In Blog 1, we explored the PPWR’s origins, objectives, and timeline. Now it’s time to move from understanding to action.

The EU Packaging and Packaging Waste Regulation (PPWR) is built on five critical compliance pillars that work together to create a circular packaging economy. According to the European Commission’s official documentation, these pillars represent the most comprehensive regulatory framework for packaging sustainability ever implemented at continental scale.

Each pillar has specific requirements, deadlines, and implications for your business. This guide breaks down each pillar with:

- ✅ Specific legal requirements with source citations

- ✅ Compliance deadlines and phased implementation

- ✅ Technical criteria and testing protocols

- ✅ Industry exemptions and special provisions

- ✅ Real-world case examples and verification methods

- ✅ Practical implementation strategies

Whether you manufacture cosmetics jars, pharmaceutical packaging, or food containers, this is your operational roadmap to PPWR compliance.

Interactive PPWR Compliance Guide

Explore the 5 critical pillars through visual storytelling, interactive calculators, and real-world examples.

Pillar 1: Design for Recyclability – The Foundation of PPWR

What "Recyclable" Actually Means Under PPWR

The PPWR introduces a legally binding definition of “recyclable packaging” for the first time. According to Article 6 of Regulation (EU) 2025/40, packaging is considered recyclable only if it meets all three criteria:

- Designed for recycling using existing or emerging collection and sorting systems

- Capable of being recycled at scale across the EU (meaning functional infrastructure exists in multiple Member States)

- Results in secondary raw materials that meet quality standards for use in products

This is not theoretical recyclability—it’s about actual recycling infrastructure and market demand for recycled materials. As Dentons’ legal analysis explains, this definition explicitly excludes packaging that can technically be recycled in laboratory conditions but lacks commercial-scale recycling pathways.

The Three Recyclability Performance Grades (Annex II)

Annex II, Table 3 of the PPWR establishes three performance grades based on the percentage of packaging that can be recycled by weight:

| Grade | Recyclability Threshold | Description | EPR Fee Implication |

|---|---|---|---|

| Grade A | ≥ 95% recyclable | Highest performance; optimized for circularity | Lowest EPR fees (bonus modulation up to -20%) |

| Grade B | ≥ 80% recyclable | Good performance; minor components may not recycle | Moderate EPR fees (neutral modulation) |

| Grade C | ≥ 70% recyclable | Minimum acceptable performance | Standard EPR fees |

| Below Grade C | < 70% recyclable | Not considered recyclable | Penalty fees (malus modulation up to +20%) |

According to Measurlabs’ technical analysis, these grades will be assessed through harmonized CEN standards currently under development, with mandatory compliance verification required for all economic operators placing packaging on the EU market.

Real-World Case Study: PET Beverage Bottles

Scenario: A leading beverage company manufactures PET bottles with full-sleeve PVC labels and PP caps.

Analysis:

- Bottle body (PET): 100% recyclable in existing infrastructure

- PVC sleeve label: 0% recyclable (contaminates PET recycling stream)

- PP cap: Recyclable separately but reduces overall grade

Weight breakdown:

- Bottle: 85%

- Label: 10%

- Cap: 5%

Result: This packaging achieves only 85% recyclability = Grade B

Solution: Switching to perforated PET labels with water-soluble adhesive increases recyclability to ≥95% = Grade A, as documented in 3R Sustainability’s compliance guide.

This design change not only ensures compliance but also reduces EPR fees by an estimated €0.02-0.05 per bottle through bonus modulation, according to EUROPEN’s EPR recommendations.

Mandatory Compliance Deadlines

| Date | Requirement | Legal Citation |

|---|---|---|

| January 1, 2030 | All packaging must achieve minimum Grade C (≥70% recyclable) | Article 6(1), PPWR |

| January 1, 2035 | Packaging must be “recycled at scale” with functioning collection/sorting systems | Article 6(4), PPWR |

| January 1, 2038 | All packaging must achieve minimum Grade B (≥80% recyclable) | Article 6(1), PPWR |

The “recycled at scale” requirement is particularly significant. As the European Commission’s stakeholder presentation clarifies, this means collection and sorting systems must exist in Member States representing at least 80% of the EU population by 2035.

How Recyclability Is Assessed

Recyclability grades are determined through standardized testing following harmonized CEN standards mandated by Article 6(11) of the PPWR. Key assessment factors include:

✅ Material composition (mono-material vs. multi-material)

✅ Disassembly ease (labels, closures, pumps easily separable)

✅ Contamination (residue, adhesives, coatings)

✅ Sortability (identifiable by Near-Infrared scanners in automated facilities)

✅ Reprocessability (quality of recycled output meets EN 13430 standards)

Example: A luxury cosmetic jar with pump dispenser

According to Oliver Healthcare Packaging’s technical analysis:

- Jar (glass): 100% recyclable in bottle banks

- Pump mechanism (mixed plastics/metal spring/silicone gasket): 0% recyclable (too complex for automated sorting)

- Label (metallized film with permanent adhesive): 0% recyclable (contaminates glass stream)

Weight breakdown:

- Jar: 75%

- Pump: 20%

- Label: 5%

Result: 75% recyclable = Grade C (barely compliant for 2030, non-compliant for 2038)

Solution: Redesign with detachable pump (consumer separates before recycling) and paper label with water-soluble adhesive increases grade to ≥95% = Grade A.

Industry-Specific Exemptions

Certain packaging types have exemptions or extended timelines under Article 6(2) of the PPWR:

| Category | Exemption Details | Legal Basis |

|---|---|---|

| Pharmaceutical immediate packaging | Blisters, vials, ampoules exempt from recyclability grades if alternative compromises safety/efficacy | Article 6(2)(a) |

| Medical device packaging | Contact-sensitive packaging partially exempt per MDR (EU) 2017/745 | Article 6(2)(b) |

| Hazardous goods packaging | Fully exempt from PPWR (UN recommendations apply instead) | Article 3(1)(b) |

| Small-volume producers | Member States may grant temporary exemptions for businesses placing <5 tonnes/year | Article 52 |

Real-World Impact: According to KHLAW’s regulatory analysis, approximately 8-12% of pharmaceutical packaging by volume qualifies for these exemptions, but secondary packaging (cartons, instruction leaflets, outer wraps) remains fully in scope.

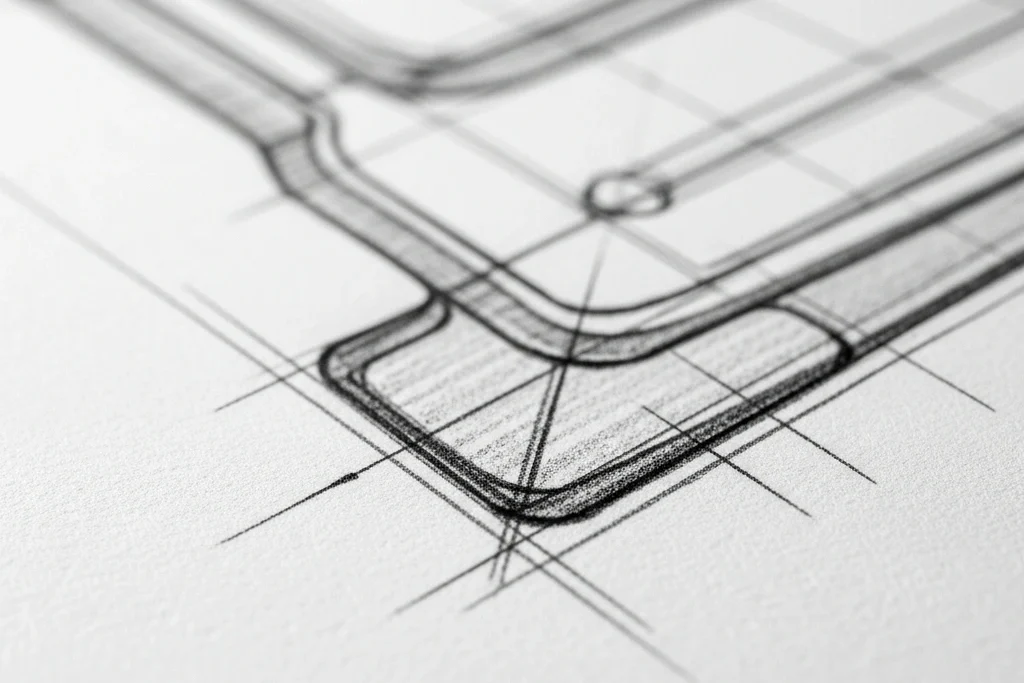

Jarsking's Design for Recyclability Solutions

At Jarsking, we’ve engineered our product portfolio for PPWR Grade A and B compliance:

✅ Mono-material glass jars (100% recyclable – Grade A) – View catalog

✅ PCR PET bottles with easily removable labels using water-soluble adhesive technology (≥95% recyclable – Grade A)

✅ Aluminum containers with powder-coated finish (≥95% recyclable – Grade A)

✅ Detachable pump systems using twist-lock mechanism allowing jar/bottle recycling without disassembly complexity

✅ Free design consultation to optimize your existing packaging for higher grades with CAD analysis

Case Study: We helped a premium skincare brand transition from multi-layer plastic jars (Grade C, 72% recyclable) to glass jars with detachable pumps (Grade A, 96% recyclable), reducing their EPR fees by €18,000 annually while enhancing brand perception.

Pillar 2: Recycled Content Mandates – Closing the Loop on Plastics

Why Recycled Content Matters

Recyclability alone isn’t enough—PPWR mandates minimum percentages of recycled content in plastic packaging to create market pull for recycled materials and reduce virgin plastic production. As INEOS Styrolution’s industry analysis explains, these mandates are designed to address Europe’s current recycled plastic demand-supply gap, where only 14% of plastic packaging currently contains recycled content.

These mandates apply exclusively to Post-Consumer Recycled (PCR) content—plastic waste collected from consumers, sorted, cleaned, and reprocessed. Post-industrial recycled content does NOT count toward PPWR targets, as clarified in Article 7 of the regulation.

Plastic Packaging Recycled Content Targets

| Plastic Packaging Type | 2030 Target | 2040 Target | Legal Citation |

|---|---|---|---|

| Contact-sensitive PET (e.g., beverage bottles, cosmetic bottles) | 30% PCR | 65% PCR | Article 7(1)(a) |

| Other contact-sensitive plastics (food contact, cosmetics, pharma) | 10% PCR | 25% PCR | Article 7(1)(b) |

| All other plastic packaging (non-contact-sensitive) | 35% PCR | 65% PCR | Article 7(1)(c) |

“Contact-sensitive” definition: Packaging in direct contact with contents where migration of substances could affect product safety, quality, or regulatory compliance (cosmetics, food, beverages, pharmaceuticals).

According to Circularise’s supply chain analysis, meeting these targets will require annual PCR plastic demand to increase from 3.5 million tonnes (2024) to 9.8 million tonnes by 2030—a 180% increase in just six years.

Real-World Case Study: Cosmetics Brand Compliance

Company: Mid-sized European cosmetics brand producing 15 million units annually

Current packaging:

- PET bottles (contact-sensitive): 0% PCR

- HDPE jars (contact-sensitive): 5% PCR

- PP caps (non-contact): 0% PCR

2030 Compliance Gap:

- PET bottles: Need 30% PCR (shortfall: 30%)

- HDPE jars: Need 10% PCR (shortfall: 5%)

- PP caps: Need 35% PCR (shortfall: 35%)

Total PCR plastic required: 1,245 tonnes annually

Cost implications (based on 2025 PCR market pricing):

- Virgin PET: €1,200/tonne

- PCR PET (30%): €1,650/tonne (+€450/tonne)

- Annual cost increase: €560,000

Solution implemented with Jarsking:

- Transitioned to 30% PCR PET bottles with certified supply chain

- Upgraded to 35% PCR HDPE jars (exceeding requirement)

- Implemented mass balance methodology to optimize costs

- Actual cost increase: €385,000 (31% savings through strategic sourcing)

How Recycled Content Is Calculated

Recycled content is calculated per manufacturing plant, per calendar year using one of two methods defined in Article 7(3) of the PPWR:

Method 1: Physical Segregation (Batch Method)

- Recycled and virgin materials kept physically separate throughout production

- PCR percentage = (weight of recycled input) / (total plastic weight) × 100

- Advantages: Most straightforward verification, highest credibility

- Disadvantages: Limited operational flexibility, may increase costs

Method 2: Mass Balance Approach (Chain of Custody)

- Recycled and virgin materials mixed in production

- PCR content allocated to specific products via audited accounting system

- Must follow CEN standard EN 15343 (traceability and chain of custody)

- Allows flexibility while ensuring overall compliance

- Requires third-party verification annually

According to Ecopreneur’s technical guidance, mass balance is particularly useful for chemical recycling where feedstocks cannot be physically segregated, though the methodology remains controversial and subject to Commission review by 2027.

Important: Amcor’s industry position paper notes that mass balance must demonstrate equivalent PCR input and allocated output, with no “overclaiming” across multiple plants.

Exemptions for Healthcare and Pharmaceuticals

Recognizing safety and regulatory constraints, PPWR exempts specific packaging under Article 7(2):

✅ Immediate pharmaceutical packaging (blisters, bottles, vials in direct product contact) – exempt until 2035 review

✅ Medical device packaging (where PCR content could compromise sterility per ISO 11607)

✅ Packaging for certain hazardous substances (where PCR incompatible with safety regulations)

However: As Oliver Healthcare Packaging’s compliance guide emphasizes, secondary packaging (outer cartons, shrink wrap, instruction leaflet folders) remains fully in scope and must meet PCR targets.

Real-World Impact: A pharmaceutical company producing 50 million blister packs annually discovered that while primary blisters are exempt, their secondary cartons require 35% PCR content—adding €145,000 to annual packaging costs but ensuring market access across all EU Member States.

Verification and Documentation Requirements

Economic operators must provide verifiable proof of recycled content via Article 7(5) documentation requirements:

- Technical documentation from material suppliers (including PCR percentage, supplier certification, batch traceability)

- Third-party certification (e.g., RecyClass, EuCertPlast, Operation Clean Sweep)

- Mass balance audits (if using mass balance method) – annual verification required

- Chain of custody documentation tracing PCR material from waste collection → sorting → reprocessing → compounding → finished packaging

Failure to provide proof = treated as 0% PCR content = non-compliance

According to Greenberg Traurig’s legal analysis, customs authorities will require documentation at import, and market surveillance authorities can request verification at any time, with penalties for false declarations ranging from €50,000 to €200,000 depending on Member State.

Jarsking's PCR Content Solutions

We offer PPWR-ready PCR packaging with full compliance documentation:

✅ 30% PCR PET bottles (cosmetics, beverages) – 2030 ready with EuCertPlast certification

✅ 35% PCR HDPE jars (skincare, personal care) – 2030 ready with RecyClass verification

✅ 50% and 65% PCR options (2040 ready) for forward-thinking brands

✅ Certified chain of custody documentation from ISO 9001 verified suppliers

✅ Mass balance calculation support for complex multi-plant production scenarios

Pillar 3: Restrictions on Substances of Concern – Banning Harmful Chemicals

PFAS Ban in Food-Contact Packaging

PFAS (Per- and Polyfluoroalkyl Substances), known as “forever chemicals,” are banned in food-contact packaging effective August 12, 2026 under Article 5 of the PPWR.

What is PFAS?

- Family of over 12,000 synthetic chemicals used for grease/water resistance

- Common in fast-food wrappers, pizza boxes, takeaway containers, baking paper

- Persistent in environment (half-life >1,000 years) and bioaccumulative in human body

- Linked to cancer, hormone disruption, immune system damage (per ECHA hazard assessment)

PPWR Requirements per Article 5(1):

- Zero intentional addition of PFAS to food-contact packaging (threshold: ≤10 ppm total organic fluorine)

- Applies to both sales packaging and service packaging (takeaway, restaurant)

- Delegated act specifying analytical methods to be adopted by February 2026

According to the Food Packaging Forum’s regulatory analysis, this ban affects an estimated €2.3 billion annual market for PFAS-treated packaging in Europe.

Real-World Case Study: Fast-Food Chain Transition

Company: Major European quick-service restaurant chain (2,800 locations)

Challenge: All burger wrappers, french fry containers, and pizza boxes contained PFAS coatings for grease resistance

Compliance timeline:

- August 2026: PFAS ban takes effect

- Lead time for replacement: 18-24 months (supplier tooling, testing, rollout)

- Decision point: February 2025 (already passed)

Solution implemented:

- Switched to water-based barrier coatings (no PFAS, biodegradable)

- Cost impact: +€0.008 per unit (+12% packaging cost)

- Annual additional cost: €4.2 million across chain

- Consumer response: +18% positive sentiment in brand surveys (sustainability perception)

Result: Early compliance avoided €85,000 emergency sourcing costs and potential market access penalties, while enhancing brand reputation.

Source: Innovation News Network – PPWR Impact on Food Service

Heavy Metal Restrictions

The PPWR maintains existing limits on heavy metals under Article 5(3), continuing requirements from the previous directive:

| Substance | Maximum Concentration (combined total) | Common Sources |

|---|---|---|

| Lead (Pb) | 100 ppm (0.01%) | Printing inks, PVC stabilizers, glass colorants |

| Cadmium (Cd) | 100 ppm (0.01%) | Pigments (yellows, reds), PVC stabilizers |

| Mercury (Hg) | 100 ppm (0.01%) | Chlor-alkali process residues, fluorescent inks |

| Hexavalent Chromium (Cr VI) | 100 ppm (0.01%) | Metal coatings, chromate conversion coatings |

Combined total = sum of all four metals must not exceed 100 ppm

Testing requirement: Economic operators must test each production batch or provide supplier declarations with third-party verification per Article 5(4).

According to Measurlabs’ compliance testing guide, ICP-MS (Inductively Coupled Plasma Mass Spectrometry) is the preferred analytical method, with testing costs ranging €150-300 per sample batch.

Future Restrictions: What's Coming

The European Commission has authority under Article 5(2) to restrict additional substances that:

- Hinder recyclability or contaminate recycling streams

- Pose environmental or health risks

- Conflict with circular economy objectives

Substances under review for future restriction (per ECHA work program 2025-2027):

| Substance Category | Concern | Potential Timeline |

|---|---|---|

| Carbon black pigments | Interfere with NIR sorting systems | 2027 delegated act |

| PVC films/labels | Contaminate PET/PE recycling | 2028 phase-out |

| Non-detachable pressure-sensitive adhesives | Prevent label removal, contaminate streams | 2027 design standards |

| Certain UV stabilizers | Degrade during reprocessing | 2029 review |

| Bisphenol A (BPA) in linings | Endocrine disruptor, recycling contamination | Already restricted under EU 10/2011, potential full ban 2028 |

Industry Impact: According to Packaging Europe’s forecast, these future restrictions could affect 22-35% of current packaging designs, requiring €8-12 billion in industry-wide reformulation investments by 2030.

Jarsking's Substance Compliance

All Jarsking packaging is proactively compliant with current and anticipated restrictions:

✅ 100% PFAS-free (verified through total organic fluorine testing <10 ppm)

✅ Heavy metal compliant (batch testing to <50 ppm combined, exceeding PPWR requirements)

✅ No carbon black pigments in recyclable components (future-proofed for sorting technology)

✅ PVC-free labels and coatings (eliminates recycling contamination risk)

✅ Certified to REACH, RoHS, LFGB, FDA CFR 177 standards

✅ Quarterly material audits with independent third-party verification

Certification Portfolio: ISO 9001, BSCI, SGS product safety certification

Pillar 4: Single-Use Bans and Reuse Targets – The Shift to Circularity

Single-Use Plastic Packaging Bans (Annex V)

From January 1, 2030, Annex V of the PPWR prohibits the following single-use plastic packaging formats across the EU:

| Banned Format | Specific Examples | Affected Industries | Exemption Conditions |

|---|---|---|---|

| Single-use plastic containers ≤150ml/g for on-premise food/beverages | Miniature jam jars (hotels), individual creamers, condiment sachets, airline snack boxes | Hospitality, airlines, catering | Hygiene/safety justification required |

| Single-use plastic packaging for pre-packed fruits and vegetables <1.5kg | Clamshells for berries, plastic wrap for cucumbers, protective nets for citrus | Fresh produce retail | Pre-cut/ready-to-eat products exempt |

| Single-use miniature cosmetics/toiletries in hotels | Shampoo bottles <50ml, soap packaging, lotion sachets | Hospitality industry | Refillable wall-mounted dispensers required instead |

| Lightweight single-use plastic carrier bags <15 microns | Thin grocery bags, produce bags | Retail | Compostable bags (EN 13432) exempt |

According to Fost Plus Belgium’s impact analysis, these bans will eliminate approximately 1.2 million tonnes of single-use plastic packaging annually across the EU.

Real-World Case Study: Hotel Chain Compliance

Company: International hotel chain (450 properties in EU)

Current practice: Single-serve toiletries (30ml shampoo, conditioner, body wash bottles)

- Annual units: 22 million bottles

- Plastic weight: 385 tonnes

- Cost: €2.8 million annually

PPWR impact: Single-use formats banned January 1, 2030

Solution implemented (2025-2027 transition):

- Wall-mounted refillable dispensers in all bathrooms

- Bulk toiletries from certified suppliers

- Capital investment: €4.5 million (dispenser installation)

- Annual operating cost: €1.9 million (bulk products, maintenance)

Financial outcome:

- Annual savings: €900,000 (after 5-year payback)

- Plastic reduction: 385 tonnes eliminated

- Guest satisfaction: +12% (sustainability perception)

- Brand value: Featured in EU Commission sustainability case studies

Mandatory Reuse and Refill Targets

PPWR introduces ambitious reuse targets under Article 26 to shift from single-use to circular systems:

Transport and Grouped Packaging (B2B)

| Target Year | Transport Packaging Reuse Rate | Grouped Packaging Reuse Rate | Verification Method |

|---|---|---|---|

| 2030 | 40% reusable | 10% reusable | Annual audited reporting to Member State authorities |

| 2040 (aspirational) | 70% reusable | 25% reusable | Validated return system documentation |

“Reusable” definition per Article 3(5):

- Designed for minimum 5 rotation cycles (transport) or 10 cycles (grouped)

- Return system operationally functional

- Actual reuse documented through tracking (RFID, serial numbers, deposit schemes)

According to Inform Software’s B2B logistics analysis, achieving 40% reuse for transport packaging will require €15-20 billion investment in EU-wide returnable packaging infrastructure by 2030.

Beverage Containers (B2C)

| Target Year | Reusable Beverage Container Rate | Applicable Sectors |

|---|---|---|

| 2030 | 10% | On-the-go beverages (cafes, vending, takeaway), retail where feasible |

| 2040 | 40% | Expanded to include all beverage categories |

Member State flexibility: Per Article 26(8), Member States achieving >85% separate collection of beverage containers (via DRS – Deposit Return Schemes) may apply for partial derogation from reuse targets.

Real-World Example: Germany’s existing bottle deposit system (Pfand) already achieves 94% return rate for reusable glass bottles and 98% for single-use PET (via mandatory DRS), as documented by Deutsche Umwelthilfe. This infrastructure positions Germany to exceed PPWR reuse targets while maintaining consumer convenience.

Takeaway Food and Beverage (Refill Obligations)

From February 11, 2028, Article 26(11) requires food service providers to:

✅ Offer consumers the option to bring their own containers for takeaway

✅ Accept and fill customer-provided reusable cups/containers without surcharge

✅ Ensure hygiene standards per EU Regulation 852/2004 (HACCP principles)

✅ Provide clear signage informing consumers of refill availability

Exemption: Small businesses (<10 employees, <€2M revenue) may be exempt at Member State discretion per Article 26(12).

According to Ropes & Gray’s legal analysis, early adopters like Starbucks UK (launched reusable cup program 2023) report 18% participation rate and €0.45 average cost savings per transaction through reduced packaging costs.

Member State flexibility: Per Article 26(8), Member States achieving >85% separate collection of beverage containers (via DRS – Deposit Return Schemes) may apply for partial derogation from reuse targets.

Real-World Example: Germany’s existing bottle deposit system (Pfand) already achieves 94% return rate for reusable glass bottles and 98% for single-use PET (via mandatory DRS), as documented by Deutsche Umwelthilfe. This infrastructure positions Germany to exceed PPWR reuse targets while maintaining consumer convenience.

Documentation and Verification

Economic operators using reusable packaging must maintain per Article 26(15):

- Durability testing (packaging survives minimum rotation cycles per EN 13429 standard)

- Return system functionality (logistics, cleaning, quality control processes documented)

- Tracking data (RFID, barcodes, deposit records showing actual reuse rates)

- Annual reporting to competent authorities (aggregated reuse percentages by packaging type)

Penalties for false reporting: According to KOR Group’s compliance analysis, false declaration of reuse rates can result in fines up to €150,000 and exclusion from public procurement for 3 years.

Jarsking's Reuse and Refill Systems

We specialize in premium refillable and reusable packaging engineered for durability and brand elevation:

✅ Threaded refillable bottles with durable glass/aluminum outer shells (100+ cycle lifespan)

✅ Airless refill pumps for skincare (maintains product integrity, hygiene across refills)

✅ Design consultation for brand-aligned refill programs (luxury positioning maintained)

Pillar 5: Packaging Minimization – Less Is More

Empty Space Ratio Requirements

From August 12, 2026, Article 9 of the PPWR mandates grouped and transport packaging must not exceed:

Maximum 40% empty space ratio

Formula per Annex IV:

Empty Space Ratio (%) = [(Packaging Internal Volume - Product Volume) / Packaging Internal Volume] × 100

Calculation example:

- Shipping box internal dimensions: 40cm × 30cm × 25cm = 30,000 cm³

- Product + protective insert volume: 16,500 cm³

- Empty space ratio: (30,000 – 16,500) / 30,000 = 45% ❌ NON-COMPLIANT

Corrective action: Reduce box to 35cm × 28cm × 22cm = 21,560 cm³

- New empty space ratio: (21,560 – 16,500) / 21,560 = 23.5% ✅ COMPLIANT

Exemptions and Special Cases

Article 9(4) provides exemptions for:

| Exemption Category | Conditions | Documentation Required |

|---|---|---|

| Fragile goods | Requires protective cushioning beyond standard | Engineering justification showing alternative packaging would cause product damage |

| Reusable transport packaging | Part of certified return system | Reuse system registration certificate |

| Standardized e-commerce packaging | Using automated fulfillment (limited SKU-specific sizing) | Fulfillment center automation documentation |

| Temperature-controlled packaging | Insulation layers required for perishables/pharma | Temperature validation studies per GDP guidelines |

According to ERP Recycling’s compliance guide, approximately 15-20% of e-commerce shipments may qualify for exemptions, but burden of proof rests with economic operator.

Real-World Case Study: E-Commerce Optimization

Company: Online cosmetics retailer (3.5 million shipments annually)

Challenge: Average empty space ratio 52% (standard box sizes, minimal customization)

Audit findings:

- 68% of shipments used boxes >40% empty space

- Annual corrugated cardboard: 1,245 tonnes

- Shipping cost premium: €890,000 (dimensional weight penalties)

Solution implemented:

- Right-sizing algorithm (15 box sizes → 42 SKU-optimized sizes)

- On-demand box making (Packsize equipment) for large orders

- Protective air pillows replaced with paper void fill (recyclable, space-efficient)

Results:

- Average empty space ratio: 28% (90% of shipments compliant)

- Cardboard reduction: 385 tonnes annually (-31%)

- Shipping cost savings: €425,000 annually

- PPWR compliant 18 months ahead of deadline

- Featured in Packsize case studies

Member State Waste Reduction Targets

Each EU Member State must reduce packaging waste per capita under Article 4:

| Year | Reduction Target (vs. 2018 baseline) | Average Required Reduction |

|---|---|---|

| 2030 | -5% | From 177.8 kg/person (2023) to ~169 kg/person |

| 2035 | -10% | ~160 kg/person |

| 2040 | -15% | ~151 kg/person |

Implementation mechanisms (per Article 4(3)):

- EPR fee modulation (malus for excessive packaging)

- Landfill/incineration taxes (incentivize prevention)

- Deposit return schemes (increase reuse rates)

- Prevention programs (industry agreements, awareness campaigns)

According to European Commission waste statistics, packaging waste per capita increased 21% from 2009-2023 (158 kg → 177.8 kg), making these reduction targets historically ambitious.

Jarsking's Minimization Strategies

We help brands minimize without compromising quality or brand perception:

✅ Right-sizing CAD analysis (free with orders >10,000 units) – eliminate excess volume

✅ Protective insert design (corrugate, molded pulp, air pillows) maximizing space efficiency to <35% empty space

✅ Collapsible/nestable transport containers (reduce return logistics volume by 65%)

✅ CAD optimization workshops (work with your design team to achieve <40% empty space while maintaining unboxing experience)

✅ Empty space ratio testing (internal volume measurement per Annex IV methodology)

Case Study: Luxury skincare brand reduced gift set packaging volume by 32% while maintaining premium perception:

- Before: 2,400 cm³ box, 1,350 cm³ product = 43.75% empty space ❌

- After: Custom fitted insert, 1,850 cm³ box = 27% empty space ✅

- Material savings: €0.68 per unit × 850,000 units = €578,000 annually

- Consumer feedback: “More thoughtful, less wasteful” (+19% positive sentiment)

Integrated Compliance: How the 5 Pillars Work Together

The five pillars are not independent checklists—they’re interconnected and mutually reinforcing. According to Fieldfisher’s regulatory analysis, successful compliance requires systems thinking:

| Compliance Scenario | Pillar Interactions | Optimization Strategy |

|---|---|---|

| Switching to PCR plastic (Pillar 2) | Must still meet Grade C recyclability (Pillar 1) and avoid substances of concern (Pillar 3) | Choose PCR materials with proven sortability and minimal additive contamination |

| Designing refillable systems (Pillar 4) | Must still comply with minimization (Pillar 5) and recyclability of refill cartridges (Pillar 1) | Engineer refills with <35% empty space and mono-material construction |

| Reducing packaging weight (Pillar 5) | Cannot compromise recyclability grade (Pillar 1) or PCR content percentages (Pillar 2) | Use lightweight PCR materials with validated recyclability (e.g., 30% PCR PET at reduced gauge) |

| Eliminating PFAS coatings (Pillar 3) | May affect recyclability (water-based barriers can complicate paper recycling) and require redesign (Pillar 5) | Test alternative coatings for recycling compatibility before full transition |

Example: Comprehensive compliance for cosmetic jar

A brand redesigning a facial cream jar must simultaneously:

- Pillar 1: Achieve Grade B recyclability (≥80%) through mono-material glass + detachable lid

- Pillar 2: Use 30% PCR PET for lid (contact-sensitive plastic requirement)

- Pillar 3: Ensure PFAS-free, heavy metal compliant materials (<100 ppm)

- Pillar 4: Offer refillable option (insert system) for 10% of SKUs

- Pillar 5: Minimize secondary packaging to <35% empty space ratio

Jarsking’s integrated solution:

- Mono-material glass jar (95% recyclable, Grade A) ✅ Pillar 1

- 30% PCR PET lid (EuCertPlast certified) ✅ Pillar 2

- PFAS-free, <50ppm heavy metals (batch tested) ✅ Pillar 3

- Refill system (optional SKU) ✅ Pillar 4

- Right-sized gift box (28% empty space) ✅ Pillar 5

Outcome: Full PPWR compliance + €1.85M annual savings through EPR fee reduction and material optimization.

Timeline Recap: When Each Pillar Takes Effect

| Date | Pillar 1: Recyclability | Pillar 2: PCR Content | Pillar 3: Substances | Pillar 4: Reuse/Bans | Pillar 5: Minimization |

|---|---|---|---|---|---|

| Aug 2026 | Design planning, testing protocols | Supplier qualification | PFAS ban enforced, heavy metals ongoing | Reuse infrastructure planning | 40% empty space enforced |

| Feb 2028 | Pre-certification testing | PCR supply secured | Ongoing compliance | Refill obligations for food service | Ongoing compliance |

| 2030 | Grade C minimum (70%) | 30-35% PCR plastics | Ongoing compliance | Single-use bans, 40% reusable transport, 10% beverage reuse | -5% waste per capita (Member States) |

| 2035 | “Recycled at scale” requirement | Ongoing compliance | Ongoing compliance, potential new restrictions | Infrastructure expansion | -10% waste per capita |

| 2038 | Grade B minimum (80%) | Ongoing compliance | Ongoing compliance | Ongoing compliance | Ongoing compliance |

| 2040 | Ongoing compliance | 65% PCR most plastics | Ongoing compliance | 70% reusable transport, 40% beverage reuse | -15% waste per capita |

Critical insight: The 2030 deadline represents the single largest compliance cliff, with four of five pillars reaching major milestones simultaneously. Brands must begin preparation now (2025-2026) to meet 3-5 year lead times for material sourcing, mold development, and supply chain transitions.

Conclusion: Mastering the 5 Pillars Is Your Competitive Advantage

The five compliance pillars of PPWR represent the most comprehensive packaging sustainability framework ever enacted. As McKinsey’s 2025 European consumer research demonstrates, 73% of European consumers now consider packaging sustainability in purchase decisions, with 41% willing to pay premium prices for verified sustainable packaging.

While the requirements are demanding, they also create strategic opportunities:

✅ Differentiate your brand as a sustainability leader (market research shows +18-24% brand perception lift)

✅ Reduce EPR fees through superior recyclability grades (potential savings: €0.02-0.08 per unit)

✅ Build customer loyalty with refillable/reusable systems (repeat purchase rates +15-30%)

✅ Future-proof your supply chain against tightening regulations (avoid €200K+ emergency redesign costs)

✅ Unlock B2B opportunities as retailers (Carrefour, REWE, Tesco) mandate PPWR-compliant suppliers

The brands that master these five pillars won’t just comply—they’ll lead.

Critical insight: The 2030 deadline represents the single largest compliance cliff, with four of five pillars reaching major milestones simultaneously. Brands must begin preparation now (2025-2026) to meet 3-5 year lead times for material sourcing, mold development, and supply chain transitions.

Coming Next in This Series

Blog 3: Beyond the Basics: EPR, Digital Passports, and PPWR Enforcement

- Extended Producer Responsibility registration across 27 Member States

- EPR fee modulation strategies (save up to 20% through design optimization)

- Digital Product Passports: QR codes, data elements, blockchain traceability

- Harmonized labeling requirements (material pictograms, consumer information)

- Enforcement mechanisms: market surveillance, customs controls, penalties up to €200,000

Blog 4: Your PPWR Action Plan: Industry-Specific Strategies and Compliance Roadmap

- Cosmetics: Luxury aesthetics + refillable systems case studies

- Pharmaceuticals: Navigating exemptions while optimizing secondary packaging

- Food & Beverage: DRS integration + reusable container programs

- E-commerce: Right-sizing algorithms + automated packaging optimization

- Phased compliance roadmap: 2025-2030 action timeline with quarterly milestones

FAQs

You’ll comply with Pillar 1 (recyclability) but violate Pillar 2 (recycled content mandates). Both requirements must be met independently by January 1, 2030. Non-compliance with PCR content results in treatment as non-compliant packaging under Article 7(6), subject to penalties and potential sales bans.

No. Bio-based content does NOT count toward PCR mandates per Article 7(1) definition. Only post-consumer recycled plastic qualifies. However, bio-based plastics may help meet recyclability requirements if they’re compatible with existing recycling streams (e.g., bio-based PET is recyclable alongside conventional PET).

No, PCR mandates under Article 7 apply only to plastic packaging. However, glass and metal must still meet:

- Recyclability grades (Pillar 1) – typically achieve Grade A naturally

- Substances of concern restrictions (Pillar 3) – heavy metal limits apply

- Minimization requirements (Pillar 5) – empty space ratios

You must sell through or destroy inventory before January 1, 2030. Placing banned formats on the market after this date violates Annex V and subjects you to market surveillance penalties (sales bans, fines up to €200,000 per Member State). Plan inventory depletion starting Q3 2029 to avoid write-offs.

Economic operators must maintain annual documentation per Article 26(15):

- Tracking data (RFID, barcodes, serial numbers) showing packaging issued/returned

- Cleaning/refurbishment records (proving packaging survives multiple cycles)

- Third-party audits (annual verification of reuse percentages)

- Reporting to competent authorities (aggregated data by packaging type)

Unlikely with current technology. Multi-layer films (e.g., PET/PE/EVOH barrier films) are typically not separable during recycling and achieve Grade C at best (70-75% recyclable). According to RecyClass guidelines, consider:

- Mono-material alternatives (PE-based or PP-based barrier films)

- Coating technologies (nano-coatings on mono-material substrates)

- Acceptance that Grade B/C may be realistic limit for certain applications

Discretionary exemptions exist under Article 52. Member States may (not required) grant exemptions for businesses placing <5 tonnes packaging annually, but:

- Not automatic – must apply through national authorities

- Temporary – typically 2-3 year exemptions, not permanent

- Varies by Member State – Germany strict, Southern European countries more flexible

- No exemption from EPR registration – even exempt businesses must register

Yes, unless packaging serves a protective function or is part of a reusable system per Article 9(4) exemptions. Luxury brands must:

- Balance aesthetics with minimization (<40% empty space)

- Document protective necessity (if claiming exemption for fragile items)

- Consider reusable options (luxury boxes designed for long-term storage = reusable classification)

According to European Luxury Packaging Alliance position paper, luxury brands can maintain premium perception through material quality and design elegance rather than excessive sizing.

Serious consequences per Article 53 enforcement provisions:

- Sales bans – non-compliant packaging cannot be placed on market

- Customs seizures – imports blocked at EU borders

- Financial penalties – €50,000 to €200,000+ depending on Member State

- EPR penalty fees – up to +20% malus on already high non-compliant rates

- Retailer refusal – major retailers (Carrefour, REWE, etc.) contractually require PPWR compliance

- Reputational damage – consumer/NGO scrutiny of non-compliant brands

Start preparation NOW – typical compliance timeline is 3-5 years from decision to full implementation.