The fourth quarter is the main event for the beauty industry. According to Circana, the U.S. prestige beauty market grew by 7% heading into the 2024 holiday season, reaching $22.8 billion, while consumer data revealed that 29% of shoppers intended to purchase beauty products as gifts, with spending up 2% compared to the previous year. For brands, this concentrated window of consumer spending represents an unparalleled opportunity to drive annual revenue, build brand equity, and secure customer loyalty that extends well beyond December.

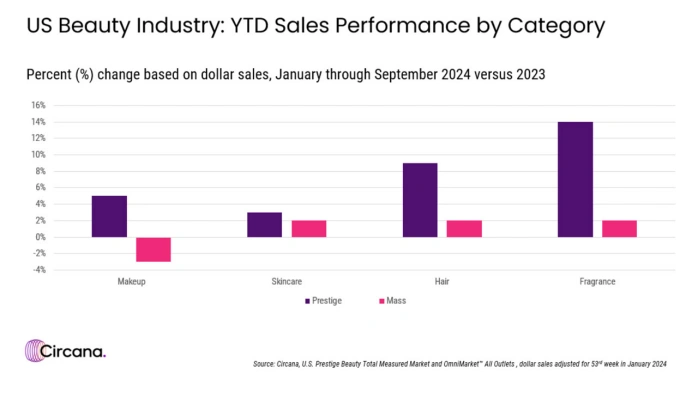

The dominant story of the U.S. beauty market in 2024 is one of premiumization. Across all major categories, the ‘Prestige’ (high-end, luxury) segment is significantly outperforming the ‘Mass’ (drugstore, supermarket) segment. While the overall industry shows growth, this growth is almost exclusively driven by consumers opting for more expensive products, particularly in the Fragrance and Hair categories.

Consumer Behavior Shift: The data clearly indicates a “flight to quality.” Consumers are prioritizing performance, brand story, and the experience associated with prestige beauty products over the lower price points of mass-market alternatives.

The Power of “Affordable Luxury”: In uncertain economic times, consumers often cut back on large purchases but continue to spend on smaller, feel-good items. Prestige beauty, especially fragrance, fits perfectly into this “lipstick effect” theory.

However, the stakes are equally high on the flip side. A poorly conceived holiday collection doesn’t just underperform—it can saddle your business with excess inventory, erode profit margins, and damage your brand’s reputation in a crowded marketplace. The complexity of orchestrating a successful limited-edition launch is significant: you must align concept development, product formulation, packaging design, manufacturing timelines, and marketing execution into a seamless whole. One misstep in this intricate chain can cascade into missed deadlines and lost opportunities.

This comprehensive guide serves as your strategic roadmap through every phase of holiday collection development. We’ll walk you through a detailed 12-month timeline, provide strategic insights into product curation and packaging design that converts, and address the critical logistical considerations that separate successful launches from costly failures. This guide will provide a detailed timeline, strategic insights into product and packaging design, and logistical considerations to help your brand succeed in the holiday season.

The Foundation: Your 12-Month Strategic Holiday Timeline

The most critical insight for holiday collection success is this: planning must begin 12-14 months before your intended launch date. This extended timeline isn’t arbitrary—it reflects the complex realities of product development, packaging manufacturing, and global supply chain logistics. Compressed timelines inevitably result in compromised quality, inflated costs due to rush fees, and the very real risk of missing your launch window entirely.

Phase 1: Strategy & Ideation (12-14 Months Out - January/February)

Begin with a thorough post-mortem of your previous holiday season. What products exceeded expectations? Which packaging formats resonated most with customers? What inventory remained unsold? These insights form the foundation of your next collection’s strategy. Conduct comprehensive market and trend analysis to identify emerging aesthetic movements, color palettes gaining traction, and the competitive landscape. Establish your high-level budget allocation across product development, packaging, marketing, and distribution.

Phase 2: Concept & Sourcing (9-11 Months Out - March/May)

Finalize your collection’s theme and narrative—the cohesive story that will differentiate your products on crowded retail shelves. Define your complete product lineup and confirm all formulations are stable and ready for production. This phase includes the crucial step of initiating conversations with packaging experts like Jarsking. Discuss custom molding feasibility, material options, decoration capabilities, and minimum order quantities. Request detailed quotes and samples of stock components that might suit your needs. Early engagement with your packaging supplier is non-negotiable—lead times for custom molds alone can range from 20-30 days, and that’s before production even begins.

Phase 3: Design & Development (6-8 Months Out - June/August)

With your packaging partner engaged, finalize all artwork, dielines, and decoration specifications. Order packaging samples and conduct rigorous stability and compatibility testing with your product formulas—glass and closures must maintain product integrity throughout the product’s shelf life. Material sourcing and color matching typically require 5-7 days, followed by mass production timelines of 15-25 days depending on order volume. Surface treatments like screen printing, hot stamping, or specialty coatings add an additional 7-10 days. Once samples are approved, place your mass production orders immediately. Delays at this stage cannot be recovered later.

Phase 4: Production & Assembly (4-5 Months Out - September/October)

Mass production of both product and packaging components occurs simultaneously during this critical phase. Quality control checks at the factory are essential—inspect materials, dimensions, decoration quality, and functionality. Quality control and packing processes typically require 3-5 days. Coordinate with your co-packer for filling and final assembly of gift sets, ensuring all components arrive on schedule. Any production delays during this window put your entire launch at risk.

Phase 5: Marketing & Logistics (2-3 Months Out - October/November)

With finished goods in hand, execute product photography and videography for all marketing channels. The unboxing experience has become a powerful marketing tool—design packaging specifically to photograph beautifully and create shareable social media moments. Seed influencer and PR kits to generate anticipation and early buzz. Coordinate shipment to distribution centers, accounting for international shipping and customs clearance timelines. Given current global supply chain considerations, build buffer time into your logistics planning.

Phase 6: Launch & Sell-Through (1 Month Out - November/December)

Execute your go-live across all sales channels—direct-to-consumer, retail partners, and e-commerce platforms. Launch coordinated marketing campaigns across digital, social, email, and traditional channels. Monitor inventory velocity closely and be prepared to adjust promotional strategies to maximize sell-through. The brands that succeed during this phase are those that completed all previous phases on schedule.

Crafting the Narrative: Theme, Story, and Curation

The most successful holiday collections don’t just offer products—they tell compelling stories that resonate emotionally with consumers. Your theme is the conceptual thread that connects every element: product formulations, scents, colors, packaging design, and marketing messaging. A well-executed theme transforms individual products into a cohesive collection that commands premium pricing and drives higher conversion rates.

Brainstorming Your Theme

Consider these detailed theme concepts as inspiration for your planning:

Celestial Glow: This theme leans into the magic of winter nights with a color palette of deep midnight blues, shimmering silvers, and luminous golds. Packaging features star and constellation motifs, possibly with metallic hot stamping or foil accents that catch the light. Product formulations might include light-reflecting particles, pearlescent finishes, and cool-toned shimmers. This theme works beautifully for skincare, highlighting products, and body oils.

Winter Apothecary: For brands with a natural or wellness positioning, this theme emphasizes botanical beauty with amber glass containers, minimalist kraft paper labels, and herb-inspired scents like eucalyptus, sage, and cedarwood. The aesthetic is clean, refined, and speaks to the growing consumer demand for sustainable, eco-conscious beauty. This theme allows for refillable formats and recyclable materials that align with environmental values.

Art Deco Gala: Embrace maximalist luxury with geometric patterns, bold jewel tones (emerald, ruby, sapphire), and heavy glass components that communicate premium quality through weight and substance. Embossing, debossing, and metallic foil details elevate the perceived value. This theme positions products as indulgent gifts worthy of special occasions.

Curating the Collection

Your product assortment should offer multiple price points and gifting options to capture different consumer segments :

The Value Set: Miniatures or travel sizes of your best-selling products packaged together create an accessible entry point for new customers while allowing existing customers to gift your brand affordably. These sets typically perform well with younger consumers and those purchasing multiple gifts.

The Hero Product: A brand-new, limited-edition item available only during the holiday season creates urgency and exclusivity. Consider a shimmering body oil, a scented candle in collectible packaging, or a complexion palette with curated shades. This hero product becomes the anchor of your marketing messaging.

The Vault/Advent Calendar: High-ticket items offering comprehensive product experiences command premium prices and generate significant revenue per transaction. These require sophisticated packaging engineering but deliver exceptional perceived value.

Ensuring cohesion is paramount—product names, scent profiles, color stories, and packaging design must all reinforce your central theme. Disjointed collections confuse consumers and dilute your brand message.

The Silent Salesperson: Your In-Depth Packaging Strategy

In a saturated holiday marketplace, packaging is the silent salesperson that earns the click online and clinches the sale in-store. It must instantly communicate quality, tell your collection’s story, and deliver a memorable unboxing experience that drives social sharing and repeat purchases.

Primary Packaging: The First Touchpoint

Material is the Message

Glass remains the undisputed champion of luxury in cosmetic packaging. The material’s inherent weight, optical clarity, and premium tactile experience immediately communicate quality to consumers. Beyond aesthetics, glass offers superior product protection—it’s chemically inert, non-reactive, and provides an impermeable barrier against oxygen and contaminants. This is particularly critical for formulations containing active ingredients, natural oils, or products sensitive to light and air exposure.

The global glass cosmetic packaging market was valued at $7.95 billion in 2024 and is projected to reach $9.97 billion by 2032, reflecting sustained demand driven by sustainability trends and premium positioning. Jarsking offers comprehensive capabilities across glass types: clear flint glass for maximum product visibility, amber glass for UV protection of light-sensitive formulations, and opaque colored glass in custom hues that reinforce brand identity.

Glass also aligns with the environmental consciousness of Gen Z and millennial consumers, who represent the fastest-growing segment of beauty purchasers. Glass is infinitely recyclable without quality degradation, and many consumers actively seek brands offering sustainable packaging options. Over 60% of beauty consumers prefer brands with clear sustainability commitments.

Shape and Form: Stock vs. Custom Molds

The choice between stock and custom molds represents a strategic decision with significant cost and timing implications. Stock components offer faster turnaround times and lower minimum order quantities, making them ideal for brands testing new concepts or working with limited budgets. However, custom molds create a unique brand signature that differentiates your products and builds brand recognition.

Shape psychology plays a subtle but powerful role in consumer perception. Rounded jars with soft curves convey warmth, comfort, and approachability—ideal for nourishing creams and body butters. Sharp-angled containers with geometric precision communicate modernity, sophistication, and premium positioning. Consider how form reinforces your theme and target audience preferences.

Decoration & Finishes: Creating the "Wow" Factor

Surface decoration transforms functional containers into covetable objects. Screen printing delivers crisp, precise logos and graphics with excellent durability. Hot stamping and foil application create brilliant metallic accents in gold, silver, rose gold, or holographic finishes that catch light and attract attention. In 2025, foil decoration on cosmetic packaging has taken center stage, offering refined glow that enhances both premium and everyday beauty lines.

Color treatments expand creative possibilities. Spraying applies uniform color coatings to glass, while frosting creates sophisticated matte finishes with soft-touch appeal. Gradient effects deliver multi-dimensional visual interest. Texture has emerged as the new luxury—embossing, debossing, and soft-touch coatings create multisensory experiences that encourage consumers to engage physically with packaging.

Closures complete the luxury experience. A high-quality cap, pump, or dropper must function flawlessly while complementing the container’s aesthetic. Component compatibility is critical—closures must create proper seals to maintain product integrity throughout shelf life.

Secondary Packaging: The Unboxing Experience

The gift box is a stage upon which your products are presented. Unboxing has evolved into a distinct marketing moment, with consumers actively sharing their experiences across social media platforms. Design packaging that photographs beautifully with pleasing color palettes, unique structural elements, and interactive features.

Paper stock selection impacts perceived quality. Premium rigid board communicates luxury, while kraft paper appeals to eco-conscious consumers. Embossing and debossing add tactile dimension, while foil accents create visual focal points. Consider FSC-certified paper to demonstrate environmental responsibility.

Inserts and fitments hold products securely and present them beautifully upon opening. Custom inserts in cardboard, foam, or molded pulp can be designed to reveal products in a choreographed sequence, building anticipation. The attention to these details transforms a transaction into an experience.

Advent calendars present unique engineering challenges—they require structural integrity to protect 12-25 individual compartments while maintaining aesthetic appeal. These high-ticket items generate substantial revenue but demand sophisticated design and manufacturing capabilities.

Sustainability: The Modern Consumer's Mandate

Sustainability is no longer optional—it’s a consumer expectation that directly influences purchasing decisions. Glass packaging inherently supports sustainability goals through infinite recyclability. Unlike plastic, which degrades with each recycling cycle, glass can be recycled repeatedly without losing quality or purity.

Design for reusability by creating packaging so beautiful that customers want to keep and repurpose it after the product is consumed. Refillable systems reduce waste while encouraging repeat purchases. Use FSC-certified paper for secondary packaging to ensure responsible forest management.

Jarsking is committed to helping clients achieve sustainability goals through material innovation, design optimization, and transparent sourcing practices. Incorporating recycled glass and exploring lightweight designs that maintain structural integrity while reducing material usage and transportation emissions are ongoing priorities.

Navigating the Maze: Production & Supply Chain

Understanding supply chain realities is essential for successful execution. The beauty industry operates within complex global networks, and timing is everything.

The Reality of Lead Times

Orders with large quantity and private molds must be placed 6-8 months before your launch date. This timeline accounts for multiple sequential processes: raw material sourcing, production scheduling, manufacturing, surface treatments, quality control, international shipping, and customs clearance. Custom molds require 20-30 days for development, material sourcing and color matching take 5-7 days, mass production spans 15-25 days, surface treatments add 7-10 days, and quality control and packing require 3-5 days. These stages are dependencies—delays in one phase automatically delay all subsequent stages.

Current tariff considerations and geopolitical factors add complexity to international sourcing decisions. Maintain open communication with your packaging partner about potential impacts on timelines and costs.

Choosing the Right Partner

Your packaging supplier is a strategic partner whose capabilities directly impact your success. Evaluate potential partners on these critical criteria: transparent communication throughout the production process, documented quality control procedures with inspection protocols, and proven track record with brands similar to yours.

Implement quality checks at multiple stages. Approve pre-production samples before mass production begins. Conduct in-process inspections during manufacturing to catch issues early. Perform final inspections before shipment. A single flawed component can ruin the entire customer experience and damage your brand reputation.

The final step brings all components together. Coordinate with your co-packer to ensure packaging components, filled products, inserts, and outer boxes converge at the assembly facility on schedule. Any missing element halts the entire operation.

Turning Planning into Profit

The brands that dominate holiday sales share common characteristics: they start planning 12-14 months in advance, they develop cohesive narratives that resonate emotionally with consumers, and they invest strategically in packaging design that serves as a silent salesperson. These elements combine to create collections that don’t just meet sales targets—they exceed them while building lasting brand equity.

The holiday season is a marathon, not a sprint. Success belongs to brands that begin planning now, execute with discipline across every phase, and partner with suppliers who understand the stakes.

The success of your Holiday 2026 collection is determined by the decisions you make in early 2025. If you’re ready to create a collection that captivates customers and boosts your bottom line, our packaging experts are here to help. Contact Jarsking today to schedule your initial consultation and let’s start building your next holiday success story.

FAQs

This extended timeline accounts for complex realities: custom mold development (20-30 days), material sourcing, mass production (15-25 days), surface treatments (7-10 days), international shipping, and customs clearance. Compressed timelines result in compromised quality, inflated rush fees, and missed launch windows.

Focus on three critical elements: material selection (glass communicates premium quality), decoration techniques (hot stamping, foiling, embossing create “wow” factor), and secondary packaging design (the unboxing experience drives social sharing). Packaging serves as your silent salesperson during the holiday rush.

Stock molds offer faster turnaround and lower minimums—ideal for testing concepts or limited budgets. Custom molds create unique brand signatures that differentiate products and build recognition, but require longer lead times and higher investment. Consider your brand positioning and budget constraints.

Glass offers superior product protection through chemical inertness and impermeability, preventing oxygen and contaminant exposure. Its inherent weight, optical clarity, and premium tactile experience instantly communicate quality to consumers. Additionally, glass is infinitely recyclable, aligning with modern sustainability expectations.

Develop a compelling, cohesive theme that connects every element—product formulations, scents, colors, packaging design, and marketing. Create multiple price points (value sets, hero products, premium calendars) to capture different consumer segments. Invest strategically in packaging that photographs beautifully for social media.

Major risks include inadequate lead time causing missed deadlines, poor quality control resulting in flawed products, insufficient inventory planning (selling out too quickly or overstocking into Q1), and failing to secure reliable packaging partners early. Any component delay halts the entire operation.