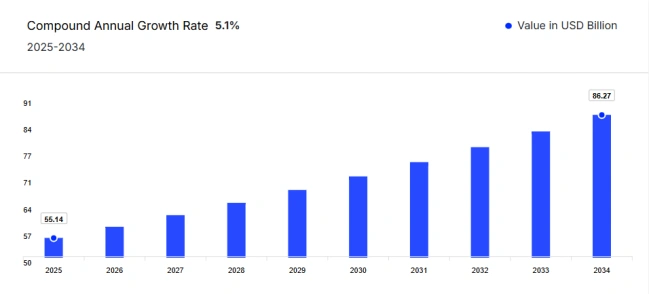

The global body lotion market represents one of the most dynamic and rapidly expanding segments within the personal care industry, presenting unprecedented opportunities for business owners and entrepreneurs. Current market data reveals a robust growth trajectory, with the global body lotion market valued at approximately $52.46 billion in 2024 and projected to reach $86.27 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.10%. This substantial market expansion is driven by evolving consumer preferences, increased skincare awareness, and rising disposable incomes worldwide.

The North American market alone represents a significant opportunity, valued at $10.49 billion in 2024 and expected to grow at a CAGR of 3.10% to reach $14.24 billion by 2034. These figures underscore the market’s resilience and potential for sustained growth, making it an attractive sector for personal care businesses seeking expansion or new market entry.

Consumer behavior patterns are fundamentally reshaping the industry landscape. Research conducted by Google and Meta in February 2024 revealed that search interest for body skincare increased by 1,025% since December 2023, indicating an explosive surge in consumer demand. Additionally, Spate’s consumer trends tracker identified 68% year-on-year growth for collagen body lotion searches, demonstrating the growing sophistication of consumer preferences and the demand for specialized, ingredient-focused products.

This comprehensive guide targets personal care business owners, product development teams, marketing professionals, and investment professionals evaluating opportunities in the body lotion market. The analysis provides actionable insights for product development, market positioning, consumer engagement strategies, and financial planning. By understanding current market dynamics, emerging trends, and successful case studies, businesses can make informed decisions about entering or expanding within this lucrative market segment.

The body lotion industry’s evolution reflects broader shifts toward wellness-oriented consumption, sustainability consciousness, and digital-first customer journeys. These trends create both opportunities and challenges that require strategic adaptation and innovative approaches to product development and marketing.

Market Landscape and Industry Analysis

Global Market Overview and Growth Projections

The body lotion market exhibits remarkable consistency across multiple research sources, confirming its strong growth potential. While market size estimates vary slightly due to different methodologies and regional inclusions, all major research organizations project sustained expansion through 2034. The Business Research Company reports the market growing from $78.94 billion in 2024 to $86.98 billion in 2025, while other sources focus specifically on body lotions as distinct from broader skincare categories.

Regional market analysis reveals significant opportunities across different geographical segments. North America leads in market maturity and consumer spending power, with the market expected to maintain steady growth despite reaching relative saturation. The incorporation of innovative facial care ingredients like retinol and hyaluronic acid into body lotions is gaining momentum in North America, indicating consumer willingness to invest in premium, multi-functional products.

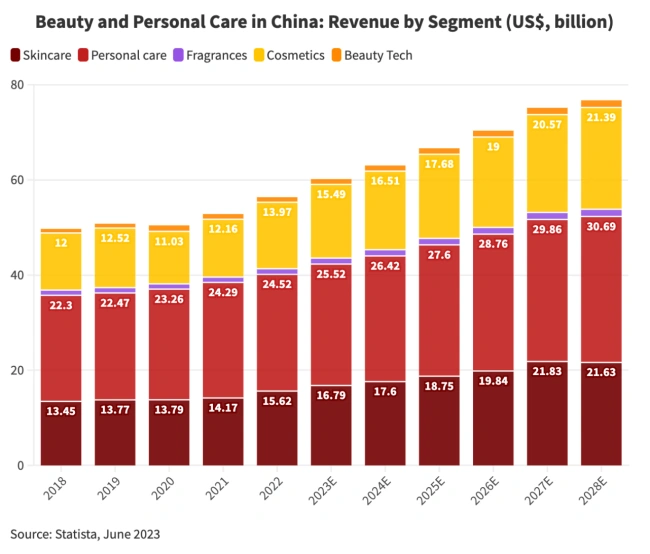

The Asia-Pacific region presents the most dynamic growth potential, driven by expanding middle-class populations and increasing skincare awareness. Analysis of Chinese personal care companies provides valuable insights into this trend. Softto Inc., established in 1988 as one of China’s earliest private consumer product brands, demonstrates how domestic companies can compete effectively against international giants. The company’s revenue of approximately $15.0 million in 2023 and presence in 238 cities across China illustrates the scale and reach achievable in emerging markets.

Consumer Behavior and Market Dynamics

Rising disposable income and urbanization represent fundamental drivers of market expansion. Chinese market analysis reveals that consumer purchasing power has increased significantly, leading to heightened demand for diverse personal care products. This trend extends globally, with consumers increasingly viewing body lotion as an essential rather than luxury item.

Social media and digital influence have transformed consumer discovery and purchase behavior. The Chinese market demonstrates this clearly, where online celebrity live streams, KOL recommendations, and e-commerce platform advertisements drive consumer awareness and trial. The expansion of online channels has been significantly boosted by the COVID-19 pandemic, with traditional platforms like Tmall and JD.com, along with social media platforms such as WeChat, Weibo, and Douyin, becoming influential in product promotion.

Increasing consumer sophistication represents another critical market driver. Chinese consumers exhibit notable increase in knowledge regarding personal care products, becoming more informed and selective in their choices. They seek specialized products that cater to specific needs and demonstrate willingness to pay premium prices for high-quality offerings. This trend reflects global patterns where consumers prioritize efficacy and ingredient transparency.

Competitive Landscape Assessment

The competitive environment features established multinational corporations competing alongside emerging domestic brands and niche players. In the Chinese market, overseas giants like P&G, Unilever, Johnson & Johnson, and L’Oreal Paris have historically dominated, but domestic brands are gaining significant momentum. Companies like Jahwa hold 0.8% market share, Lafang 0.1%, and Mingchen 0.08%, indicating opportunities for market share growth.

Case Study: Park Ha Biological Technology provides insights into successful market positioning and product differentiation. The company has developed a comprehensive product line ranging from basic skin protection to anti-aging solutions, with nearly 200 products divided into 18 series covering almost all skincare categories. Their focus on small molecule peptide compositions demonstrates how technical innovation can create competitive advantages.

Park Ha’s product portfolio includes specialized formulations like the “Park Ha Mussel Repairing Essence Lotion” priced at RMB 199 and targeting oily, combination, and acne-prone skin. Their “Park Ha Carbon Based Gilded Fragrance Bath Lotion” at RMB 98 demonstrates price tier diversification to capture different market segments. This multi-product, multi-price strategy enables companies to address various consumer needs while maximizing market penetration.

Market Segmentation Deep Dive

Skin type segmentation represents the primary market division method, with products specifically formulated for dry, oily, normal, sensitive, and combination skin types. North American market analysis reveals that excessive sun exposure and harsh soap usage accelerate demand for intensive-care body lotions for dry skin, while pollution exposure drives demand for sensitive skin formulations.

Gender-based segmentation continues evolving, with traditional female-focused marketing expanding to include male and unisex formulations. Park Ha’s customer analysis reveals that 95% of their customers are women, but the company plans to launch new brands targeting male groups across all ages, indicating recognition of this underserved market segment.

Packaging format segmentation includes bottles, tubes, pumps, and innovative dispensing systems. This seemingly simple categorization significantly impacts consumer preference and purchase decisions, with different formats appealing to various usage occasions and consumer lifestyles.

Premium versus mass market positioning creates distinct competitive environments within the overall market. Premium products leverage ingredient innovation, sustainability claims, and personalization, while mass market products compete on value, accessibility, and broad appeal. Successful companies often operate across multiple price tiers to capture maximum market opportunity.

Consumer Trends and Preferences

The Natural and Organic Revolution

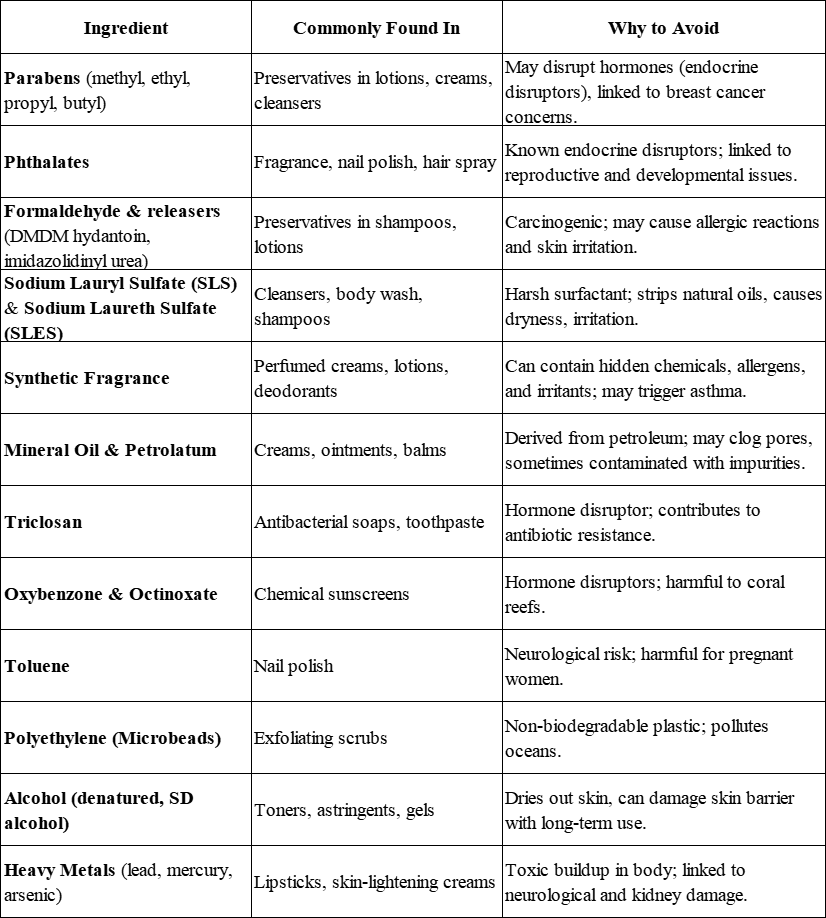

Consumer demand for natural and organic ingredients has fundamentally transformed product development priorities across the body lotion market. Chinese market research reveals a burgeoning inclination toward natural and organic personal care products, anticipated to persist in the foreseeable future. Consumers display increased awareness regarding potential health and environmental hazards linked to prevalent ingredients in personal care items, driving a shift toward safer and more sustainable alternatives.

This trend extends beyond ingredient preferences to encompass complete product lifecycle considerations. Companies like Park Ha Biological Technology emphasize their use of various plant extracts and botanical ingredients in their formulations. Their “Park Ha Ganoderma Soothing Cream” utilizes patented extraction technology of Ganoderma lucidum, demonstrating how traditional natural ingredients can be enhanced through modern processing techniques.

Regulatory developments further accelerate this trend. The Chinese government has actively enforced more stringent regulations and guidelines pertaining to personal care products, including mandatory ingredient labeling requirements and prohibition of specific substances. These regulatory changes create market opportunities for companies positioned with cleaner, more sustainable product portfolios.

Consumer education and ingredient transparency have become competitive necessities rather than differentiators. Brands must now communicate not only what ingredients they use but also why those ingredients were selected and how they benefit specific skin concerns. This transparency requirement creates barriers for companies relying on generic formulations while advantaging those with proprietary research and development capabilities.

Personalization and Customization Trends

Individual skin needs and customization demands are reshaping product development strategies across the industry. Chinese company Softto’s i-softto brand focuses on mid-to-high-end skincare products with personalized customization to meet individual needs, targeting consumers aged 22 and above with various skincare requirements. This approach demonstrates how personalization can justify premium pricing while building consumer loyalty.

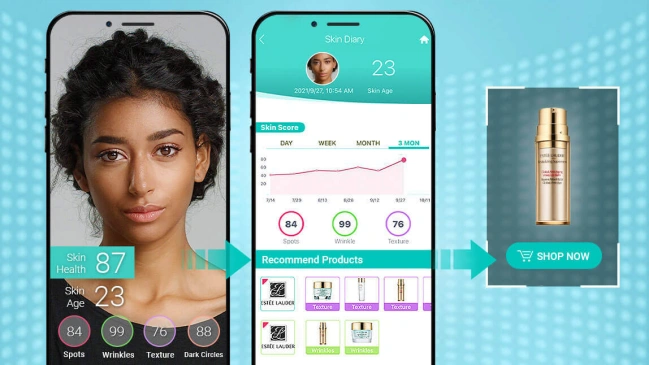

Technology-driven personalization represents the next frontier in product development. Companies are exploring AI-driven skin analysis, personalized ingredient recommendations, and custom formulation services to meet individual consumer needs. While currently limited to premium market segments, these technologies are expected to become more accessible as costs decrease and consumer demand increases.

Specialized products for customer-specific requirements extend beyond basic skin type differentiation to address particular concerns like stretch marks, eczema, and age-related skin changes. Park Ha’s comprehensive product line includes specialized formulations for different skin concerns, from their “Aqua Hydrating Mask” for dry skin to their “Acne Clean Tea Mask” for oily, acne-prone skin.

Case Study: Successful Personalization Implementation can be observed in Park Ha’s approach to product development. Their nearly 200 products divided into 18 series enable consumers to select products matching their specific needs rather than accepting one-size-fits-all solutions. This extensive product range, while complex to manage, allows for precise market targeting and consumer satisfaction.

Multi-Functional Product Expectations

Beyond basic moisturization demands have transformed consumer expectations regarding product performance. Modern consumers expect body lotions to deliver anti-aging benefits, sun protection, therapeutic effects, and cosmetic enhancement in addition to fundamental hydration. This trend creates opportunities for premium positioning while requiring more sophisticated formulation capabilities.

Convenience-driven formulations reflect busy consumer lifestyles and preferences for streamlined skincare routines. Products that combine multiple benefits reduce application time and product proliferation in consumer bathrooms. Olay’s Super Serum Body Lotion exemplifies this trend, featuring five skincare ingredients in a single formulation that provides hydration while delivering additional skin benefits in a lightweight, luxurious texture.

Integration with overall wellness routines positions body lotion as part of comprehensive self-care practices rather than standalone cosmetic application. This positioning enables premium pricing and emotional connection with consumers who view skincare as health maintenance rather than vanity.

Therapeutic benefits represent a growing market segment, with products targeting specific skin conditions like eczema, psoriasis, and dermatitis. Quoin Pharmaceuticals’ development of QRX003, a topical lotion for treating Netherton Syndrome, demonstrates how therapeutic positioning can create market opportunities in specialized segments. While this represents an extreme case of medical positioning, it illustrates consumer openness to products making health-related claims.

Digital-First Consumer Journey

E-commerce growth and digital platform expansion have fundamentally altered how consumers discover, evaluate, and purchase body lotion products. Chinese market data shows online channel sales of personal care products increased from RMB 133.1 billion in 2017 to RMB 287.9 billion in 2022, representing a CAGR of 16.7%. This trend is expected to continue, with projections reaching RMB 535.5 billion by 2027.

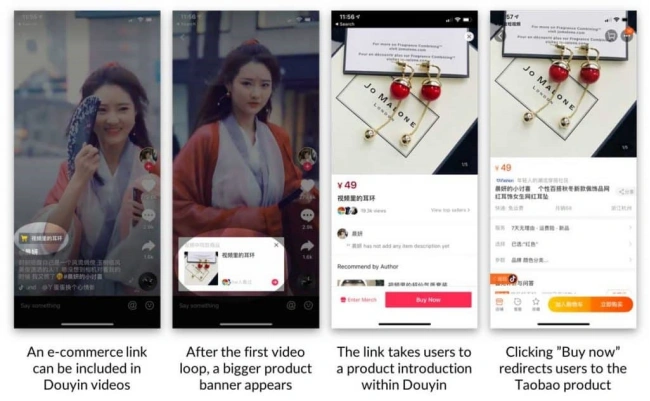

Social media influence on purchasing decisions has become primary rather than supplementary to traditional marketing. Live commerce on platforms such as Taobao Live and Douyin has seen remarkable growth, allowing real-time consumer engagement, product demonstrations, and exclusive promotions. This interactive approach to product marketing creates immediate purchase opportunities while building brand relationships.

User-generated content and reviews significantly impact product credibility and purchase decisions. Consumers increasingly rely on peer recommendations and authentic usage experiences rather than brand-generated content. Companies must actively manage their online reputation while encouraging satisfied customers to share their experiences.

Influencer partnerships and KOL collaborations have proven particularly effective in the personal care segment. Online celebrity live streams and KOL recommendations drive consumer awareness and trial, creating scalable marketing approaches that can generate significant return on investment when properly executed.

Jarsking understands the fascination of e-commerce in China, we explored this topic in depth in the following blogs:

Unlocking the Power of Influencer Marketing for Your Business

Strategies, Challenges, and Emerging Trends for Foreign Brands in China’s Influencer Marketing

Price Sensitivity and Value Perception

Consumer sophistication regarding value assessment has increased significantly, with buyers evaluating ingredient quality, packaging sustainability, brand reputation, and effectiveness claims when making purchase decisions. Market analysis reveals certain consumer groups’ willingness to invest in premium products that offer superior quality and specific benefits.

Economic factors and market segmentation create opportunities across different price tiers. COVID-19 pandemic impacts have made some consumers more price-sensitive, opting for economical personal care products to manage budgets effectively. However, other segments continue pursuing premium products, creating market polarization between value and luxury segments.

Brand loyalty factors influence long-term consumer relationships and repeat purchase behavior. Consumers tend to be more loyal to brands they are familiar with and trust, making brand building and reputation management critical for sustained success. Companies achieving strong brand recognition can command premium pricing and weather competitive pressures more effectively.

Product Development and Formulation Strategies

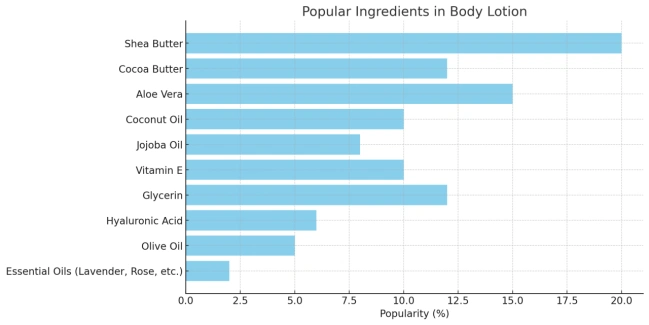

Key Ingredient Trends and Innovation

Advanced peptide compositions represent the forefront of body lotion formulation innovation. The emergence of PDRN (Polydeoxyribonucleotide), derived from salmon DNA, demonstrates the commercial viability of sophisticated ingredient systems. According to industry experts, PDRN is gaining attention for its powerful ability to repair, hydrate, and revitalize the skin, with dermatologists praising its collagen-boosting, elasticity-enhancing, and skin-repairing properties. These advanced peptides deliver multiple skincare benefits in single formulations, enabling brands to justify premium positioning.

Breakthrough delivery technology enhances ingredient effectiveness and consumer experience. United Guardian Inc.’s Lubrajel line exemplifies innovative delivery systems, featuring multifunctional hydrogel formulations designed to provide sensory enhancement, lubrication, and texture to personal care products. Their Lubrajel products offer skin hydration benefits while being primarily used in moisturizers, anti-aging creams, and body lotions. Additionally, Quoin Pharmaceuticals’ Invisicare® polymer delivery technology provides an optimized topical delivery system that moisturizes skin while simultaneously providing protective barriers against allergens, toxins, and environmental agents.

Botanical extracts and plant-based formulations continue gaining consumer acceptance and market share. Trilogy Laboratories identifies plant-based oils as booming in 2025, with camellia, baobab, and sea buckthorn loaded with essential fatty acids, vitamins, and antioxidants that help soothe irritation, lock in moisture, and keep skin glowing. Shea butter emerges as especially trending, driven by the growing influence of West African body care, characterized by moisturizing, anti-inflammatory, and antioxidant properties. These natural ingredients can be enhanced through modern extraction and processing techniques to concentrate beneficial compounds.

Hyaluronic acid, niacinamide, and vitamin C integration has become standard in premium body lotion formulations. Trilogy Laboratories’ Vitamin C Antioxidant Emulsion demonstrates this trend, ensuring skin receives anti-aging, rejuvenating, and brightening benefits while including ceramides to restore skin barrier function. Their Luminessence Serum contains niacinamide to help repair damage, increase moisture levels, and ward off hyperpigmentation. These ingredients address hydration, skin brightening, and antioxidant protection respectively, enabling single products to deliver multiple benefits.

Formulation Considerations by Skin Type

Dry skin formulations require rich, nourishing textures with ingredients that repair skin barrier function and provide long-lasting hydration. North American market research indicates excessive sun exposure and harsh soap usage accelerate demand for intensive-care body lotions for dry skin. United Guardian’s natural Lubrajel line, certified to meet COSMOS standards, offers multifunctional, RSPO certified, vegan, biodegradable formulations that provide deep moisturization while meeting sustainability requirements. These formulations typically feature ceramides, fatty acids, and occlusive agents that prevent moisture loss.

Oily and acne-prone skin solutions demand lightweight, fast-absorbing formulas that provide hydration without exacerbating sebum production. Trending ingredients for 2025 include bisabolol, known as “the calming hero” for its ability to soothe irritation while providing lightweight hydration. Additionally, bakuchiol emerges as a gentle alternative to retinol, offering smoother skin, fewer wrinkles, and even tone without irritation, making it perfect for sensitive and oily skin types. These formulations often incorporate salicylic acid, niacinamide, and zinc compounds to manage oil production.

Sensitive skin products require gentle, hypoallergenic formulations with minimal potential irritants. United Guardian’s preservative-free product line, including Lubrajel DV PF, Lubrajel IIXD PF, and Lubrajel MS PF, addresses customer demand for preservative-free products while maintaining efficacy. The company’s natural product line uses green technology and contains natural raw materials, meeting COSMOS certification standards for sensitive skin applications. Propolis, identified as a “golden glow booster,” provides natural antimicrobial properties while being gentle enough for sensitive formulations.

Anti-aging formulations represent a premium market segment demanding sophisticated ingredient combinations. Coenzyme Q10 (CoQ10) emerges as a powerhouse antioxidant that helps combat oxidative stress while energizing skin cells. Bio-fermentation technology creates supercharged plant benefits through fermenting ingredients like rice, kombucha, or algae, unlocking nutrients that are more bioavailable for enhanced anti-aging effects. These products command higher prices due to advanced ingredient costs and research requirements but offer improved profit margins for successful formulations.

Texture and Sensory Experience

Consumer preferences for application feel significantly impact product acceptance and repeat purchase behavior. 2025 trends emphasize multi-tasking body care products that go beyond basic moisturization, with body butters infused with SPF, exfoliating body washes packed with niacinamide, and shimmering body oils that double as skincare treatments. North American market research specifically mentions non-greasy body lotions addressing problems like dry skin, stretch marks, and eczema gaining rapid popularity, especially in whipped textures.

Seasonal formulation adaptations enable companies to optimize products for different environmental conditions and consumer needs. Winter formulations typically feature richer textures and more occlusive ingredients, while summer products emphasize fast absorption and lighter feel. Marine algae and blue biotechnology ingredients like Spirulina, Chlorella, and Sea Kelp provide hydration, repair, and protection while offering sustainably harvested, eco-friendly alternatives for seasonal adaptation.

Cultural preferences in texture vary significantly across different markets, requiring localized product development. Asian consumers often prefer lighter, more quickly absorbing formulations, while European and American markets show greater acceptance of richer textures. United Guardian’s global distribution through five distributors demonstrates how companies can adapt formulations for different cultural preferences while maintaining core technology platforms.

Innovation in delivery systems creates differentiated sensory experiences that justify premium positioning. Exosomes represent one of the most futuristic skincare ingredients trending in 2025, described as tiny extracellular vesicles responsible for cell communication and regeneration. These advanced delivery systems provide unique application experiences through encapsulated actives, time-release moisturizing systems, and temperature-activated ingredients that enhance consumer perception of product sophistication and efficacy.

Packaging Innovation and Brand Positioning

Packaging Trends and Consumer Preferences

Sustainable packaging solutions have evolved from optional differentiators to essential market requirements. Consumer research consistently demonstrates growing environmental consciousness influencing purchase decisions, particularly among younger demographics who prioritize sustainability alongside product performance. This trend creates opportunities for companies investing in eco-friendly packaging materials, refillable systems, and minimalist design approaches that reduce environmental impact while appealing to conscious consumers.

Innovative dispensing systems significantly impact user experience and product differentiation. Pump dispensers, airless systems, and precision applicators enhance convenience while protecting product integrity. These systems, while increasing packaging costs, often justify premium pricing through improved functionality and perceived value. Companies must balance packaging investment with consumer willingness to pay for enhanced delivery systems.

Premium packaging for luxury positioning enables brands to command higher prices while creating emotional connections with consumers. Glass containers, sophisticated closure systems, and premium labeling materials communicate quality and exclusivity. La Mer’s luxury skincare packaging design demonstrates this approach perfectly, with their classic moisturizing cream arriving in soft green luxury box packaging, often finished with pearlized coatings and delicate gold foil. These subtle visual cues immediately suggest that what’s inside is something rare and refined, with pricing that can command premium market positioning due to packaging that communicates purity, serenity, and exclusivity.

Estée Lauder Companies’ portfolio strategy exemplifies sophisticated luxury packaging across multiple price tiers. Their luxury brands including La Mer, Jo Malone London, TOM FORD, and AERIN Beauty utilize distinctive packaging that enhances brand image and differentiates from other market players. TOM FORD’s beauty products feature sleek, bold packaging with rich colors like deep plum and oxblood, paired with gold accents and glossy finishes, while Jo Malone’s instantly recognizable cream and black color palette uses rigid boxes tied with grosgrain ribbon, creating timeless luxury package design.

Digital-first packaging considerations have become essential for e-commerce success. Packages must survive shipping stress, photograph well for online listings, and create unboxing experiences that encourage social media sharing. This requirement often conflicts with sustainability goals, requiring creative solutions that balance environmental responsibility with digital marketing effectiveness. Tokyo Lifestyle Co.’s approach to Japanese beauty products demonstrates this balance, with their approximately 64,800 SKUs of beauty products requiring packaging that performs across physical stores, online platforms, and wholesale distribution channels.

Visual Identity and Marketing Materials

Packaging design communication must effectively convey product benefits, ingredient quality, and brand personality within seconds of consumer viewing. Color psychology, typography selection, and imagery choices significantly impact purchase decisions, particularly in retail environments where consumers make rapid comparisons between alternatives. Successful packages clearly communicate target skin type, key benefits, and usage instructions while maintaining brand consistency.

Ingredient transparency and clean labeling have become competitive necessities rather than optional features. Consumers increasingly demand complete ingredient lists, source information, and explanation of ingredient benefits. This transparency requirement creates opportunities for companies with high-quality formulations while challenging those relying on proprietary blends or inferior ingredients.

Cultural adaptation for international markets requires sophisticated understanding of local preferences, regulations, and aesthetic sensibilities. Color associations, imagery preferences, and text requirements vary significantly across different cultures, requiring localized packaging approaches for international success. Companies must balance global brand consistency with local market relevance.

For more in-depth discussion about packaging and culture, check out Jarsking’s blog in design section:

How Culture Influences Packaging Aesthetics: A Global Design Imperative I

How Culture Influences Packaging Aesthetics: A Global Design Imperative II

Digital asset optimization ensures packaging translates effectively across online channels where consumers increasingly discover and purchase products. High-resolution imagery, clear text readability, and compelling visual hierarchy become essential for e-commerce success. Packages must photograph well for social media sharing and create Instagram-worthy unboxing experiences that generate organic marketing content.