The essential oil industry has undergone a remarkable transformation over the past decade, evolving from a niche aromatherapy market into a mainstream wellness powerhouse that spans multiple industries and consumer segments. This evolution represents one of the most significant shifts in the global wellness sector, driven by changing consumer preferences toward natural health solutions, sustainable living practices, and holistic well-being approaches.

As consumers increasingly prioritize authenticity, purity, and environmental responsibility in their purchasing decisions, the essential oil market has responded with unprecedented innovation and growth. The industry now encompasses sophisticated extraction technologies, cutting-edge packaging solutions, and complex market dynamics that reflect broader trends in health consciousness and sustainability. Recent surveys indicate that 68.7% of adults use essential oils regularly, demonstrating the widespread adoption of these natural products across diverse demographic segments.

This comprehensive analysis examines the industry’s current state through three critical perspectives that define success in today’s competitive landscape: product innovation and market categorization, packaging trends and technological solutions, and detailed competitive market analysis with strategic brand positioning. Understanding these interconnected elements is essential for businesses seeking to navigate the complexities of this rapidly growing sector, where traditional botanical knowledge converges with modern technology to create products that meet evolving consumer demands for natural, effective, and sustainable wellness solutions.

Essential Oil Products: Types and Market Categories

Essential Oil Types and Classifications

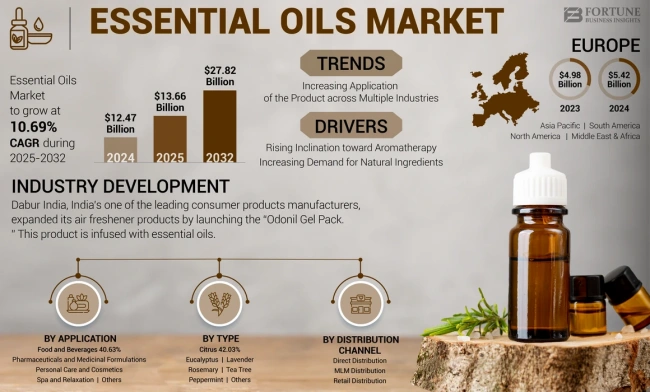

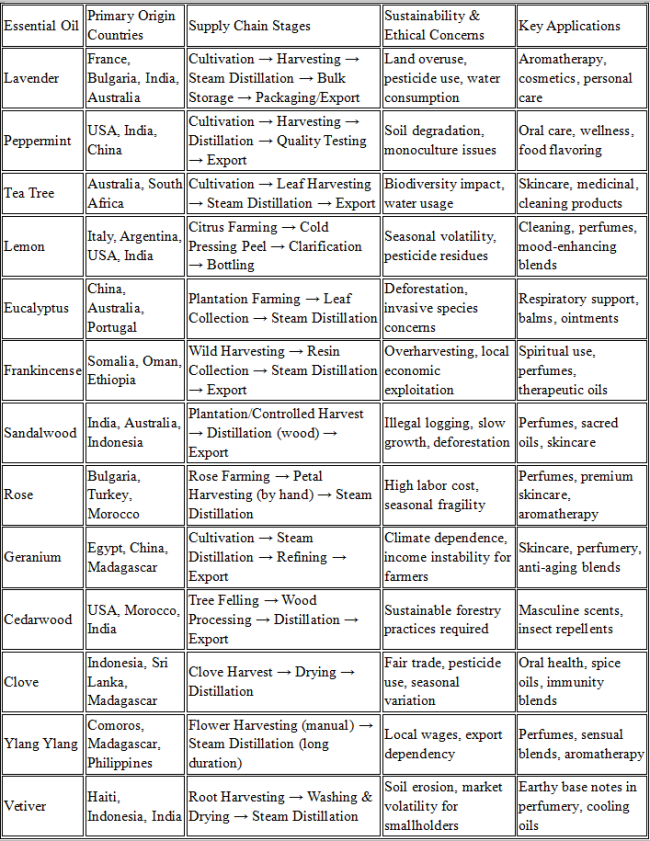

The essential oil market in 2025 is characterized by distinct product categories that serve specific consumer needs and market segments. Citrus oils dominate the market with widespread consumer appeal, including lemon, orange, grapefruit, and bergamot varieties. These oils have gained popularity due to their versatility in aromatherapy, cleaning applications, and food flavoring, with lemon essential oil ranking as the second most used essential oil globally. The refreshing and energizing properties of citrus oils make them particularly attractive for mood enhancement and natural cleaning solutions.

Floral oils represent the premium segment of the market, with lavender leading as the most popular essential oil worldwide. Lavender’s dominance stems from its proven calming effects and versatility in wellness routines, particularly for sleep aids and stress reduction. Rose, jasmine, and ylang ylang oils command luxury market positioning due to their complex extraction processes and sophisticated aromatic profiles. These oils appeal to consumers seeking high-end aromatherapy experiences and premium personal care formulations.

Herbal oils occupy the therapeutic and functional market space, with peppermint ranking as the third most popular essential oil due to its invigorating properties and applications in pain relief and mental clarity enhancement. Tea tree oil maintains strong market presence for its powerful antiseptic and anti-inflammatory properties, making it a staple in natural antibacterial formulations. Eucalyptus oil has gained significant traction, particularly following increased consumer focus on respiratory health, with its decongestant properties driving demand in wellness centers and home care applications.

Woody oils command the luxury and meditation markets, with frankincense often called the “king of oils” for its grounding aroma and skin-rejuvenating benefits. These oils appeal to consumers interested in mindfulness practices and premium aromatherapy experiences. The limited sourcing of many woody oils, particularly frankincense, creates supply chain challenges that influence pricing and market positioning strategies.

Essential oil blends have emerged as a significant market category, with specialized formulations targeting specific wellness outcomes gaining popularity. doTERRA’s On Guard® and Breathe® blends exemplify this trend, offering pre-formulated solutions for immune support and respiratory wellness. The essential oil blends market is experiencing 14.9% CAGR growth from 2025 to 2032, driven by consumer preference for convenient, ready-to-use formulations that eliminate the guesswork of DIY mixing.

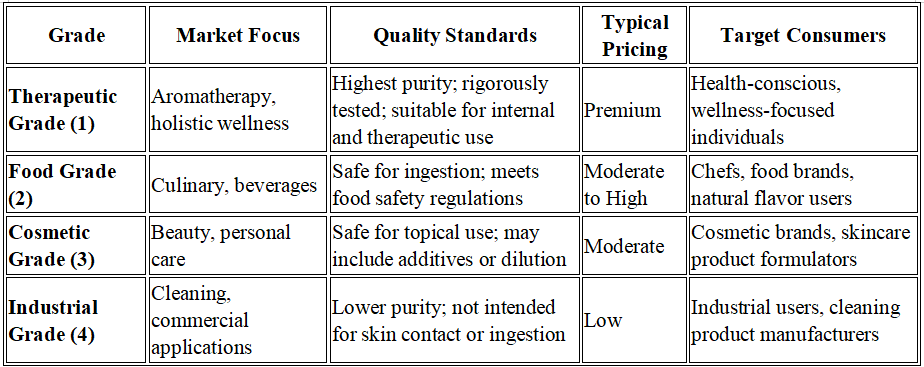

Quality grades significantly impact market positioning and pricing strategies. Therapeutic Grade (Grade 1) oils represent the highest quality, commanding premium prices and targeting wellness-focused consumers. These oils undergo rigorous testing and maintain strict purity standards, making them suitable for aromatherapy and holistic health applications. Food Grade (Grade 2) oils serve the culinary and beverage market, with the essential oil flavorings market projected to reach $7.6 billion by 2035, reflecting growing demand for natural flavor alternatives.

Cosmetic Grade (Grade 3) oils target beauty and personal care applications, while Industrial Grade (Grade 4) oils serve cleaning and commercial applications. This quality classification system enables brands to position products appropriately across different market segments and price points, from mass-market cleaning products to luxury wellness formulations.

Market Applications and Consumer Segments

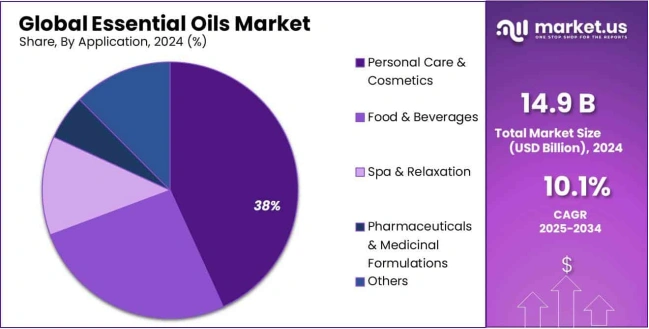

Personal care and beauty applications drive significant essential oil demand, with the cosmetics industry experiencing rapid growth as consumer awareness of natural beauty solutions increases. Essential oils are increasingly incorporated into skincare formulations for their anti-inflammatory, antimicrobial, and antioxidant properties. The shift toward natural and organic cosmetics has forced manufacturers to seek plant-based extracts and natural oils that support clean beauty initiatives.

The aromatherapy and wellness segment dominates with 46.5% market share, reflecting the growing consumer focus on mental health and stress management. Lavender, chamomile, and frankincense oils lead in stress reduction applications, while eucalyptus and tea tree oils boost respiratory and immune support. The post-pandemic wellness consciousness has permanently altered consumer behavior, with essential oils becoming integral to at-home wellness routines and self-care practices.

Food and beverage applications represent a rapidly growing segment, with essential oils increasingly used as natural flavorings and preservatives. The food and beverages segment is expected to grow at 9.3% CAGR from 2025 to 2033, driven by clean-label trends and consumer demand for natural ingredient alternatives. Premium beverages and functional drinks are adopting essential oil flavorings for healthier, more natural taste experiences, with botanical-infused cocktails and wellness teas gaining popularity among health-conscious consumers.

Household and commercial applications continue expanding as consumers seek natural cleaning solutions. Essential oils’ antimicrobial properties make them valuable for air freshening and odor elimination, while industrial applications in manufacturing and processing create additional market opportunities. The integration of essential oils into eco-friendly cleaning products aligns with growing environmental consciousness and regulatory pressure to reduce synthetic chemical usage.

Emerging Product Trends and Innovation

Sustainable and organic positioning has become a market necessity rather than a differentiator. Consumer demand for ethically sourced and certified organic oils drives premium pricing and brand loyalty. Fair trade practices and supply chain transparency have become essential for brand credibility, with 74% of consumers preferring Ukrainian goods and producers, demonstrating how geopolitical and ethical considerations influence purchasing decisions.

Specialized and exotic oil varieties are gaining market traction as consumers seek unique experiences and therapeutic benefits. Agarwood essential oils have undergone dynamic evolution, driven by diverse applications in perfumery, pharmaceuticals, and alternative medicine. Regional and indigenous plant-based oils create opportunities for brands to differentiate through unique sourcing stories and traditional knowledge integration.

Enhanced delivery systems and formulations address consumer demand for convenience and effectiveness. Ready-to-use dilutions eliminate safety concerns while roll-on applicators and convenient delivery methods simplify application for busy lifestyles. The integration of essential oils with other wellness products and supplements creates synergistic formulations that appeal to holistic health consumers.

Nanoencapsulation technology represents a significant innovation in essential oil delivery, with encapsulation efficiency reaching 84.7% and demonstrating 2-4 fold increased antibacterial activity compared to free essential oils. This technology addresses fundamental challenges in essential oil applications by improving stability, bioavailability, and sustained release patterns, enabling more consistent therapeutic outcomes and expanding pharmaceutical applications.

Packaging Innovations and Trends

Current Packaging Challenges and Requirements

Essential oil packaging faces unique technical and regulatory challenges that distinguish it from conventional consumer products. UV light sensitivity remains the primary concern, necessitating amber or cobalt blue glass bottles for product protection. However, recent innovations include violet glass technology that provides enhanced UV protection while maintaining recyclability, and aluminum containers that offer complete light protection with improved portability for travel-friendly applications.

Child-resistant packaging has become a critical safety mandate, particularly following recent regulatory enforcement. The recall of Euqee Wintergreen Essential Oils highlighted the importance of compliance with the Poison Prevention Packaging Act (PPPA), which requires child-resistant packaging for products containing methyl salicylate. These packaging systems must be significantly difficult for children under 52 months to open while remaining accessible to adults, creating engineering challenges that impact both functionality and aesthetics.

Oxidation prevention requires sophisticated sealing mechanisms and specialized closure systems that maintain product integrity throughout extended shelf life periods. Temperature stability concerns drive innovations in thermal-resistant materials and protective coatings that preserve essential oil potency under varying storage conditions. Modern essential oil containers incorporate precision dropper systems, leak-proof mechanisms, and tamper-evident seals to ensure product quality and consumer safety.

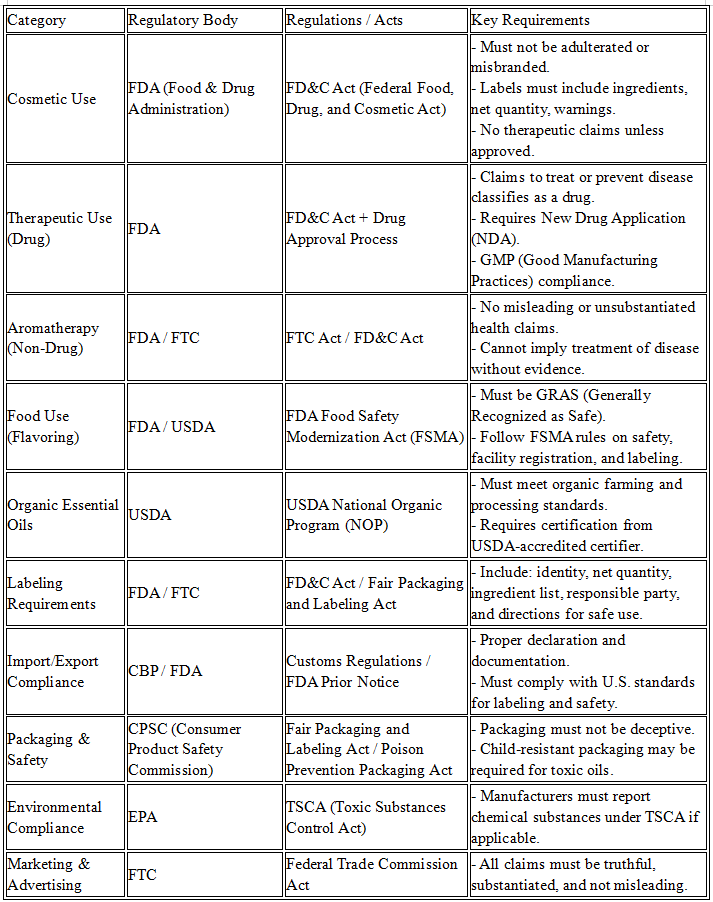

Regulatory compliance extends beyond safety requirements to encompass comprehensive labeling mandates. The FDA requires specific information including product identity, net quantity, manufacturer details, ingredient declarations, and appropriate warning statements depending on the product’s intended use classification. International shipping and customs considerations add complexity to packaging design, requiring multi-language labeling and compliance with varying international standards.

Sustainable Packaging Solutions

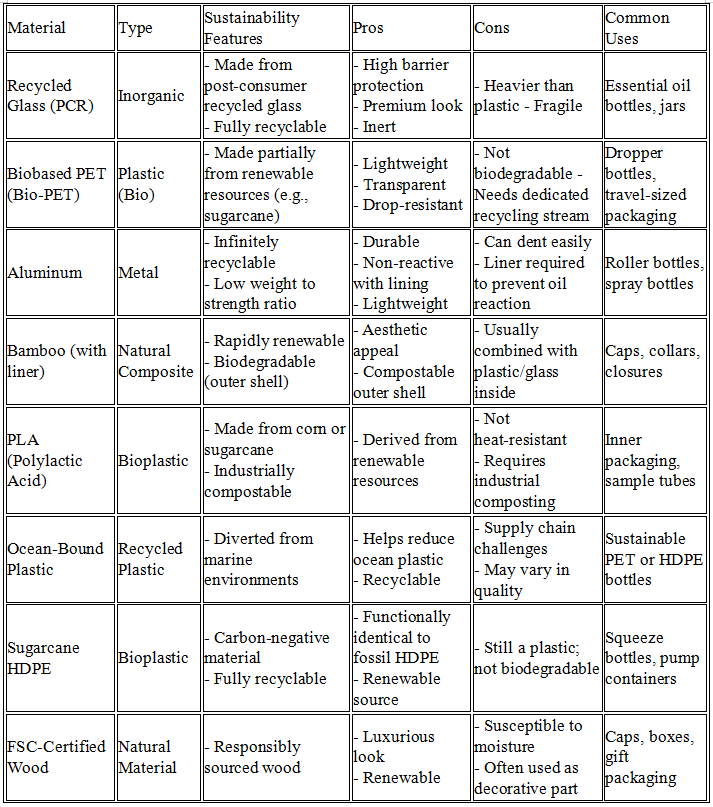

Eco-friendly materials have gained significant market traction as sustainability becomes a primary consumer priority. In 2025, eco-conscious consumers are gravitating toward refillable bottles made from recycled materials, offering cost-effective and convenient solutions for replenishing favorite oils. These containers reduce environmental impact while providing sustainable business models that align with circular economy principles.

Biodegradable and recyclable options include bamboo-capped glass bottles for natural aesthetics, plant-based inks, and minimal packaging waste strategies. The shift toward sustainable packaging reflects broader environmental consciousness, with over 75% of personal care brands preferring essential oil containers with ultraviolet protection that also meet sustainability criteria. These innovations demonstrate that environmental responsibility and product protection can coexist effectively.

Refillable and reusable systems create sustainable revenue models while addressing growing environmental concerns. Consumer incentives for container returns significantly reduce packaging waste and environmental impact. These systems align with circular economy packaging models that transform traditional linear consumption patterns into regenerative business practices.

Innovative material applications include glass, aluminum, and BPA-free plastic containers with enhanced protective properties. Recent advances in biodegradable materials, refillable designs, and AI-integrated smart packaging solutions provide functionality while meeting environmental standards. The development of bio-based polymer alternatives enhances sustainability aspects while maintaining the durability and protective qualities essential for essential oil storage.

Design and Smart Packaging Innovations

Minimalist and luxury aesthetics dominate contemporary essential oil packaging design. Brands are shifting toward clean, minimalist designs that emphasize purity and sophistication, with frosted glass bottles, embossed branding, and monochrome aesthetics creating premium positioning. Metallic finishes including gold, rose gold, and matte black provide luxury touches that enhance perceived value and brand differentiation.

Smart and interactive packaging incorporates advanced technologies that enhance consumer experience and product authentication. QR codes provide product authentication and traceability, enabling consumers to access comprehensive product histories and verify authenticity. Temperature-sensitive indicators and NFC technology create enhanced consumer engagement while providing real-time product monitoring capabilities.

Digital authentication methods combat counterfeiting while ensuring product authenticity through RFID-enabled authentication, tamper-evident seals, and blockchain-powered sourcing transparency. These technologies enable real-time tracking and provide consumers with unprecedented access to product information, from sourcing locations to quality testing results.

Functional innovation encompasses precision dropper systems, rollerball applicators, UV-blocking coatings, child-resistant caps, and multi-use packaging designs. These features enhance user experience while maintaining safety and product integrity. Recent developments include magnetic closure caps for sleek opening experiences and smart humidifiers and air purifiers that integrate with essential oil applications.

Customization and personalization address luxury consumer demands for exclusivity. Engraved glass dropper bottles, limited-edition packaging, and bespoke color palettes create unique brand experiences. These customization options enable brands to create memorable consumer interactions while commanding premium pricing for personalized products.

Sustainable packaging innovations continue evolving with eco-friendly makeup bags, essential oil bags, and jewelry packaging that align with environmental values. The integration of AI-driven material engineering creates more efficient and customizable eco-friendly containers for organic skincare, wellness, and aromatherapy brands. These innovations demonstrate how technology and sustainability can converge to create superior packaging solutions.

Market Analysis: Competitive Landscape and Brand Dynamics

Competitive Market Structure and Brand Positioning

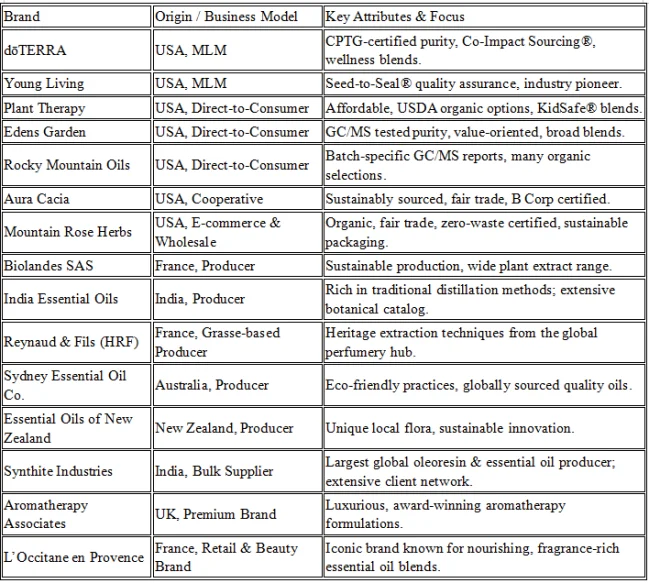

Premium market leaders have established distinct competitive advantages through proprietary quality systems and vertical integration strategies. Young Living’s Seed to Seal® process represents comprehensive vertical integration from farming through distillation to distribution, creating quality control throughout the entire supply chain. This approach enables premium pricing justification while building consumer trust through transparency and consistency.

doTERRA’s Co-Impact Sourcing® and Certified Pure Therapeutic Grade (CPTG) positioning differentiates the brand through ethical sourcing practices and rigorous quality testing protocols. While the CPTG designation is company-internal rather than industry-standard, doTERRA’s Source to You website provides comprehensive transparency from oil sourcing to consumer delivery, including downloadable GC/MS quality reports for batch verification. This transparency strategy builds consumer confidence while justifying premium pricing structures.

Brand differentiation through quality certifications has become essential for market positioning. Leading brands invest heavily in third-party testing, batch-specific documentation, and comprehensive Certificate of Analysis (COA) reporting that includes chemical composition breakdown, purity percentages, and detailed sourcing information. This documentation enables premium brands to command higher prices while building long-term consumer loyalty through quality assurance.

Mass market and accessible brands target different consumer segments through strategic pricing and positioning approaches. Plant Therapy’s family-friendly positioning and KidSafe product line addresses safety-conscious parents seeking affordable, high-quality oils for household use. Their budget-friendly bundles and frequent promotions make essential oils accessible to broader consumer segments while maintaining therapeutic-grade quality standards.

Aura Cacia and Mountain Rose Herbs target natural lifestyle consumers through ethical sourcing practices and carbon-neutral initiatives. These brands emphasize sustainability and environmental responsibility, appealing to environmentally conscious consumers willing to pay premium prices for ethically sourced products. Their positioning strategies focus on transparency, traditional knowledge, and environmental stewardship rather than proprietary quality systems.

Emerging and specialty brands create market opportunities through niche positioning and specialized offerings. Aromaaz International’s carbon-neutral and ethical sourcing focus appeals to environmentally conscious consumers, while Aarnav Global Exports specializes in rare and exotic varieties that command premium pricing through scarcity and uniqueness. These brands demonstrate how specialized positioning can create competitive advantages in crowded markets.

Regional Market Dynamics and Consumer Behavior

North American market leadership stems from high consumer spending power and established wellness infrastructure. The U.S. market was valued at $9.19 billion in 2024 with 10.0% CAGR growth projections, driven by widespread adoption of aromatherapy and personal care applications. Premium brand concentration reflects consumer willingness to pay higher prices for quality assurance and brand prestige.

- commerce dominance and subscription model success characterize North American distribution strategies. Multi-level marketing approaches by Young Living and doTERRA create dedicated sales forces while traditional retail brands leverage online platforms for direct-to-consumer sales. The success of subscription services demonstrates consumer preference for recurring delivery and product discovery through curated selections.

European market dominance with 49.4% global share reflects strong cultural affinity for aromatherapy and natural wellness practices. Sustainability focus drives brand differentiation in European markets, where consumers prioritize environmental responsibility and ethical sourcing. Organic certification importance and regulatory frameworks create higher barriers to entry while protecting established brands with compliant operations.

Traditional aromatherapy culture in European markets supports premium pricing and sophisticated consumer education. Consumers demonstrate deep knowledge of essential oil applications and quality indicators, requiring brands to invest in educational content and expert positioning. This market sophistication creates opportunities for premium brands while challenging new entrants to establish credibility.

Asia-Pacific growth opportunities emerge from traditional medicine integration and expanding middle-class consumer segments. Manufacturing advantages and supply chain efficiencies in countries like India and China create cost advantages while traditional knowledge of plant medicine supports consumer acceptance. Emerging middle-class wellness adoption drives rapid market expansion as disposable incomes increase.

Consumer behavior analysis reveals distinct patterns across regions and demographics. Health-conscious consumers drive premium segment growth through willingness to invest in high-quality products for wellness benefits. Social media influence on brand discovery and education creates opportunities for brands to build communities and educate consumers about product benefits and applications. Wellness routine integration and lifestyle positioning demonstrate how essential oils become integral to daily self-care practices rather than occasional purchases.

Strategic Brand Analysis and Market Positioning

Innovation and product development strategies enable brand differentiation in competitive markets. Unique extraction methods and specialized sourcing create competitive advantages through proprietary processes and exclusive supplier relationships. Seasonal collections and limited edition marketing generate excitement and urgency while testing new product concepts and building brand prestige through scarcity.

Therapeutic blend development and wellness partnerships expand market opportunities through collaboration with healthcare practitioners and wellness centers. Brands that develop evidence-based formulations and partner with credible wellness professionals gain competitive advantages through professional endorsement and clinical validation.

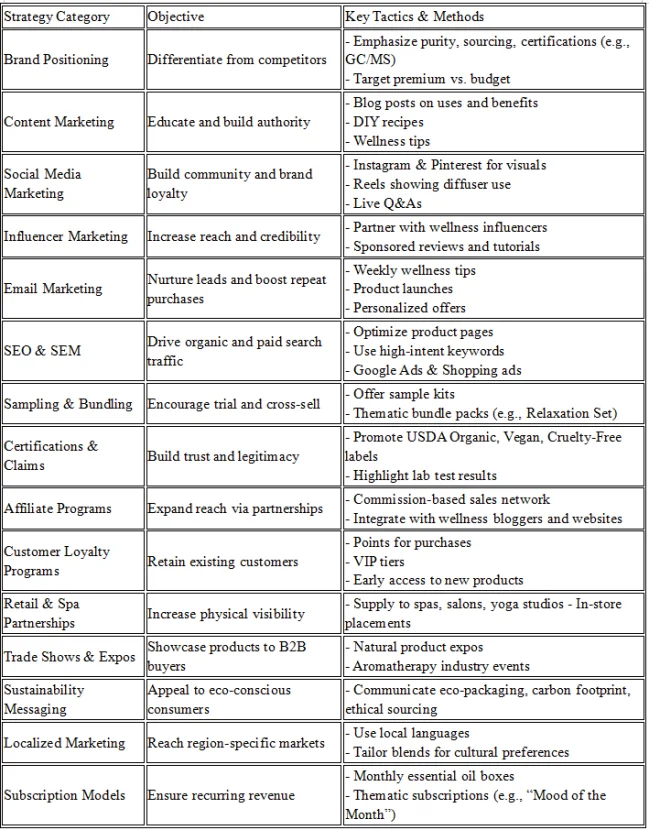

Marketing and distribution channel evolution reflects changing consumer preferences and technology adoption. Multi-level marketing versus traditional retail distribution models create different competitive dynamics, with MLM companies building dedicated sales forces while retail brands focus on broader market accessibility. Social media marketing and influencer partnership strategies enable brands to reach younger consumer segments and build authentic relationships through trusted recommendations.

Educational content marketing and consumer trust building become essential for brand success in markets where consumers seek information about product safety and effectiveness. Brands that invest in comprehensive educational resources, safety information, and application guidance position themselves as trustworthy authorities while building long-term customer relationships.

Pricing strategies and value proposition development require careful balance between quality positioning and market accessibility. Premium pricing justification through quality and testing enables higher margins while bulk purchasing and wholesale market development creates opportunities for volume sales and market penetration. Subscription services and customer retention strategies build recurring revenue while improving customer lifetime value.

Future competitive threats and opportunities include synthetic alternatives and biotechnology disruption potential that could challenge traditional sourcing models. Regulatory changes impacting market access and health claims require brands to maintain compliance while adapting to evolving legal frameworks. Sustainability requirements reshaping competitive advantages make environmental responsibility essential for long-term market success rather than optional differentiation.

Challenges and Future Outlook

Industry Challenges

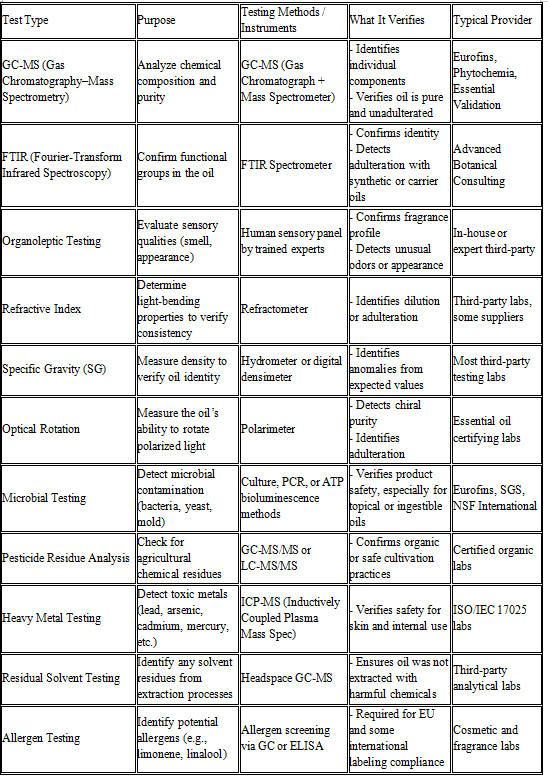

Quality control and standardization remain fundamental challenges as the industry lacks universally accepted purity standards beyond company-specific protocols. Adulteration prevention requires sophisticated testing methodologies, with recent research showing 42% adulteration rates in commercial peppermint essential oil samples. Advanced techniques like NMR spectroscopy combined with chemometric tools are being developed to detect adulteration more effectively, but implementation costs create barriers for smaller producers.

Consumer education on quality indicators becomes crucial as market expansion brings less informed buyers who may not distinguish between therapeutic-grade and synthetic alternatives. The proliferation of quality claims without standardized definitions creates confusion and enables misleading marketing practices that undermine consumer trust across the industry.

Supply chain vulnerabilities include climate change impacts on raw material availability that threaten consistent sourcing of high-quality botanical materials. Geopolitical factors affecting sourcing create additional risks, particularly for oils sourced from politically unstable regions. Price volatility and cost management challenges require sophisticated procurement strategies and supply chain diversification to maintain consistent product availability and pricing.

Regulatory complexity varies significantly across international markets, creating compliance challenges for brands seeking global expansion. Health claims substantiation requirements limit marketing flexibility while safety testing and documentation needs increase operational costs. The FDA’s classification system for essential oils as cosmetics, drugs, or household items depending on intended use requires careful compliance management and legal expertise.

Future Market Predictions

Technology integration will continue advancing through AI-driven personalization and recommendation systems that enable customized product suggestions based on individual preferences and wellness goals. Blockchain for supply chain transparency will become standard for premium brands seeking to verify sourcing claims and build consumer trust through verifiable traceability.

Advanced extraction and processing technologies will improve efficiency and quality while reducing environmental impact. Innovations in sustainable extraction methods and renewable energy applications will become competitive advantages as environmental consciousness drives purchasing decisions.

Market evolution trends suggest consolidation versus boutique brand growth patterns will continue, with large corporations acquiring successful smaller brands while new entrants find opportunities in specialized niches. Sustainability becoming table stakes rather than differentiator means environmental responsibility will be expected rather than optional, requiring all brands to adopt sustainable practices to remain competitive.

Integration with broader wellness and lifestyle ecosystems will expand essential oil applications beyond traditional aromatherapy. Smart home and IoT integration will enable automated diffusion systems and personalized wellness environments, while pharmaceutical integration and drug delivery systems will create new therapeutic applications and market opportunities.

New application areas include industrial and commercial applications expansion through bio-based alternatives to synthetic chemicals. The development of bio-nano-herbicides and enhanced food packaging applications demonstrates essential oil versatility and potential for market diversification beyond traditional consumer applications.

The essential oil industry stands at a transformative moment where traditional botanical knowledge converges with cutting-edge technology to create products that meet evolving consumer demands for natural, effective, and sustainable wellness solutions. The market’s continued growth reflects not just commercial opportunity but a fundamental shift toward holistic approaches to health and environmental responsibility.

From nanoencapsulation technologies that enhance bioavailability to blockchain systems ensuring supply chain transparency, the industry demonstrates remarkable innovation while maintaining commitment to natural origins. The packaging revolution reflects broader consumer values, with sustainability, safety, and functionality driving design decisions that balance environmental responsibility with product protection.

Market dynamics reveal a robust, growing sector with global valuations reaching $25.86 billion in 2024 and projected growth to $56.25 billion by 2033. Regional variations create diverse opportunities, from European sustainability leadership to Asia-Pacific’s emerging middle-class adoption. The convergence of health consciousness, technological advancement, and environmental awareness creates foundations for sustained growth.

For businesses entering or expanding in this market, success requires understanding the complex interplay of product innovation, packaging excellence, and strategic market positioning. The essential oil industry’s evolution from niche aromatherapy to mainstream wellness sector represents more than commercial expansion—it signifies a cultural transformation toward natural, sustainable approaches to health and well-being that will continue shaping consumer expectations and market opportunities for years to come.