In our blog Body Lotion for Personal Care Businesses: Market Insights, Consumer Trends, and Strategic Opportunities, we highlighted the rapid growth of the global body lotion market, driven by increasing skincare awareness, innovative formulations, and shifting consumer preferences. Building on those insights, this report explores market projections, emerging trends, and packaging strategies. In today’s discussion, we take a closer look at distribution strategies, marketing approaches, and growth opportunities for personal care businesses competing in the global beauty industry.

Distribution and Sales Channel Strategy

Multi-Channel Distribution Approach

Omnichannel distribution strategies have become essential for maximizing market reach and accommodating diverse consumer shopping preferences. Research indicates that supermarkets and hypermarkets serve as primary channels for body lotion distribution, providing broad consumer access and impulse purchase opportunities. However, successful companies complement traditional retail with specialty stores, pharmacies, and online platforms to capture consumers across different shopping occasions and price sensitivities.

Specialty stores and pharmacy positioning offers opportunities for premium pricing and expert consultation. These channels enable product education, personalized recommendations, and professional endorsement that justify higher prices while building consumer confidence. Empro Group Inc.’s strategic approach demonstrates how specialized retail environments can enhance brand value through key partnerships with prominent players in the personal care industry, such as Watsons, Sasa and Guardian, strategically covering the entirety of Malaysia as well as other markets within the ASEAN region.

These collaborations represent their three main key accounts within the beauty category, enabling the company to leverage professional retail environments that provide expert consultation and product education. The company’s establishment of specialized retail outlets dedicated to their beauty products, strategically positioned at fashionable Mid Valley Mall in the heart of Kuala Lumpur, further illustrates how premium retail positioning can create brand authority and justify higher pricing through enhanced customer experience and professional retail environments.

E-commerce platform optimization has transitioned from optional to mandatory for market success. Online channels provide convenience, extensive product choices, competitive pricing, and economically viable delivery options, making digital presence essential for consumer access. The Chinese market demonstrates this trend clearly, with online personal care sales growing at a CAGR of 16.7% from 2017 to 2022.

Direct-to-consumer strategies and subscription models enable companies to build direct customer relationships while improving profit margins by eliminating retail markup. Subscription services for body lotion replenishment create predictable revenue streams while increasing customer lifetime value through convenience and automatic reordering.

Retail Partnership Development

Building relationships with key retail buyers requires understanding retailer priorities, consumer demographics, and competitive dynamics within each channel. Successful companies develop category management expertise, promotional support capabilities, and supply chain reliability that make them valuable retail partners. Softto’s distribution through more than 1,000 cosmetics counters in various stores including RT-Mart, CR Vanguard, Yonghui, Carrefour, and others demonstrates the scale achievable through effective retail partnerships.

Negotiating shelf space and promotional support demands sophisticated understanding of retail economics and consumer behavior. Companies must demonstrate product velocity, profit margins, and marketing support that justify prime shelf placement and promotional investment. In-store marketing materials, point-of-sale displays, and staff training programs enhance retail partner value while improving consumer engagement.

Performance metrics and retail analytics enable data-driven optimization of retail relationships and space allocation. Sales velocity, inventory turnover, profit per square foot, and consumer demographics provide insights for improving retail performance and justifying continued partnership. Companies investing in retail analytics capabilities can optimize their channel strategies while providing valuable insights to retail partners.

Supply chain logistics and inventory management must balance product availability with inventory investment while accommodating retailer requirements for delivery schedules, packaging specifications, and administrative processes. Efficient logistics systems reduce costs while improving customer service, creating competitive advantages in retail partnerships.

E-commerce Optimization

Platform-specific strategies demand distinct approaches for maximum effectiveness. Amazon requires Sponsored Brands campaigns showcasing multiple products in single ads, A+ Content with rich media and lifestyle imagery, and DSP retargeting to re-engage customers who viewed products but didn’t purchase. Beauty brands specifically benefit from video placements and interactive product ads that capture attention, while Amazon Posts using lifestyle imagery and ingredient deep dives drive organic engagement directly within Amazon’s shopping experience.

Search optimization centers on Amazon’s AI-powered algorithms that prioritize relevance, engagement, and purchase intent. Successful beauty brands leverage Amazon Marketing Cloud (AMC) to analyze shopper behavior and create hyper-personalized ad campaigns, while optimizing listings with natural language for voice search queries like “best natural skincare for sensitive skin”. Backend keyword optimization and Amazon Brand Analytics tracking provide measurable performance insights for continuous refinement.

Customer acquisition tactics focus on conversion rate optimization through enhanced content strategies. Beauty brands achieve success through A+ Content highlighting ingredient transparency, clinical credentials, and certifications (vegan, organic, cruelty-free), combined with high-quality visuals that clearly explain product benefits and usage instructions. Prime eligibility significantly boosts trust and appeal, while competitive pricing strategies balance profitability with market positioning.

Reviews management directly impacts purchase decisions, with beauty products particularly dependent on social proof and authentic testimonials. Companies implement systematic review encouragement programs, professional response protocols for negative feedback, and influencer partnerships through Amazon’s Influencer Program. Amazon Posts and Brand Storefronts create additional touchpoints for building brand awareness and showcasing product portfolios, while loyalty programs integrated with Amazon’s ecosystem increase customer lifetime value through repeat purchase incentives and exclusive access benefits.

International Market Entry

Market research and cultural adaptation strategies provide foundations for successful international expansion. Consumer preferences, competitive landscapes, regulatory requirements, and distribution channels vary significantly across different countries, requiring localized approaches to product positioning, pricing, and marketing. L’Oréal’s successful entry into the Indian market demonstrates this approach, launching affordable products tailored to local skin tones and hair types rather than simply transplanting Western formulations. Companies must invest in comprehensive market research beyond domestic sales regions to reveal cultural preferences, popular beauty trends, and customer behavior patterns.

Regulatory compliance in target markets demands understanding of ingredient restrictions, labeling requirements, testing standards, and import procedures specific to each country. EU cosmetics market entry requires navigating 25 different regulatory frameworks, with manufacturers needing to ensure compliance from the start through finding the right local partners and focusing on high-quality production practices. Companies must budget for regulatory consulting, product testing, and compliance monitoring when expanding internationally, as regulatory hurdles can significantly delay market entry processes.

Distribution partner selection and management requires identifying local partners with appropriate market coverage, brand alignment, and operational capabilities. Beauty Health Company’s strategic decision to transition China market sales to a distributor partner illustrates this approach, discontinuing direct sales presence to align go-to-market strategy with in-market partner capabilities and market opportunity. This change was expected to be accretive to long-term profitability through operating spend reductions while leveraging local expertise.

Localization of marketing and product positioning adapts global brand strategies to local market conditions while maintaining core brand identity. Strategic partnerships with local influencers, region-specific promotional strategies, and cultural sensitivity in content creation enhance market acceptance while avoiding cultural missteps that could damage brand reputation. Language translation, local celebrity partnerships, and platform-specific digital strategies ensure authentic market connection rather than superficial adaptation.

Marketing and Consumer Education

Content Marketing and Education

Educational content strategy has evolved from brand nicety to competitive necessity, as consumers increasingly seek information about ingredients, application techniques, and skin health before making purchase decisions. Creating valuable content for consumer education builds brand authority while guiding consumers toward informed product selection. This approach particularly benefits companies with sophisticated formulations or specialized ingredients that require explanation to justify premium pricing.

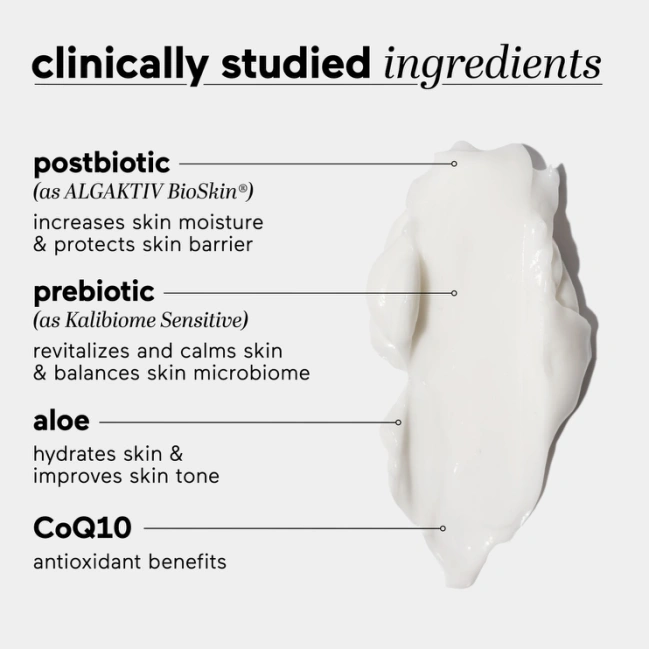

Ingredient education and benefits communication addresses consumer sophistication regarding skincare ingredients while building trust in product claims. XJ Beauty Limited’s focus on advanced peptide technology requires extensive consumer education campaigns to communicate complex benefits and justify premium positioning. The company invests in informative campaigns, helping customers differentiate between marketing hype and scientifically validated claims, while their website features detailed ingredient glossaries, usage guides, and access to third-party clinical data, empowering users to make informed decisions about their skincare routines.

Peptide Technologies Inc. demonstrates this challenge through their proprietary peptide/collagen blend formulations, requiring comprehensive consumer education about how peptides can help manage wrinkles and reverse signs of aging through collagen synthesis stimulation. Companies must balance technical accuracy with accessibility, ensuring content educates without overwhelming consumers with excessive complexity, as consumer education becomes more important than ever with the surge in peptide-based products.

Skincare routine integration and usage guidance positions body lotion within comprehensive self-care practices rather than as standalone products. Step-by-step application guides, routine timing recommendations, and product layering instructions help consumers maximize product benefits while increasing usage frequency and loyalty. This educational approach can increase per-customer revenue while improving satisfaction through better results.

Building brand authority through expert content leverages dermatologist partnerships, research citations, and clinical evidence to establish credibility in competitive markets. Expert endorsements, peer-reviewed research summaries, and ingredient science explanations differentiate brands based on knowledge and expertise rather than marketing claims alone.

Digital Marketing Strategies

Social media platform optimization requires understanding unique characteristics, demographics, and content preferences of each platform while maintaining consistent brand messaging. Instagram’s visual focus, TikTok’s video preference, and Facebook’s community features demand different content approaches and engagement strategies. In Chinese market, analysis reveals social media platforms such as WeChat, Weibo, and Douyin becoming influential through influencer collaborations.

Influencer partnerships and collaborations provide authentic product endorsements and expanded audience reach when properly executed. Live commerce platforms such as Taobao Live and Douyin enable real-time consumer engagement, product demonstrations, and exclusive promotions. These partnerships must balance authenticity with brand control to maintain credibility while achieving marketing objectives.

Video content and product demonstrations address consumer desires to see products in use before purchasing, particularly important for texture-sensitive products like body lotions. Application tutorials, before/after comparisons, and ingredient explanations provide valuable content while showcasing product benefits. Live streaming and real-time interaction create immediate engagement opportunities and purchase conversion.

User-generated content and community building leverage satisfied customers as brand advocates while reducing marketing costs. Review incentives, social media contests, and hashtag campaigns encourage customers to share experiences while creating authentic marketing content. Companies must actively moderate and engage with user-generated content to maintain brand image and customer relationships.

Customer Acquisition and Retention

Loyalty programs and repeat purchase incentives address the challenge of building long-term customer relationships in competitive markets. Points-based systems, exclusive access programs, and subscription discounts can increase customer lifetime value while reducing acquisition costs. However, programs must provide genuine value while remaining economically viable for the business.

Sampling and trial strategies address consumer hesitancy to purchase unfamiliar products, particularly important for premium-priced items. Free samples, trial sizes, and money-back guarantees reduce purchase risk while enabling product trial. Yatsen Holding Ltd’s extensive experience store network demonstrates how sampling can be integrated into retail strategies. The company operates 88 stores as of December 31, 2024, with their offline experience store network providing customers with seamless omni-channel shopping experiences that complete their journey of beauty discovery.

These experience stores are empowered by data and technology capabilities, enabling customers to trial products from their diverse portfolio including Perfect Diary, Eve Lom, Galénic, and DR.WU brands before making purchase decisions. This comprehensive sampling approach addresses the challenge of premium skincare products like Galénic’s N°1 Poudre Vitamine C Pure Eclaircissante serum with highly-concentrated 20% Vitamin C extract and DR.WU Intensive Renewal Serum with Mandelic Acid, allowing consumers to experience product efficacy and texture before committing to full-size purchases.

Customer feedback integration and product improvement creates value for customers while generating insights for product development. Review analysis, survey programs, and direct customer communication provide valuable market research while demonstrating company responsiveness to customer needs. This feedback loop can guide formulation improvements, packaging changes, and new product development.

Lifetime value optimization strategies focus on maximizing revenue per customer rather than simply acquiring new customers. Cross-selling complementary products, upselling premium alternatives, and encouraging increased usage frequency can significantly impact profitability while providing additional value to customers.

Traditional Marketing Integration

In-store marketing and point-of-sale materials remain important for impulse purchases and brand visibility in retail environments. Eye-catching displays, informational brochures, and product samples can influence purchase decisions at critical moments. Staff training programs and retail education ensure consistent brand representation and product knowledge across distribution partners.

Trade show participation and industry networking provide opportunities for business-to-business relationship building, product launches, and industry trend identification. These events enable face-to-face relationship building with distributors, retailers, and industry professionals while showcasing products to targeted audiences.

Public relations and media outreach generate third-party credibility and brand awareness through product reviews, expert interviews, and industry recognition. Beauty magazine features, dermatologist endorsements, and award programs provide external validation that supplements paid advertising efforts.

Collaboration with skincare professionals and dermatologists creates professional endorsement and educational content while building credibility for specific product claims. Professional training programs, sample distribution, and collaborative content creation can generate valuable endorsements while providing educational resources for healthcare providers.

Financial Considerations and Business Planning

Investment Requirements and ROI Analysis

Initial capital requirements for body lotion market entry vary significantly based on business model, target market, and scale of operations. Product development costs, regulatory compliance, manufacturing setup, and marketing investment represent major expense categories requiring careful budgeting and cash flow planning. Functional Brands Inc.’s approach demonstrates how companies can reduce initial capital requirements while maintaining quality control. The company manufactures nutraceutical products including topical creams and lotions through their cGMP certified and FDA registered facility, while utilizing existing product formulations with plans to introduce 12 different products under their Golf Mellow brand. Their creams are specially designed to provide targeted relief for sore muscles and joints, including Epsom Salt Cream for recovery applications.

Functional Brands’ manufacturing strategy illustrates cost-effective capital allocation, as they source all materials from high quality suppliers and test finished goods in certified laboratories with state-of-the-art equipment while manufacturing in US-based facilities. The company’s financial data reveals net revenue of $6.57 million in 2024 with cost of goods sold at $2.96 million, demonstrating how outsourced manufacturing partnerships can maintain quality standards while reducing initial capital requirements for facility investment and equipment purchase. This approach allows companies to focus capital on product development, regulatory compliance, and marketing rather than substantial manufacturing infrastructure investments.

Manufacturing setup costs and scalability considerations depend heavily on the chosen production model. Contract manufacturing reduces initial investment but may limit control and profit margins, while private manufacturing facilities require substantial capital but offer greater control and long-term cost advantages. Companies must evaluate minimum order quantities, quality control requirements, and scalability needs when selecting manufacturing approaches.

Marketing budget allocation and expected returns require sophisticated understanding of customer acquisition costs, lifetime value, and channel effectiveness. Digital marketing typically offers better measurability and targeting than traditional advertising, but retail relationships and in-store presence remain important for brand building and impulse purchases. Chinese market data showing 68% year-on-year growth for collagen body lotion searches indicates strong organic demand that can amplify marketing investments.

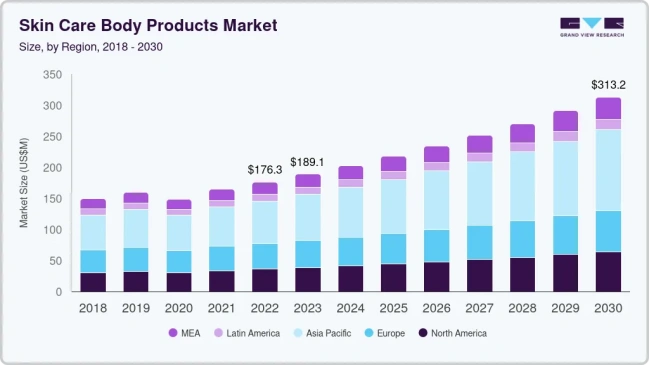

Break-even analysis and profitability projections must account for product development costs, regulatory expenses, marketing investments, and working capital requirements while projecting realistic sales volumes and pricing. North American market growth projections of 3.10% CAGR through 2034 provide baseline assumptions for revenue modeling, though individual companies may achieve significantly different results based on positioning and execution.

Risk Assessment and Mitigation

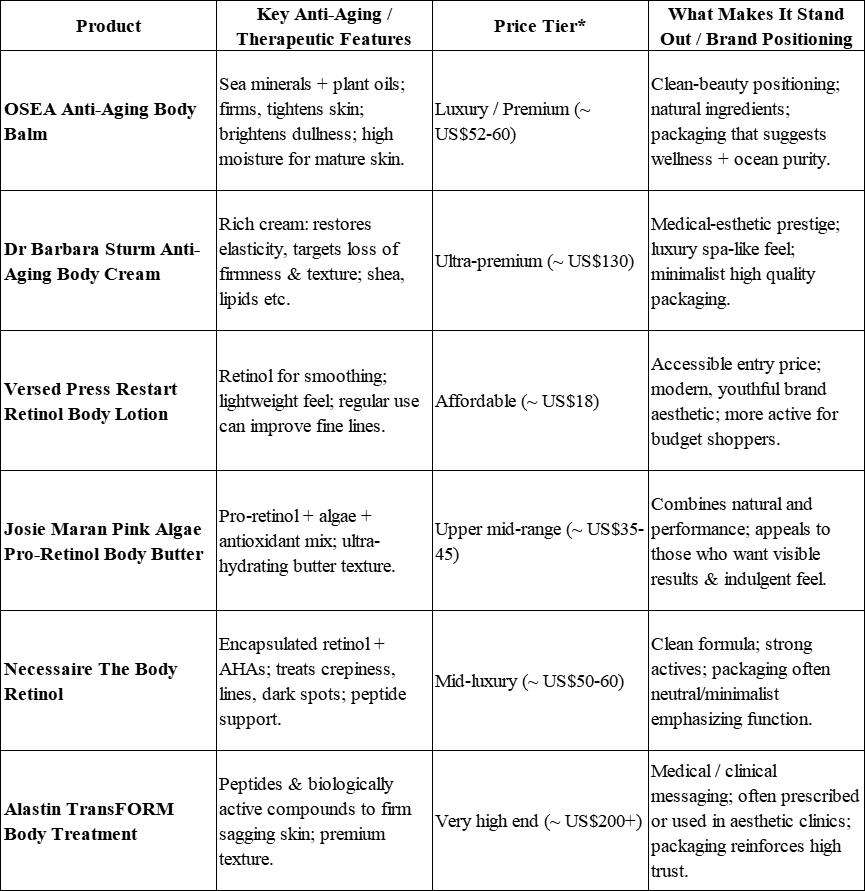

Market competition and differentiation challenges represent ongoing threats requiring continuous innovation and brand building. Intense competition in skincare industries demands sustained investment in product development, marketing, and customer relationship building to maintain market position. Companies must develop defensible competitive advantages through proprietary ingredients, brand loyalty, or distribution relationships.

Supply chain disruptions and ingredient availability can significantly impact production continuity and cost structures. COVID-19 impacts on global supply chains demonstrated the importance of supplier diversification, inventory management, and supply chain flexibility. Companies should develop multiple supplier relationships and contingency plans for critical ingredients and packaging materials.

Regulatory changes and compliance costs create ongoing operational requirements and potential market barriers. Chinese government enforcement of more stringent regulations illustrates how regulatory evolution can impact market entry and operational costs. Companies must budget for ongoing compliance monitoring, regulatory consulting, and potential reformulation costs.

Consumer trend shifts and market volatility demand agility in product development and positioning. Search interest for body skincare increased 1,025% since December 2023, while collagen body lotion searches grew 68% year-on-year, demonstrating rapid preference changes driven by social media influence. Companies require flexible development approaches, trend monitoring systems, and inventory management strategies to avoid obsolescence and positioning misalignment.

Future Outlook and Emerging Opportunities

Technology Integration and Innovation

Artificial intelligence and personalized recommendations represent the next frontier in consumer engagement and product development. AI-driven skin analysis, customized formulation recommendations, and predictive replenishment systems will enable unprecedented personalization while improving customer satisfaction and lifetime value. Early adopters of these technologies will likely achieve significant competitive advantages through enhanced customer experience and operational efficiency.

Smart packaging and IoT integration offer opportunities to track product usage, monitor skin condition changes, and provide real-time application guidance through connected devices and mobile applications. While currently expensive, these technologies will become more accessible as costs decrease and consumer adoption increases. Connected packaging can provide valuable usage data while creating ongoing customer engagement opportunities.

Biotechnology and sustainable ingredient innovation address consumer demands for environmental responsibility while maintaining product effectiveness. Lab-grown ingredients, fermentation-based production, and biodegradable formulations represent emerging technologies that could transform manufacturing while appealing to environmentally conscious consumers.

Virtual try-on and augmented reality applications enable consumers to visualize product benefits and application techniques before purchase, potentially reducing return rates while improving online conversion. These technologies particularly benefit texture-sensitive products like body lotions where consumer hesitation about feel and absorption can impact purchase decisions.

Market Evolution Predictions

Demographic shifts toward aging populations in developed markets will fundamentally transform product demand patterns and market opportunities. The global skincare market, valued at $192.8 billion in 2025 and projected to reach $432.1 billion by 2035, reflects this demographic transition driving premium product adoption. Aging consumers increasingly prioritize therapeutic formulations with clinically validated ingredients, creating opportunities for companies developing advanced peptide systems, biotech-derived actives, and medical-grade formulations.

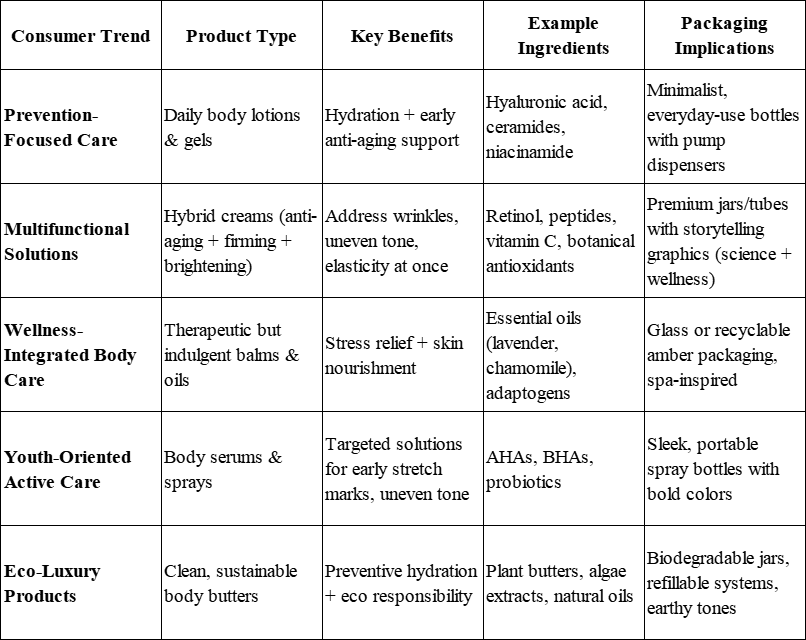

Simultaneously, younger consumers prioritizing prevention over treatment are driving multifunctional product development that addresses multiple skin concerns simultaneously. This generational divide creates distinct market segments requiring age-specific marketing strategies and product positioning approaches.

Climate change impacts on formulation requirements represent an emerging market transformation that forward-thinking companies can leverage for competitive advantage. BASF’s research demonstrates rising temperatures and poor air quality driving consumer demand for adaptive skincare products, leading to climate-adaptive beauty routines based on four key themes: Hydrating & Cooling, Cleansing & Protection, UV Protection, and Optimistic Glow. Industry experts predict formulations that dynamically adjust protective barriers based on humidity, pollution, and UV exposure, with self-optimizing skincare that evolves on the skin—creams that thicken in cold temperatures then transform into breathable veils in heat. Companies like Polarwise are redefining cooling and dryness with formulas combining aluminum salt and alcohol for up to seven days of sweat protection, while expanding into body creams infused with advanced formulas and ingestible supplements featuring sage leaf extract.

Economic volatility and consumer budget pressures are accelerating market polarization between premium and value segments, requiring sophisticated portfolio strategies. The concept of “360 beauty” emerging—acknowledging the inextricable link between environmental and skin health—enables premium positioning through sustainability integration and therapeutic benefits. However, economic pressures also drive value-seeking behavior, creating opportunities for multi-tier product portfolios that serve different price sensitivities. Successful companies will address this polarization through flexible positioning strategies, offering basic efficacy at accessible price points while developing premium formulations with advanced delivery systems, clinical validation, and sustainability credentials for consumers willing to invest in scientifically validated, environmentally responsible products.

Conclusion and Action Steps

The body lotion market presents exceptional growth opportunities for personal care businesses willing to invest in understanding consumer needs, developing differentiated products, and executing comprehensive market strategies. With global market projections reaching $86.27 billion by 2034 and sustained growth across major markets, the sector offers attractive returns for companies with appropriate positioning and execution capabilities.

Key success factors identified through this analysis include consumer-centric product development, multi-channel distribution excellence, digital marketing sophistication, and operational scalability. Companies achieving success in this market demonstrate deep understanding of consumer needs, commitment to product quality, and agility in responding to market changes. Critical strategic priorities for personal care businesses include investing in formulation capabilities, building direct consumer relationships, developing omnichannel distribution, and creating sustainable competitive advantages through proprietary technologies or strong brand positioning. The rapid growth in consumer sophistication and digital engagement requires companies to excel in both product development and customer experience delivery.

The convergence of consumer sophistication, digital transformation, and sustainability consciousness creates both opportunities and requirements for success in the modern body lotion market. Companies that embrace these trends while maintaining focus on product quality, customer value, and operational excellence are positioned to achieve sustained success and significant returns on investment in this dynamic and growing market segment.

Future success will favor companies that combine deep consumer insights, innovative formulation capabilities, sophisticated marketing execution, and operational scalability to create compelling value propositions for increasingly demanding consumers. The body lotion market offers exceptional opportunities for businesses prepared to invest in understanding and serving evolving consumer needs through superior products and experiences.

FAQs

Rising consumer demand for skincare, ingredient transparency, sustainability, and digital shopping convenience are the key drivers of the body lotion market’s growth worldwide.

The global body lotion market is projected to reach $86.27 billion by 2034, with strong growth across North America, Asia-Pacific, and Europe.

Supermarkets and hypermarkets remain dominant, but specialty stores, pharmacies, and e-commerce platforms are crucial for reaching different consumer segments.

E-commerce offers convenience, wide product choices, competitive pricing, and targeted marketing tools, making it a mandatory channel for modern beauty consumers.

Brands can leverage subscription models, loyalty programs, sampling strategies, and personalized skincare education to drive repeat purchases and long-term customer value.

Eco-friendly packaging, cruelty-free certifications, and sustainable sourcing build trust and align with consumer expectations, supporting premium positioning in the market.

Global expansion requires localized product formulations, cultural adaptation in marketing, and strict compliance with regional regulations such as EU cosmetic laws.

360 beauty takes a holistic view of wellness, integrating skincare, nutrition, lifestyle, and sustainability. Body lotion fits into this approach as part of complete self-care.