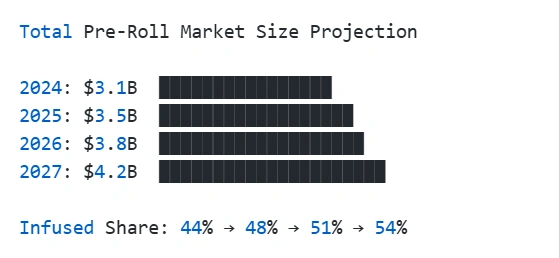

The cannabis pre-roll has undergone a remarkable transformation. Once dismissed as a convenient but unremarkable product—something beginner consumers purchased when they couldn’t roll their own—pre-rolls have evolved into a $3.1 billion powerhouse commanding 15.3% of the entire legal cannabis market. At the heart of this revolution stands an even more impressive phenomenon: infused pre-rolls, enhanced products combining premium flower with concentrated extracts that now dominate the category with $1.75 billion in sales and a commanding 44.4% market share.

This is a fundamental shift in how consumers approach cannabis consumption and how brands compete in an increasingly sophisticated marketplace. According to industry analysis from Forbes, Americans consumed more than 316 million pre-rolls in 2024, with infused varieties capturing the fastest growth and highest profit margins in the entire cannabis category.

For cannabis brands and industry observers alike, understanding this market means recognizing that success depends on far more than what’s inside the cone. Consumer demographics, pricing psychology, brand positioning, and product presentation collectively determine whether a product commands $4 or $24, whether it sits on shelves or flies off them, and whether consumers return once or become loyal advocates.

Market Explosion: The Numbers Behind the Phenomenon

From Niche to Mainstream in Five Years

The trajectory of infused pre-rolls reveals one of the most dramatic category shifts in cannabis history. Market research from Custom Cones USA and Headset documents that infused pre-rolls’ market share has surged from an average of 34.4% in 2019 to 44.4% in the first half of 2024—a 10-percentage-point gain in just five years that represents billions in shifted consumer spending.

| Year | Infused Market Share | Traditional Market Share | Total Pre-Roll Sales |

|---|---|---|---|

| 2019 | 34.4% | 65.6% | ~$2.1 billion |

| 2020 | 36.8% | 63.2% | ~$2.4 billion |

| 2021 | 39.2% | 60.8% | ~$2.7 billion |

| 2022 | 41.5% | 58.5% | ~$2.9 billion |

| 2023 | 43.1% | 56.9% | ~$3.0 billion |

| 2024 (H1) | 44.4% | 55.6% | ~$3.1 billion (projected) |

Infused Pre-Roll Market Share Growth (2019-2024), Source: Custom Cones USA & Headset Industry Analysis

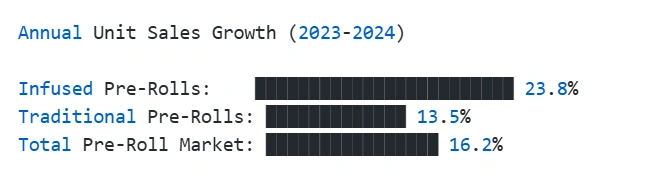

More telling still, infused pre-roll unit sales grew 23.8% year-over-year, substantially outpacing the 13.5% growth rate for traditional pre-rolls. This isn’t cannibalization where one category grows at another’s expense; it’s genuine category expansion driven by consumer willingness to pay premium prices for elevated experiences.

The velocity of adoption varies by market maturity, but the pattern remains remarkably consistent across geographies. In Michigan, America’s volume leader with 94.6 million pre-rolls sold annually, infused products maintain strong positioning despite the state’s price-competitive environment averaging just $5.57 per item. In Massachusetts, where pre-rolls command the highest market share at 19.2% of total cannabis sales, premium infused offerings drive category growth even as competition intensifies.

California, the nation’s largest legal market, generated $734.5 million in pre-roll sales over the past year, with infused products representing the majority of premium-priced offerings. The state’s sophisticated consumer base—experienced users who have moved beyond novelty consumption to discerning quality evaluation—demonstrates mature market dynamics where infused products become the expected standard rather than specialty exception.

Premium Pricing Power: The Economics of Infusion

Perhaps the most significant indicator of infused pre-rolls’ market position is their pricing resilience amid broader cannabis price deflation. While many cannabis categories have seen prices decline 20-40% as markets mature and supply increases, infused pre-rolls maintain and even expand price premiums.

| Product Type | Avg Price/Gram | Avg Item Price | Premium vs Traditional |

|---|---|---|---|

| Traditional Pre-Rolls | $6.44 | $9.50 | Baseline |

| Infused Pre-Rolls | $8.27 | $11.68 | +28% / +23% |

| Premium Infused (Jeeter) | $24.62/item | $24.62 | +159% |

| Premium Infused (STIIIZY) | $21.79/item | $21.79 | +129% |

| Ultra-Premium Infused | $28-35/item | $30.00 | +216% |

Average Pre-Roll Pricing Comparison (September 2024), Source: Headset Market Data & Forbes Industry Analysis

Traditional pre-rolls averaged $6.44 per gram across tracked markets in September 2024, already a decrease from $8.13 two years prior. Infused varieties, however, commanded $8.27 per gram—a 28% premium that consumers consistently pay despite having lower-priced alternatives readily available. The average item price tells an even more dramatic story: $11.68 for infused products compared to $9.50 for traditional pre-rolls.

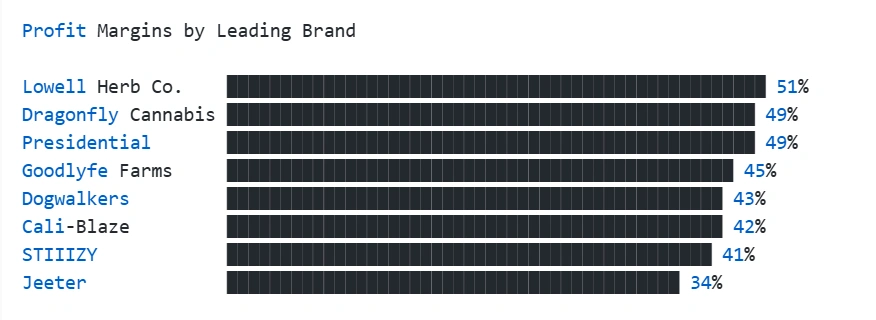

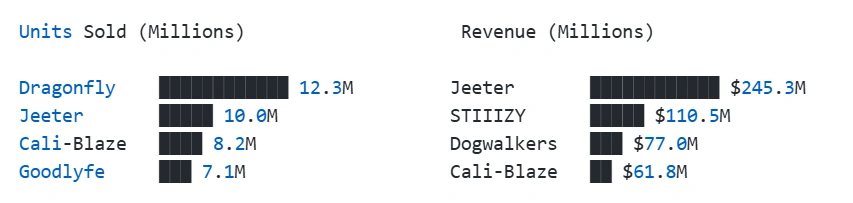

At the premium end, leading brands demonstrate extraordinary pricing power that would seem implausible in commodity markets. Jeeter, the market leader with $245 million in annual sales, achieves an average item price of $24.62 while maintaining 34% profit margins. STIIIZY, ranking second with $110.5 million in sales, commands $21.79 per item with an impressive 41% margin—the highest profitability in the entire category.

Even volume-focused brands operating in highly competitive markets maintain remarkable margins. Dogwalkers averages $22.66 per item with 43% margins, Presidential Cannabis achieves 49% margins at $16.79 average prices, and Lowell Herb Co. posts 51% margins despite operating in multiple mature markets. These aren’t anomalies; they’re systematic evidence that infused pre-rolls have successfully positioned themselves as premium products where branding, quality, and experience justify prices far above input costs.

The Infused Pre-Roll Consumer: Demographics and Behavior

Who's Buying and How Often

Consumer behavior research paints a detailed picture of the infused pre-roll customer that challenges some stereotypes while confirming others. Survey data encompassing over 900 cannabis consumers reveals that 82% of cannabis smokers purchase pre-rolls, with 70% having bought infused varieties—though most (64%) reserve these premium products for special occasions or monthly treats rather than daily consumption.

| Metric | Percentage/Frequency |

|---|---|

| Cannabis smokers who buy pre-rolls | 82% |

| Pre-roll buyers who’ve purchased infused | 70% |

| Buy infused products weekly or more | 36% |

| Reserve infused for special occasions | 64% |

| Consume cannabis multiple times daily | 79.7% |

| Consume cannabis once daily | 11.7% |

| Visit dispensary 1-3 times weekly | 38.3% |

| Purchase pre-rolls per dispensary visit | 16% |

Consumer Purchase Behavior, Source: Custom Cones USA 2024 Pre-Roll Consumer Report

This occasional-use pattern hasn’t hindered growth; instead, it’s created a premium tier similar to craft cocktails or specialty coffee—products consumers enjoy regularly but not exclusively. The willingness to pay premiums for special occasions or quality experiences drives the category’s high margins and rapid growth as consumers trade up from everyday products.

Usage frequency reveals heavy users driving the market: 79.7% of pre-roll smokers consume cannabis multiple times daily, with another 11.7% using it once per day. These aren’t casual users experimenting with cannabis; they’re experienced consumers with refined preferences who recognize and reward quality differences.

Generational Preferences: Millennials Lead the Market

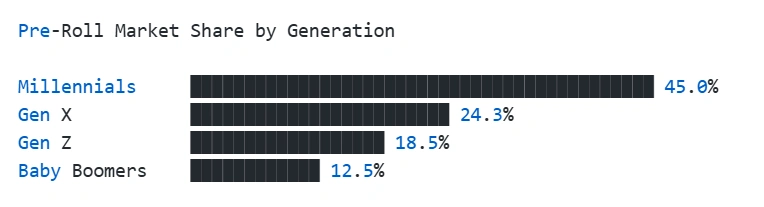

The demographic profile skews millennial, with consumers aged 28-43 accounting for 45% of all pre-roll purchases, totaling $104 million in sales during tracked periods. This generational dominance reflects both purchasing power and cultural comfort with premium cannabis products positioned similarly to craft beverages or artisanal foods.

| Generation | Age Range | Market Share | Total Sales | Average Purchase |

|---|---|---|---|---|

| Millennials | 28-43 | 45.0% | $104.0M | $231 |

| Gen X | 44-59 | 24.3% | $56.7M | $233 |

| Gen Z | 18-27 | 18.5% | $43.2M | $234 |

| Baby Boomers | 60+ | 12.5% | $29.2M | $234 |

Pre-Roll Purchases by Generation, Source: Headset Dispensary Loyalty Program Data (September 2024)

Generation X follows at 24.3% market share ($56.7 million), demonstrating that pre-roll appeal extends beyond younger consumers into established middle-aged users. Gen Z consumers represent 18.5% ($43.2 million) despite many being below legal purchase age in some markets—suggesting this cohort will drive future growth as they age into peak cannabis consumption years. Baby Boomers account for 12.5% ($29.2 million), the smallest but fastest-growing segment as cannabis normalization continues and medical applications drive adoption among older consumers.

Gender distribution across dispensary loyalty programs shows 62% male buyers, though this skew is lessening as cannabis shopping becomes less stigmatized and product varieties expand beyond stereotypically masculine positioning. Premium brands with sophisticated packaging and lifestyle branding increasingly appeal to female consumers, a demographic shift that favors infused products over traditional flower.

Purchase Drivers: Potency Reigns Supreme

When asked what factors guide their infused pre-roll purchases, 70% of respondents ranked potency as the primary consideration, followed by price and brand reputation. This potency focus explains infused products’ dominance—they deliver substantially higher THC levels (25-45%) compared to traditional pre-rolls (15-25%), offering experienced users the elevated effects they seek without requiring multiple consumption sessions.

| Factor | Primary Consideration | Important Factor |

|---|---|---|

| Potency (THC %) | 70% | 92% |

| Price/Value | 58% | 89% |

| Brand Reputation | 43% | 78% |

| Concentrate Type (for infused) | 52% | 81% |

| Terpene Profile | 31% | 64% |

| Packaging Quality | 18% | 52% |

| Sustainability | 14% | 47% |

Top Purchase Decision Factors, Source: Custom Cones USA Consumer Survey (900+ respondents)

Notably, 52.4% cited concentrate type as the most important factor when selecting among infused options, suggesting educated consumers who understand the difference between distillate, live resin, and rosin products. This sophistication creates opportunity for brands investing in premium concentrates and educating consumers about quality differences.

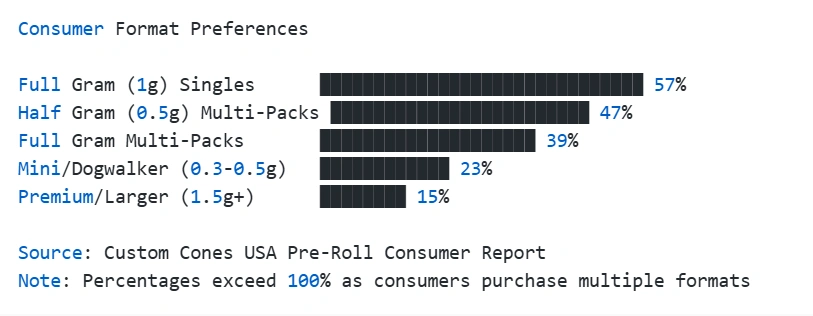

Format preferences show evolution toward multi-packs, which now represent nearly 50% of all pre-roll sales. Five-pack and ten-pack configurations enable better price-per-gram value while creating gifting opportunities and encouraging larger basket sizes.

Interestingly, 46.7% prefer kief-coated products, while 44.8% favor internally oil-infused options and 8.5% seek “hash hole” style presentations. This distribution suggests no single infusion method dominates consumer preference, creating opportunities for brands to differentiate through production technique rather than competing solely on concentrate type or potency numbers.

Market Leaders: What Success Looks Like

Jeeter: Building an Empire on Quality and Presentation

With $245 million in annual sales and 8% national market share, Jeeter has established itself as the undisputed pre-roll leader through a formula combining high-quality infusion, distinctive packaging, and relentless brand building.

| Rank | Brand | Total Sales | Units Sold | Market Share | Avg Price | Profit Margin |

|---|---|---|---|---|---|---|

| 1 | Jeeter | $245.3M | 9.96M | 8.0% | $24.62 | 34% |

| 2 | STIIIZY | $110.5M | 5.07M | 3.6% | $21.79 | 41% |

| 3 | Dogwalkers | $77.0M | 3.40M | 2.5% | $22.66 | 43% |

| 4 | Cali-Blaze | $61.8M | 8.17M | 2.0% | $7.57 | 42% |

| 5 | Presidential | $43.3M | 2.58M | 1.4% | $16.79 | 49% |

| 6 | Simpler Daze | $31.5M | 4.33M | 1.0% | $7.26 | 46% |

| 7 | Goodlyfe Farms | $29.6M | 7.10M | 1.0% | $4.17 | 45% |

| 8 | Dragonfly Cannabis | $29.3M | 12.34M | 1.0% | $2.38 | 49% |

| 9 | Lowell Herb Co. | $28.3M | 1.00M | 0.9% | $28.27 | 51% |

| 10 | Good Day Farm | $25.9M | 1.33M | 0.8% | $19.45 | 46% |

Top 10 Pre-Roll Brands (2024), Source: Forbes & Custom Cones USA Top 100 Pre-Roll Brands Analysis

The company’s signature Baby Jeeter five-packs—half-gram pre-rolls infused with liquid diamonds and live resin, rolled in kief, and packaged in collectible glass jars—exemplify premium positioning that commands an average price of $24.62 per item while maintaining healthy 34% profit margins.

Jeeter’s success stems from strategic product decisions that deliver both performance and visual appeal. The dual infusion approach (internal concentrate plus external kief coating) provides exceptional potency while creating Instagram-worthy aesthetics that drive organic social media marketing—critical in an industry where paid advertising remains restricted.

The company’s $245 million revenue across four states (California, Michigan, Arizona, Massachusetts) demonstrates both production scale and multi-state execution capabilities. Maintaining product consistency and brand identity across different regulatory environments and supply chains separates leaders from regional players unable to scale successfully.

STIIIZY: Minimalist Design Meets Maximum Potency

STIIIZY’s $110.5 million in sales and 3.6% market share come from a markedly different strategic approach, demonstrating that multiple successful formulas exist in premium cannabis. Where Jeeter employs bold packaging and celebrity partnerships, STIIIZY pursues sleek minimalism and product quality differentiation.

The brand’s “40’s” line—pre-rolls and blunts infused with live resin and coated in kief—became America’s best-selling non-house-brand pre-roll product through consistent quality and sophisticated branding. The distinctive packaging—minimalist black tubes and boxes with subtle gold accents—communicates premium positioning through design restraint rather than visual excess.

STIIIZY’s industry-leading 41% profit margins reflect both premium pricing power and operational efficiency. The company’s concentrate heritage (initially known for vape products before expanding into pre-rolls) provides expertise in extraction and infusion that translates to superior product quality.

Volume Players: The Alternative Success Path

While Jeeter and STIIIZY represent premium positioning, brands like Dragonfly Cannabis and Goodlyfe Farms demonstrate alternative paths to success through volume strategies in price-competitive markets. Dragonfly leads the nation in units sold—12.3 million pre-rolls annually—despite ranking eighth in revenue at $29.3 million. The math reveals the strategy: average prices of just $2.38 per unit, enabled by Michigan’s mature market dynamics and efficient outdoor cultivation.

Despite rock-bottom pricing, Dragonfly maintains impressive 49% profit margins through operational excellence: 150-acre outdoor grow providing low-cost biomass, automated infusion systems maximizing throughput, and simple but compliant packaging keeping costs minimal. The brand proves that premium pricing isn’t the only route to profitability; volume-focused strategies work in markets where consumer price sensitivity limits premium penetration.

Success Patterns: Common Threads

Across premium and value segments, successful infused pre-roll brands share several characteristics:

- Product consistency: Whether commanding $25 or $5, products must deliver predictable experiences every time

- Clear positioning: Brands succeed by owning specific market positions rather than attempting everything

- Operational excellence: Execution separates winners from failures—quality control, efficient production, supply chain reliability

- Brand storytelling: Whether through celebrity partnerships, sustainability commitments, or heritage narratives, brands need stories consumers connect with

- Packaging alignment: Container quality and design must reinforce positioning rather than contradict it

Regional Market Dynamics: Geography Matters

Price Variation Across Markets

Cannabis remains a state-by-state patchwork of regulations, tax structures, and market maturity levels that create dramatic price variations.

| State | Avg Price/Gram | Avg Item Price | Market Maturity | Pre-Roll Market Share |

|---|---|---|---|---|

| New York | $13.74 | $21.20 | Emerging | 18.2% |

| Illinois | $11.90 | $17.15 | Developing | 14.8% |

| California | $7.81 | $12.35 | Mature | 11.7% |

| Massachusetts | $8.42 | $13.60 | Mature | 19.2% |

| Nevada | $7.65 | $11.85 | Mature | 12.4% |

| Washington | $3.36 | $6.24 | Very Mature | 13.9% |

| Oregon | $3.87 | $7.10 | Very Mature | 12.8% |

| Michigan | $4.42 | $5.57 | Mature | 18.2% |

| Colorado | $6.15 | $9.85 | Mature | 11.3% |

| Arizona | $8.20 | $13.45 | Developing | 14.1% |

Pre-Roll Pricing by State (Top 10 Markets), Source: Headset Market Data & Custom Cones USA State Analysis

Pre-roll consumers in Washington and Oregon pay the lowest prices nationally at $3.36 and $3.87 per gram respectively, benefiting from mature markets where abundant supply and intense competition drive down prices. Conversely, buyers pay the highest prices in New York ($13.74/gram) and Illinois ($11.90/gram), reflecting newer markets with limited licensed operators, high tax burdens, and ongoing black market competition.

These price differences create strategic opportunities and challenges. Brands operating in high-price markets enjoy better margins but face political pressure and black market competition. Those in low-price markets benefit from established consumer bases but must achieve operational excellence to maintain profitability amid price compression.

Market Share Variation

Pre-roll market share—the percentage of total cannabis sales represented by pre-rolls—varies significantly by state, revealing different consumer preferences and market dynamics. Massachusetts leads at 19.2% market share, followed by Michigan and New York tied at 18.2%. These high-share markets indicate strong consumer acceptance of pre-rolls as primary consumption method rather than occasional convenience purchase.

The Premium Product Trend: Beyond Cannabis

The infused pre-roll phenomenon mirrors broader consumer trends across multiple industries where premiumization drives growth even as mass-market segments stagnate. Just as craft beer captured market share from mass-market lagers, specialty coffee displaced generic brews, and premium spirits grew while value brands declined, infused pre-rolls represent cannabis consumers trading up to higher-quality experiences.

| Category | Premium Segment Growth | Mass Market Growth | Consumer Shift Pattern |

|---|---|---|---|

| Infused Pre-Rolls | +23.8% YoY | +13.5% YoY | Trading up for potency & quality |

| Craft Beer | +8.2% (2019-2023) | -2.1% | Flavor & local authenticity |

| Specialty Coffee | +12.5% | -1.8% | Quality & ethical sourcing |

| Premium Spirits | +9.7% | +1.2% | Experience & status signaling |

| Organic Foods | +11.3% | +2.4% | Health & sustainability |

Premiumization Across Consumer Categories, Sources: Various industry reports and market analyses

This premiumization reflects several societal shifts. First, experienced consumers develop sophisticated palates and preferences, seeking quality over quantity. Second, cannabis normalization reduces stigma, making premium purchases socially acceptable rather than shameful. Third, wellness positioning frames cannabis as self-care investment rather than vice, justifying higher spending. Finally, social media amplifies premium products’ visibility through user-generated content that mass-market products rarely inspire.

Looking Forward: Market Evolution 2025-2030

Continued Growth Trajectory

Industry forecasts project infused pre-rolls will capture 50%+ category market share by 2026 as consumer preferences continue shifting toward premium products. Total pre-roll sales could exceed $4 billion annually by 2027 as new markets launch (Florida, Pennsylvania, Ohio expansion) and existing markets mature.

This growth won’t be uniform—premium segments will expand faster than value tiers, multi-packs will gain share versus singles, and solventless products will capture increasing portions of ultra-premium spending. Brands positioning for these trends today will capture disproportionate growth tomorrow.

Regulatory Evolution Impact

Federal rescheduling or legalization would fundamentally reshape markets, enabling interstate commerce, increasing regulatory standardization, and potentially reducing compliance costs. However, it would also intensify competition as regional brands face national players with superior capital access and distribution capabilities.

Consumer Sophistication Continues

As markets mature, consumer knowledge deepens. Today’s educated consumers distinguish between extraction methods, recognize terpene profiles, and evaluate brands on consistency and transparency. Tomorrow’s consumers will be even more sophisticated, demanding detailed information about cultivation practices, supply chain sustainability, and product testing.

Conclusion: Premium Products for Informed Consumers

The infused pre-roll market’s explosive growth from niche experiment to $1.75 billion category leader demonstrates how product innovation meets consumer demand. These aren’t your grandfather’s joints—they’re sophisticated cannabis delivery systems combining premium flower, cutting-edge concentrates, and thoughtful presentation into experiences that justify premium pricing.

For cannabis industry participants, the implications are clear. Consumers will pay premiums for quality, consistency, and experience. Brands that deliver across these dimensions while communicating value effectively will capture disproportionate market share and profit margins. Those competing solely on price will face increasingly challenging economics as markets mature and competition intensifies.

The infused pre-roll revolution is still accelerating, and the brands that understand market dynamics—who’s buying, why they’re buying, what drives loyalty, and how to position for sustainable competitive advantage—will write the next chapter of cannabis industry success stories.

FAQs

Infused pre-rolls command 28-159% price premiums due to added concentrate costs (distillate, live resin, or rosin), specialized manufacturing processes requiring automated infusion equipment, enhanced packaging preserving product quality, and premium brand positioning. The concentrate alone adds $2-5 per unit in production costs, while superior packaging and quality control further increase expenses. However, these costs enable 34-51% profit margins for leading brands as consumers willingly pay premiums for elevated potency (25-45% THC vs 15-25% in traditional pre-rolls) and enhanced flavor profiles.

Millennials (ages 28-43) dominate infused pre-roll purchases, accounting for 45% of market share and $104 million in annual sales. This reflects their purchasing power, comfort with premium cannabis products, and willingness to pay for quality experiences. Gen X follows at 24.3% ($56.7M), Gen Z at 18.5% ($43.2M), and Baby Boomers at 12.5% ($29.2M). The millennial dominance suggests infused products are positioned similarly to craft beverages and artisanal foods—premium lifestyle products rather than commodity purchases.

Leading brands achieve 34-51% profit margins through premium pricing power ($20-28 per item), operational efficiency via automation, vertical integration controlling production costs, distinctive branding justifying price premiums, and consistent quality building consumer loyalty. Jeeter’s collectible glass jar packaging and celebrity collaborations create brand equity commanding $24.62 average prices, while STIIIZY’s minimalist design and concentrate expertise enable 41% margins despite competitive markets. Volume brands like Dragonfly maintain 49% margins through outdoor cultivation, automated production, and extreme efficiency rather than premium positioning.

Potency ranks as the primary consideration for 70% of consumers, followed by price/value (58%), and brand reputation (43%). Among infused product buyers specifically, 52% prioritize concentrate type (distillate vs live resin vs rosin), demonstrating sophisticated understanding of quality differences. Terpene profiles influence 31% of purchases, while packaging quality (18%) and sustainability (14%) play secondary roles. This hierarchy explains why high-THC products succeed regardless of packaging, but premium brands combining potency with quality concentrates, attractive packaging, and compelling stories capture disproportionate margins.

State-by-state regulatory variations create dramatic pricing disparities: New York averages $13.74/gram (emerging market, limited licenses, high taxes), while Washington averages $3.36/gram (mature market, abundant supply, lower taxes). Regulatory factors affecting pricing include licensing limitations constraining supply, tax structures (excise, sales, cultivation taxes totaling 15-45%), testing requirements adding $50-150 per batch, packaging mandates increasing costs 20-50%, and market maturity as older markets show price compression. Brands in high-price states enjoy better per-unit margins but face black market competition, while those in low-price markets require operational excellence for profitability.

Industry analysts project infused pre-rolls will capture 50%+ category market share by 2026, with total market size reaching $4+ billion by 2027. Key trends include continued premiumization as consumers trade up from traditional to infused products, solventless concentrate growth (live rosin, ice water hash) commanding 30-50% premiums, multi-pack format expansion for better value perception, sustainability requirements influencing packaging choices, and federal legalization potentially enabling interstate commerce while intensifying competition. New market launches (Florida, Pennsylvania, Ohio expansion) will drive volume growth, while mature markets see premium tier expansion as consumers become more sophisticated.