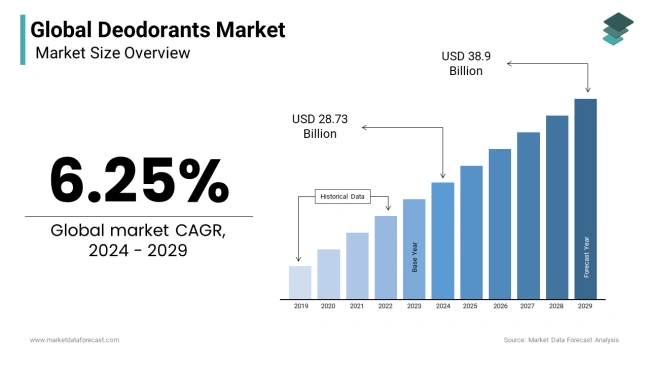

The global personal care landscape is witnessing an unprecedented transformation, with the deodorant industry at the forefront of innovation and growth. As temperatures rise worldwide and fitness culture continues to expand, consumer demand for effective, sustainable, and technologically advanced deodorant solutions has reached new heights. The global deodorant market, projected to grow from $28.41 billion in 2025 to $42.19 billion by 2032, represents far more than just basic hygiene—it embodies a convergence of sustainability consciousness, technological advancement, and evolving consumer expectations that’s reshaping the entire personal care sector.

This comprehensive analysis explores the multifaceted evolution of deodorant products, groundbreaking packaging innovations, and dynamic market forces that are driving this remarkable growth trajectory. From whole-body formulations to smart packaging solutions, from aluminum-free alternatives to refillable systems, the deodorant industry is experiencing its most significant transformation since the introduction of aerosol technology decades ago.

The Evolution of Deodorant Products: Beyond Traditional Boundaries

Product Categories and Types

The traditional deodorant landscape, once dominated by simple stick and spray formats, has expanded into a sophisticated ecosystem of specialized products designed to meet increasingly diverse consumer needs. Today’s market encompasses five distinct categories, each engineered with specific application methods and formulation technologies.

Spray deodorants continue to lead the market through their unmatched convenience and rapid application capabilities. The modern spray category has evolved significantly since environmental concerns about aerosols emerged in the 1990s. Contemporary formulations utilize eco-friendly propellants and concentrated active ingredients that deliver superior coverage with reduced environmental impact. The distinction between traditional aerosol sprays and pump-action alternatives has become crucial for environmentally conscious consumers, with pump sprays gaining traction due to their elimination of pressurized gases and reduced carbon footprint.

Roll-on deodorants have experienced a renaissance through advanced liquid formulation technologies that address historical concerns about white residue and staining. Water-based formulas now incorporate micro-encapsulated fragrances and aluminum salts that provide extended protection without the chalky appearance that plagued earlier generations. The portable nature and precise application control of roll-on systems make them particularly popular among travelers and consumers seeking targeted protection.

The solid/stick deodorant category, representing the most traditional format, has undergone significant modernization. The market for solid deodorants is projected to grow from $4.3 billion in 2025 to $5.2 billion by 2035, driven by innovations in invisible solid formulations that eliminate visible residue while maintaining the familiar twist-up application method that consumers trust. These products have evolved from simple wax-based compositions to sophisticated solid matrices incorporating advanced odor-neutralizing compounds and skin-conditioning agents.

Gel deodorants occupy a unique position in the market, offering the clarity of liquid formulations with the controlled application of solids. Their thick consistency provides strong staying power and creates a barrier against moisture that appeals to consumers with active lifestyles. The gel format has proven particularly successful in men’s grooming segments, where the substantial feel and long-lasting protection align with masculine product preferences.

Cream deodorants, while representing the smallest market segment, cater to consumers seeking the most intensive protection available. These formulations typically incorporate the highest concentrations of active ingredients and require specialized application methods, often involving fingertip application for precise coverage.

Formulation Innovations: The Natural Revolution

The formulation landscape has been revolutionized by consumer demand for natural and organic alternatives to traditional synthetic ingredients. The natural and organic deodorant market, reaching $160.9 million in 2025 with a projected CAGR of 14.8%, represents one of the fastest-growing segments in personal care.

This growth reflects a fundamental shift in consumer consciousness regarding ingredient transparency and long-term health implications. Aluminum-free formulations have emerged from niche health food stores to mainstream retail, driven by consumer concerns about potential links between aluminum compounds and health issues. While scientific consensus remains inconclusive regarding these concerns, consumer perception has created massive demand for aluminum-free alternatives that deliver comparable efficacy through alternative active ingredients like baking soda, arrowroot powder, and naturally derived antimicrobial compounds.

The emergence of whole-body deodorants represents perhaps the most significant product innovation in recent years. Unilever’s strategic launch of Sure Whole Body Deodorant in January 2025 exemplifies this trend, targeting the reality that only 1% of body sweat originates from underarms. This insight has driven the development of specialized formulations using proprietary technologies like Odour Adapt Technology™, which adjusts to varying bacterial populations across different body areas. The innovation addresses the fact that 45% of men experience lower-body odor issues, representing a massive untapped market opportunity.

Probiotic and essential oil formulations represent the cutting edge of natural deodorant technology. These products introduce beneficial bacteria that compete with odor-causing microorganisms while incorporating antimicrobial essential oils like tea tree, eucalyptus, and lavender. The complexity of these formulations requires sophisticated stability testing and preservation strategies that challenge traditional manufacturing processes.

Crystal deodorants, utilizing potassium alum and ammonium alum, offer completely synthetic-free alternatives that work through mineral salt barriers rather than chemical intervention. While these products require consumer education regarding proper application techniques, they appeal to the most environmentally conscious segment of the market.

Specialized Products: Targeting Specific Consumer Needs

The specialization trend extends beyond basic odor protection to address specific consumer circumstances and preferences. Antiperspirant-deodorant combinations continue to dominate the mass market by offering dual functionality that addresses both odor and moisture concerns. These products require complex formulation chemistry to balance the astringent properties of aluminum salts with the conditioning agents necessary for comfortable daily use.

Sensitive skin formulations have evolved from simple fragrance-free products to sophisticated hypoallergenic systems that eliminate common irritants while maintaining efficacy. These products often incorporate skin-soothing ingredients like aloe vera, chamomile, and colloidal oatmeal, requiring careful formulation balance to avoid compromising active ingredient performance.

The rise of gender-neutral products reflects changing consumer demographics and preferences. Brands are moving away from heavily gendered marketing and formulations toward universal appeal, with sophisticated scent profiles that avoid traditionally masculine or feminine associations. This trend aligns with broader cultural shifts toward inclusive product development and marketing strategies.

Performance deodorants designed specifically for fitness and sports applications incorporate advanced sweat-resistant technologies and extended-wear formulations. These products often feature higher concentrations of active ingredients and specialized delivery systems that maintain effectiveness during high-intensity physical activity.

Packaging Innovation and Sustainability

Current Packaging Trends: Form Meets Function

The deodorant packaging landscape encompasses a diverse array of formats, each optimized for specific product formulations and consumer preferences. Traditional formats—aerosol cans, plastic tubes, and roll-on bottles—continue to dominate market share, but their designs have evolved significantly to address contemporary consumer demands for sustainability, convenience, and aesthetic appeal.

Aerosol cans remain the most technically complex packaging format, requiring pressurization systems that maintain product integrity while ensuring safety and consistent dispensing performance. Modern aerosol packaging incorporates advanced valve technologies that provide controlled spray patterns and minimize product waste. The challenge facing this category involves balancing the superior user experience of aerosol delivery with growing environmental concerns about propellants and aluminum can recycling.

Plastic tube packaging for stick deodorants has undergone substantial innovation in materials science. Contemporary tubes incorporate post-consumer recycled content while maintaining the structural integrity required for the mechanical stress of twist-up mechanisms. The integration of recyclability features, such as separable components and material identification codes, reflects growing regulatory pressure and consumer expectations for end-of-life product management.

Roll-on bottle packaging presents unique challenges in sealing technology and ball-applicator mechanisms. Modern designs incorporate anti-leak technologies and precision-engineered ball systems that provide consistent product flow while preventing contamination. The transparency of many roll-on packages allows consumers to monitor product levels, creating design opportunities for brands to communicate product benefits through visual cues.

Sustainable Packaging Revolution: Beyond Single-Use

The sustainability revolution in deodorant packaging represents a fundamental reimagining of the relationship between product and container. Eco-friendly materials have moved from experimental alternatives to mainstream options, with biodegradable plastics and post-consumer recycled content becoming standard features rather than premium upgrades.

The refillable deodorant market, growing from $206.79 million in 2025 to $305.60 million by 2032, represents the most significant packaging innovation in decades. This growth reflects a paradigm shift from disposable containers to durable applicator systems that dramatically reduce packaging waste over product lifecycles.

Wild, the UK-based refillable deodorant brand acquired by Unilever in 2025, exemplifies this transformation. Their system features sleek aluminum cases designed to last a lifetime, paired with bamboo pulp refills that save 30 grams of plastic per unit. The Wild case study demonstrates how sustainability can be packaged as premium lifestyle positioning, with their refillable system generating $33.6 million in annual revenue while building a loyal customer base attracted to both environmental benefits and design aesthetics.

Myro, another pioneering refillable brand, has demonstrated the scalability of sustainable packaging through their refill pod system that uses 50% less plastic than traditional deodorant packages. Since their 2018 launch, Myro has sold over 1 million units and collectively saved the equivalent of 30 metric tons of plastic waste—demonstrating that sustainable packaging innovations can achieve meaningful environmental impact at commercial scale.

Alternative materials continue to expand beyond traditional plastics and metals. Cardboard tubes, exemplified by brands moving toward push-up paperboard tubes made with recycled content, dramatically reduce plastic waste while maintaining functional performance. Glass containers, while heavier and more fragile, appeal to premium segments seeking zero-plastic alternatives. Biodegradable options utilizing plant-based polymers represent the frontier of sustainable packaging, though they currently face challenges in durability and cost-effectiveness.

Innovation in Application Methods: Technology Meets Usability

The integration of advanced technologies into deodorant packaging extends beyond materials to encompass application mechanisms and user interfaces. Airless pump technology preserves product integrity by preventing oxidation and contamination while ensuring consistent dispensing throughout the product’s lifecycle. This technology particularly benefits natural formulations that lack synthetic preservatives and may be susceptible to degradation when exposed to air and bacteria.

Smart packaging integration represents the next frontier in deodorant container innovation. IoT-enabled packaging systems can monitor environmental conditions such as humidity and gas levels, providing real-time data for supply chain optimization and product integrity verification. These systems incorporate micro-sensors, dose counters, RFID tags, or Bluetooth connectivity that enable precise product delivery and user feedback mechanisms.

The concept of connected packaging extends beyond simple monitoring to encompass interactive consumer experiences. Future applications may include personalized scent profiles based on user preferences, usage reminders through mobile app integration, and automatic reorder systems triggered by product depletion. These innovations transform deodorant containers from passive vessels to active participants in the consumer experience.

Multipurpose designs reflect the whole-body deodorant trend by incorporating application methods suitable for various body areas. These packages often feature multiple dispensing options or adjustable application surfaces that accommodate different anatomical requirements while maintaining single-product convenience.

Market Analysis and Industry Dynamics

Global Market Overview: Scale and Regional Dynamics

The deodorant industry’s impressive growth trajectory reflects fundamental shifts in global demographics, climate patterns, and consumer behavior. The global market size of $28.41 billion in 2025, growing at a 6.46% CAGR, represents more than statistical growth—it embodies changing lifestyles and increasing urbanization across developing economies.

Europe’s leadership with a 34.46% market share illustrates the maturity of personal care consciousness in developed markets, where consumers demonstrate willingness to pay premium prices for innovative formulations and sustainable packaging. The North American market’s $6.09 billion valuation in 2025 reflects both market size and the region’s role as an innovation laboratory for emerging trends that subsequently spread globally.

The Asia-Pacific region’s 4.11% CAGR through 2030 represents enormous growth potential driven by rapid urbanization, rising disposable incomes, and increasing awareness of personal hygiene standards. This growth is particularly significant in countries like India and China, where expanding middle classes are adopting Western personal care routines while maintaining preferences for locally relevant formulations and price points.

Consumer Behavior and Trends

Fogg Deodorant's Market Expansion in India

The clean beauty movement has fundamentally altered consumer purchasing decisions, moving beyond simple price and efficacy comparisons to encompass ingredient transparency, manufacturing ethics, and environmental impact. Fogg deodorant’s meteoric rise in the Indian market exemplifies how brands can harness the clean beauty movement’s core principles while simultaneously addressing fundamental consumer pain points through strategic product innovation and culturally resonant communication. Launched in 2011 by Vini Cosmetics under the leadership of Darshan Patel, Fogg identified a critical gap in the gas-dominated Indian deodorant market where established international brands like Axe, Nivea, and Wild Stone were delivering only 200-300 sprays per can due to their gas-based formulations.

Fogg’s revolutionary “No Gas, Only Perfume” proposition delivered 800+ sprays per bottle through liquid-based technology, directly addressing consumer concerns about value, longevity, and product integrity that align perfectly with clean beauty movement principles of transparency and authentic benefit delivery. The brand’s success trajectory was remarkable—growing from a 10% market share in 2015 to commanding over 20% by 2022, surpassing global competitors like Axe (reduced to 5-6% market share) and Nivea.

This achievement resulted from a sophisticated understanding of Indian consumer psychology, where Fogg positioned itself not through celebrity endorsements or sexualized advertising typical of competitors, but through family-friendly, humorous campaigns with memorable taglines like “Kya Chal Raha Hai? – Fogg Chal Raha Hai” and “Bina Gas Wala Body Spray” that created cultural phenomenon status while emphasizing product superiority.

Fogg’s competitive pricing strategy—offering premium liquid formulation technology at accessible middle-class price points—combined with extensive last-mile distribution ensuring availability from local kirana stores to major supermarkets, demonstrated how clean beauty principles of ingredient transparency and authentic value proposition could be scaled across diverse socioeconomic segments in emerging markets.

The brand’s annual sales exceeding ₹1000+ crore while maintaining its core message of “more sprays, longer lasting, no gas wastage” proves that consumers will embrace clean beauty alternatives when brands deliver tangible functional benefits supported by clear, culturally relevant communication that resonates with local values and purchasing behavior.

Unilever's Strategic Approach to Whole-Body Deodorant Opportunity

Unilever’s strategic approach to the whole-body deodorant opportunity represents a masterclass in data-driven product development that transforms market insights into coordinated brand launches across multiple product lines. The company’s research team identified a fundamental shift in consumer behavior when they discovered that global Google searches for ‘whole-body deodorants’ increased by 1,000% between 2024 and 2025, signaling unprecedented consumer interest in odor protection beyond traditional underarm applications. This dramatic search volume increase wasn’t just a fleeting trend—it reflected a deeper understanding that only 1% of body sweat originates from underarms, while 45% of men experience malodor issues in intimate parts, creating a massive untapped market opportunity.

Unilever’s response was strategically comprehensive, launching coordinated whole-body deodorant products across their Sure, Rexona, and Dove brands simultaneously rather than testing with a single brand. The Sure Whole Body Deodorant launched with three distinct formats—spray, stick, and cream—designed for different body areas and application preferences, utilizing exclusive Odour Adapt Technology™ that adapts to varying bacterial populations across different body parts. Rexona (known as Sure in some markets) followed with their own whole-body range, while Dove, Dove Men+Care, and SheaMoisture brands all launched variations targeting their specific consumer demographics.

The £12.5 million television campaign investment demonstrates Unilever’s commitment to category creation rather than simple product launch. The campaign strategy focused on “demystifying” the product category for mainstream consumers, recognizing that whole-body deodorants required consumer education to overcome potential embarrassment or confusion about usage. AMV BBDO’s creative approach challenged assumptions about body odor by listing different body parts that might smell, using humorous nicknames to normalize conversations around full-body odor protection. This educational approach was crucial because one in three UK adults were already using deodorant on body parts besides underarms, indicating existing behavior that needed validation and expansion rather than complete behavior change.

Unilever’s multi-brand strategy leverages their collective 55% market share in deodorants to maximize market penetration while targeting different consumer segments—Sure targeting performance-oriented consumers, Dove focusing on skin-care benefits, and Lynx appealing to younger male demographics with their Lower Body Spray. This coordinated approach allows Unilever to capture the entire emerging category rather than ceding market share to competitors or startup brands that might have pioneered the space.

The Subscription Model Phenomenon

The subscription model phenomenon has fundamentally transformed the deodorant industry by converting one-time purchases into recurring revenue relationships while creating unprecedented opportunities for consumer data collection and product customization. This transformation extends far beyond simple convenience to encompass sophisticated customer relationship management, predictive analytics, and sustainable packaging integration that creates competitive moats for direct-to-consumer brands.

Direct-to-consumer brands have leveraged subscription services to build recurring revenue streams that provide predictable cash flow and higher customer lifetime values compared to traditional retail models. Wild Deodorant exemplifies this success, with their subscription processing growing to over £1 million monthly in less than one year. Their refillable system creates a particularly compelling subscription proposition—customers purchase durable aluminum cases designed to last a lifetime, then subscribe to bamboo pulp refills that save 30 grams of plastic per unit. This model transforms the traditional deodorant purchase from a commodity transaction to a lifestyle choice aligned with sustainability values.

The subscription model’s power lies in its ability to gather valuable consumer usage data that informs both product development and marketing strategies. Wild’s partnership with Recharge enabled them to create a fully functional customer portal where customers can easily skip shipments, try new fragrances, or change delivery dates. This flexibility reduces churn while generating data about usage patterns, scent preferences, and seasonal variations that inform inventory management and new product development. The portal’s ability to facilitate product swapping has proven crucial for customer retention, with the enhanced user experience contributing to Wild’s reduced churn rates and increased lifetime value.

Refillable systems have proven particularly effective for subscription models because regular refill deliveries create customer loyalty while reinforcing environmental benefits. The refillable deodorants market, valued at $3.1 billion in 2025 and projected to grow at 11.6% CAGR to reach $9.3 billion by 2035, demonstrates the scale of this opportunity. Brands like Myro, Fussy, and Refillism have built entire business models around subscription refill systems, with metal packaging materials (40-45% market share) providing durable, recyclable containers that justify premium pricing while supporting recurring refill purchases.

Subscription models also enable sophisticated personalization that would be impossible through traditional retail channels. Brands can adjust delivery frequencies based on individual usage patterns, offer seasonal scent rotations, and introduce new products to subscribers before general market availability. The model’s success is evidenced by major corporations like Unilever and Procter & Gamble actively expanding refillable solutions under established brands like Dove and Secret, recognizing that subscription-based refillable systems represent the future of sustainable personal care commerce.

E-commerce Growth and Social Commerce Success

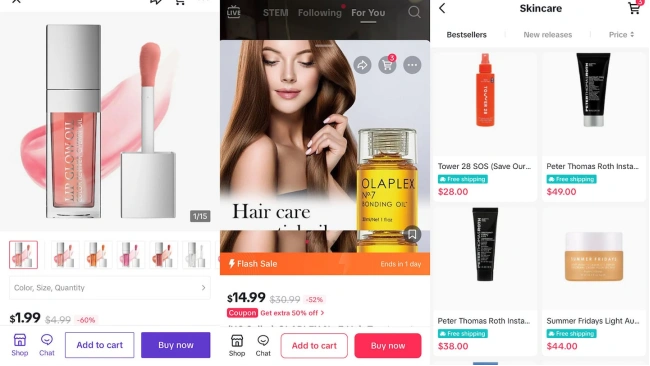

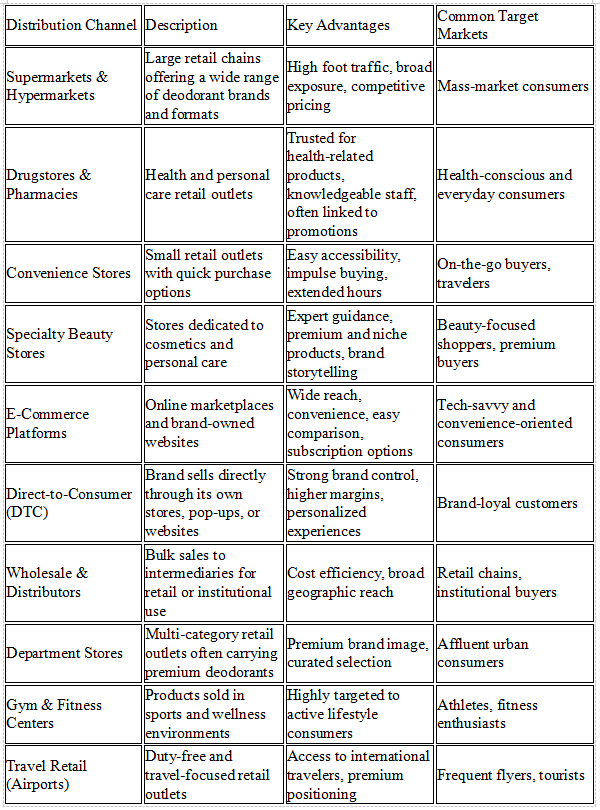

E-commerce growth has fundamentally democratized access to niche and premium deodorant brands by eliminating traditional retail distribution barriers that previously limited consumer choice to mass-market options available in physical stores. This transformation has been particularly pronounced in the deodorant category, where aluminum-free, natural, and sustainable alternatives struggled to achieve meaningful retail presence due to limited shelf space and retailer skepticism about consumer demand for premium-priced alternatives.

The rise of platforms like TikTok Shop has created entirely new pathways for brand discovery and consumer education that bypass traditional advertising and retail gatekeepers. TikTok Shop, where hygiene items rank among top sellers, has become a crucial platform for beauty and personal care brands seeking to reach younger demographics. The platform’s integration of content discovery, influencer endorsements, and immediate purchase capabilities creates a seamless path from brand awareness to conversion that traditional e-commerce platforms struggle to match.

Native Deodorant’s success story illustrates how e-commerce enables direct consumer feedback loops that drive rapid product iteration and improvement. Native’s founder personally emailed every customer for the first two years, requesting feedback and using negative responses to guide product reformulation rather than simply collecting positive reviews. This direct relationship enabled Native to improve their reorder rate from 20% to 50% in 2017 and position themselves for a $100 million acquisition by Procter & Gamble. Their initial direct-to-consumer approach through their website allowed them to charge premium prices (three times typical deodorant pricing) while building the customer base and product credibility necessary for eventual retail expansion.

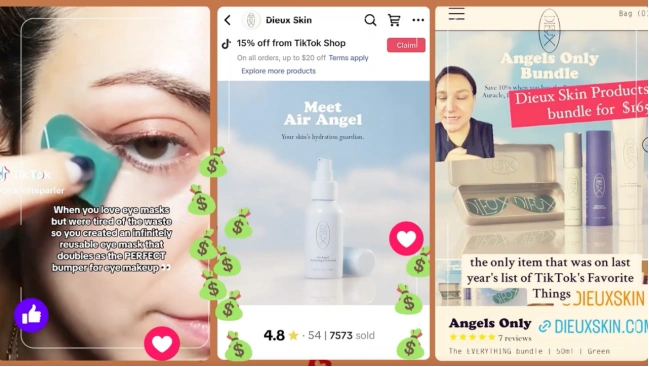

Dieux Skin’s success on TikTok Shop demonstrates how social commerce can drive rapid adoption of innovative products through authentic influencer partnerships and educational content. As one of the first beauty brands to partner with TikTok Shop before its official U.S. launch, Dieux leveraged founder-led content and their reputation for clinically vetted skincare to build trust with social media audiences. Their strategy of launching highly anticipated products exclusively through TikTok Shop created urgency and exclusivity that drove immediate sellouts while establishing TikTok Shop as their fastest-growing sales channel.

The social commerce revolution has proven particularly effective for aluminum-free formulations and sustainable packaging alternatives because these products require consumer education about ingredients, usage, and environmental benefits that traditional advertising cannot effectively deliver. TikTok’s format allows brands to demonstrate product application, explain ingredient benefits, and showcase packaging innovations through authentic user-generated content and influencer partnerships. Native’s collaboration with YouTubers and Instagram influencers, using coupon codes and trackable Bitly links, enabled them to measure influencer effectiveness while generating millions in sales and reaching hundreds of millions of viewers.

The democratization effect extends beyond brand access to encompass consumer education and community building around previously niche concepts like aluminum-free deodorants, refillable packaging, and whole-body odor protection. Social commerce platforms enable brands to build communities around shared values—sustainability, ingredient transparency, and personal health—that create emotional connections transcending simple product functionality. This community-building capability has proven essential for premium deodorant brands seeking to justify higher price points and build customer loyalty in an increasingly competitive market.

Climate Change Impact and Papatui's Strategic Response

Climate change’s impact on deodorant demand represents a multifaceted transformation that extends far beyond simple temperature increases to encompass fundamental shifts in urban living patterns, lifestyle behaviors, and consumer expectations for comprehensive odor protection. The phenomenon of urban heat island effects, where cities experience temperatures 2-9°F higher than surrounding rural areas, has created microclimates that intensify perspiration and odor challenges throughout extended periods of the year. This environmental reality combines with changing lifestyle patterns—including increased fitness participation, longer commutes, and more time spent in climate-controlled environments followed by exposure to extreme heat—to create demand for more sophisticated and comprehensive deodorant solutions.

Rising global temperatures have also altered the traditional seasonality of deodorant usage, with consumers now requiring year-round heavy-duty protection rather than seasonal adjustments in product strength or application frequency. The psychological impact of climate anxiety has further influenced consumer behavior, with individuals seeking products that provide confidence and security in unpredictable environmental conditions. This has driven demand for longer-lasting formulations, multi-area protection, and products that maintain effectiveness during high-stress situations caused by extreme weather events.

Papatui’s strategic response to these climate-driven market changes exemplifies how brands can address environmental challenges through innovative product development and targeted positioning. Launched in March 2024 by Dwayne “The Rock” Johnson, Papatui recognized that traditional underarm-only deodorants were insufficient for the comprehensive odor management needs created by increasingly hot and humid environments. The brand’s Full Body Deodorant Spray, featuring their exclusive Triple Action Deodorizing Complex™, provides aluminum-free protection “from shoulders to toes” with up to 48-hour effectiveness.

The product’s formulation directly addresses climate change challenges through its comprehensive approach to body odor management. Available in three signature scents—Sandalwood Suede, Cedar Sport, and Lush Coconut—the spray delivers “powerful odor protection from pits, back, butt, package to toes” while remaining gentle enough for everyday use on sensitive skin areas. The aluminum-free formula incorporates zinc ricinoleate, citronellyl methylcrotonate, and other advanced odor-neutralizing compounds that eliminate odor-causing bacteria, absorb moisture, and deliver lasting fresh scent without the potential irritation concerns associated with traditional aluminum-based antiperspirants.

Papatui’s $12.99 price point and availability through Target stores and their direct-to-consumer website demonstrates how climate-responsive products can achieve mainstream accessibility rather than remaining premium niche solutions. Johnson’s positioning of the product as addressing “real life” needs reflects consumer research showing that men were “reaching out, sharing what they were looking for and where other products were falling short” in addressing comprehensive odor protection for increasingly challenging environmental conditions. The brand’s success in the full-body deodorant boom of 2024-2025 illustrates how climate change has created genuine market opportunities for innovative solutions that address evolving consumer needs.

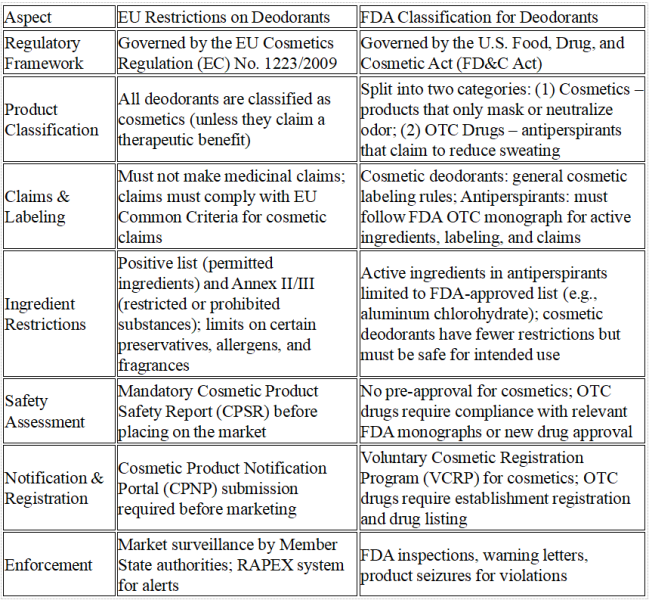

Regulatory Considerations: EU Restrictions and FDA Classification Systems

Regulatory considerations continue to fundamentally reshape deodorant product development through increasingly stringent restrictions on chemical ingredients and evolving classification systems that create different pathways for product approval and marketing. The European Union’s proactive approach to cosmetic ingredient safety has accelerated the development of natural alternatives through comprehensive restrictions on substances deemed potentially harmful to human health or environmental systems.

Future Outlook and Predictions

Market Projections

The deodorant industry’s growth projections reflect more than demographic trends—they represent a fundamental expansion of the category’s scope and consumer relevance. Emerging markets in Southeast Asia, Africa, and Latin America present enormous opportunities as urbanization accelerates and disposable incomes rise. These markets often leapfrog traditional product development stages, adopting premium formulations and sustainable packaging from the outset rather than progressing through historical evolutionary stages.

Category evolution toward natural and organic segments will likely accelerate as manufacturing costs decline and consumer education increases. The organic deodorant market’s 14.8% CAGR suggests this segment will capture increasing mainstream market share rather than remaining a niche premium category.

Technology and Innovation Trends: The Connected Future

Advanced formulations incorporating sweat-activated and extended-wear technologies represent the next generation of product performance. These innovations utilize micro-encapsulation technologies that release active ingredients in response to moisture levels or bacterial activity, providing customized protection that adapts to individual physiological patterns.

Smart packaging integration will likely evolve from novelty features to essential brand differentiators. IoT-enabled containers that monitor usage patterns, environmental conditions, and product integrity will provide brands with unprecedented consumer behavior insights while offering users personalized experiences and automatic reorder conveniences.

Customization capabilities utilizing AI and machine learning will enable brands to create personalized formulations based on individual skin chemistry, lifestyle patterns, and scent preferences. This level of customization was previously available only through expensive bespoke services but will become accessible through digital platforms and advanced manufacturing technologies.

Sustainability integration will transition from marketing positioning to fundamental business model requirements. Circular economy principles will drive innovations in package-as-a-service models, take-back programs, and closed-loop manufacturing systems that eliminate waste rather than simply reducing it.

Industry Transformation: Paradigm Shifts

Brand positioning evolution from utilitarian necessity to lifestyle expression reflects broader trends in consumer goods marketing. Deodorant brands increasingly compete on identity and values rather than functional benefits alone, requiring sophisticated brand storytelling and community building capabilities.

Market consolidation tensions between large established players and innovative startups will likely resolve through acquisition strategies similar to Unilever’s Wild acquisition. This pattern enables large corporations to access innovation while providing startups with scaling capabilities and global distribution networks.

Distribution evolution toward omnichannel experiences that seamlessly integrate online discovery, subscription convenience, and physical retail trial opportunities will become the standard rather than the exception. Brands must excel across all touchpoints while maintaining consistent messaging and user experiences.

Global standardization efforts will balance regulatory compliance requirements across different markets with local customization needs. International brands will develop platform technologies that can be adapted for regional preferences while maintaining manufacturing efficiencies and brand consistency.

Conclusion

The deodorant industry’s evolution represents far more than product innovation—it embodies a fundamental transformation in how consumers relate to personal care products and the brands that create them. The convergence of sustainability consciousness, technological advancement, and changing lifestyle patterns has created unprecedented opportunities for brands willing to embrace comprehensive change.

The $42.19 billion market projection for 2032 reflects not just growth but expansion—expansion of product categories through whole-body formulations, expansion of packaging possibilities through refillable systems, and expansion of consumer relationships through digital engagement platforms. Brands that view these changes as isolated trends rather than interconnected transformation opportunities will find themselves increasingly disconnected from evolving consumer expectations.

Sustainability has evolved from optional differentiation to fundamental business requirement, with consumers demonstrating willingness to change established usage patterns and pay premium prices for environmentally responsible alternatives. The success of brands like Wild and Myro proves that sustainability and commercial success are not just compatible but synergistic when executed with design excellence and operational sophistication.

Innovation leadership in the deodorant industry now requires capabilities spanning advanced chemistry, sustainable packaging design, digital engagement platforms, and supply chain transparency. The brands thriving in this environment are those that view complexity as opportunity rather than challenge, building integrated systems that deliver superior consumer experiences while advancing environmental and social responsibility goals.

The deodorant industry’s transformation reflects broader shifts in consumer consciousness toward products and brands that align with personal values while delivering superior performance. As climate change intensifies, urbanization accelerates, and digital native consumers mature into primary market influence, the deodorant industry will continue evolving toward more sophisticated, sustainable, and personalized solutions that address comprehensive lifestyle needs rather than simple functional requirements.

The future belongs to brands that understand this transformation imperative and commit to the comprehensive innovation necessary to meet evolving consumer expectations while advancing positive environmental and social impact. The deodorant industry’s remarkable growth trajectory is just beginning.